Clucking good: Shanghai plant-based ‘fried chicken’ firm Haofood reveals exclusive expansion plans

The firm successfully raised USD$3.5m in seed capital from co-investors like the CEO of Monde Nissin Henry Soesanto, Rich Products Ventures and Big Idea Ventures.

Armed with the investments, CEO Astrid Prajogo outlined plans to achieve a 4,000% to 6,000% growth through advancing its R&D infrastructure, diversifying sales channels and expanding to other regions.

“I feel extremely grateful and honoured. This funding can empower us to accelerate our business.

“When I was about to build Haofood, I intended to do good. I thought… How can I secure a good future for my daughter? She’s 20 now. What kind of life and environment do we want to pass on to them? This makes me think time and again. What I do will come back to me,” said Astrid.

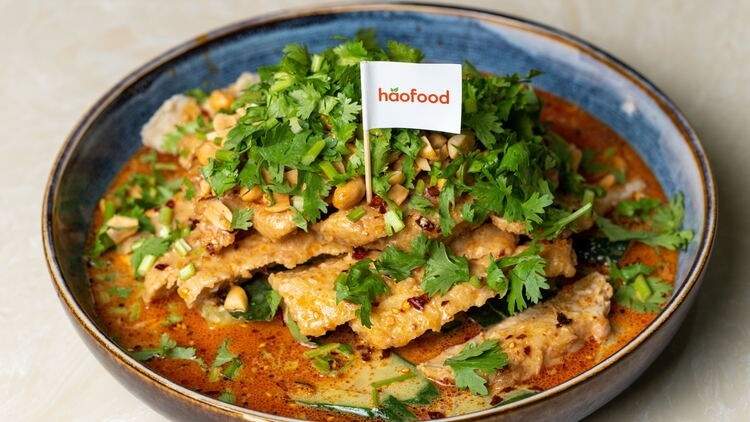

Haofood manufactures plant-based chicken using peanuts processed with proprietary technology Innotein. The technology can create a textured plant-based protein resembling fried chicken.

The firm has more than 50 brands under its portfolio and is available at more than 250 locations across China.

It has a co-manufacturing plant in Hefei, Anhui (eastern China), with a protein output of 15 tonnes daily, roughly translating to 450 tonnes monthly or over 5,000 tonnes annually.

Currently, Haofood utilises the ‘horeca’ sales channel – hotels, restaurants and cafes – across Shanghai. Its products are also available on the e-commerce site T-Mall and Taobao.

The firm has achieved a 2,000% growth since its inception with these efforts.

However, with the funding, it aims to enter 5,000 restaurants this year out of the total 250,000 restaurants in the city.

The firm also wants to target quick-service restaurants (QSRs) and convenience stores. Convenience stores can be found after every 50 metres of walking in Shanghai; hence, it is a great sales channel to tap on, added Astrid.

Therefore, she is gunning for a 1,000% growth in China from April 2022 to April 2023.

“We loved our journey with them (‘horeca’), but we need to bring our solutions to the wider community. Our priority is to make getting our products as easy as possible.

“Accessing QSRs and convenience stores is more complex than ‘horeca’ because we deal with the corporate side of businesses. With the investment, we can hire more professionals to assist, employ more distribution methods and manage complex logistics,” said Astrid.

As an investor, Soesanto believes peanuts have a unique proposition in the market as it is a unique protein to use in manufacturing plant-based products.

A chemical engineer by training, he hopes that Haofood can spot this uniqueness, keep enhancing its technology and grab the opportunities available.

“I hope they can capitalise on their strength and keep on upgrading. We are trying to improve the well-being of people and the planet and solve the food security issue sustainably.

“Alternative meat takes up 1% of the meat market. It can become 10% in 10 years, a 1,000% jump. This is proven by the alternative dairy market, in which 14% is comprised of plant-based milk like oats, soy and almond.

“This is going to generate a lot of investment. Therefore, the players need to be innovative and update their IT,” said Soesanto.

Innovate, or dissipate

Haofood’s proprietary technology Innotein is an end-to-end approach to manufacturing plant-based proteins using ingredients such as peanuts, corn and soy.

After being processed using the technology, the proteins become ‘chicken’ with a fibrous texture, complete with the umami flavour and vegan flavouring, and without the MSG and colourings.

The process can produce the basic product ‘raw meat’ and ready-to-cook and ready-to-heat nuggets and ‘jipai’ (akin to patties or chops).

According to Astrid, the funding can accelerate its plant evolution, complete with more High Moisture Extrusion Technology (HMET) equipment and bigger floor space for R&D.

If the plant upgrading succeeds, Haofood intends to produce other ‘formats’ of chicken and a pork alternative in Q3.

“If we can’t innovate, we can’t go far. It’s not an option – it’s a must. We heavily emphasise production innovation because our end product is food. Application is important,” she said.

Ending the conversation, she said South East Asian consumers can look forward to Haofood products as she plans to ‘mudik’ (Indonesian for ‘coming home’) around Q4 2022.

The firm has also inked a new deal with convenience store Lawson to sell its new satay nugget on a stick in China. It will be on sale at 2,300 stores in Shanghai, Zhejiang and Jiangsu provinces.