Since 2021, China has been on a mission to expel the use of what it has deemed ‘excessive packaging’ in the country with particular focus on the foods and cosmetics sectors, first focusing on packaged foods and especially products with a tendency to use luxurious packaging materials such as festive foods like mooncakes, and later expanding this to cover fresh foods as well.

The first version of this regulation saw most products being allowed a maximum of four packaging layers with the exception of specific items such as packaged grains and grain-based products which were limited to three layers e.g. individual cereal snacks in a multi-pack would be allowed one individual wrapper, a second later wrapping around the total number of snacks in the pack, and a final third layer with the product brand name on the outside.

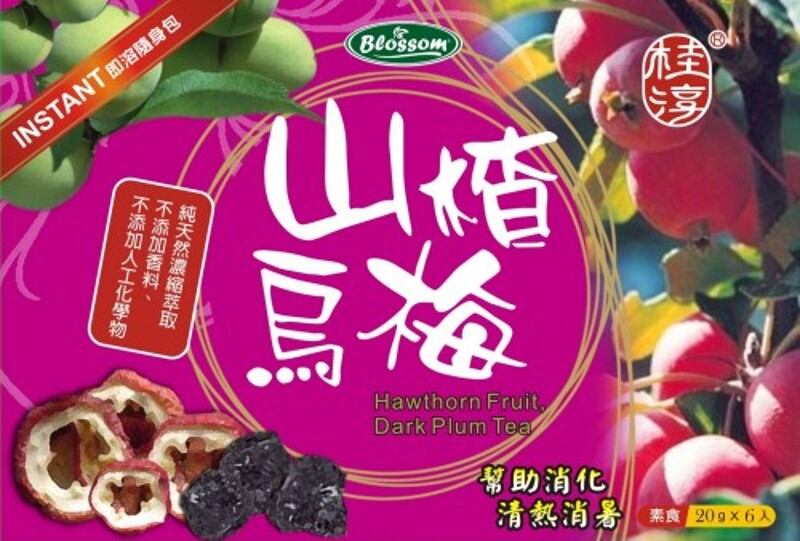

In its latest update to the excessive packaging regulation, SAMR has now mandated that tea and tea-related products will fall under the latter category and allowed a maximum of three packaging layers instead of four.

“Any products that utilise or are related to the use of tea such as tea leaves, tea-based products and flavoured teas will be subject to this new regulatory amendment,” SAMR stated via a formal statement.

“The maximum number of packaging layers allowed for all tea products will be reduced from the current four to three, and it has been made clear that these must not be made out of precious metals or premium wood material such as rosewood/mahogany.

“In terms of the permitted cost allowed to be allocated to packaging, tea products that retail for above CNY200 (US$) will need to limit this cost to be within 15% of the retail price – all others can be within 20% of the retail price.

“Manufacturers should also note that regardless of the tea products’ pricing and quality, the mass of the packaging used must not be more than eight times the mass of the actual product.”

Based on the k-value coefficient standards determined by SAMR, where the k-value is a representation of the amount of empty space allowed inside the package e.g. beverages have a k=5 value and chips have a k=20 value, different tea products and variants have been allocated different k-values as per this update.

“Tea products will be categorised into ‘compressed teas’ and ‘other tea products’ and the k-values for each product will be determined accordingly – for instance general variants of compressed teas will have a k=9 value and other general tea products will have a k=13 value,” said the ministry.

“But for specific tea variants such as Taiping houkui, Anji white tea, Wuyi tea, Shoumei tea, White peony tea and several more, the k-value will be 20 whereas flower teas will have a k=60 value.

The k-value revisions take effect immediately, but most of the other changes will be enforced starting March 1 2025 – all tea products produced before this date but in compliance with the first iteration of the excessive packaging regulations will still be permitted for sale until their expiry dates.

Tea in the spotlight

Tea has been a major beverage in Chinese culture since close to the beginning of Chinese civilisation, and has long been considered a traditional beverage but recently experienced a renaissance of sorts in the country linked to the RTD category.

According to Statista, local revenue alone from the tea market in China is estimated to be some US$117.4bn from both supermarket-bought RTD teas as well as tea specialty shops such as Naixue and HeyTea, with an expected CAGR of 6.37% growth between 2024 and 2028.

With consumption volumes expected to reach 2.4 billion kilogrammes in total this year, and the average volume per person in China to reach 1.58kg, the tea sector also has the unfortunate potential of generating a huge amount of waste e.g. via the plastic bottles used to sell RTD teas in if not controlled, hence it comes as no surprise that SAMR is hoping to nip this potential issue in the bud.