Expanding palm oil horizons: Malaysia taps trans-fat free and cost advantages to spotlight Middle East as major new export market

Earlier this year, MPOC CEO Datuk Dr Wan Zawawi Wan Ismail had already revealed to us the council’s plans to diversify Malaysian palm oil export markets beyond depending on its two current major markets of China and India.

“The current palm oil market only has two major palm oil exporters – Indonesia takes about 70% and we take about 26% to 27% and it has been this way for some time,” he told us.

“If we don’t seek to diversify our export markets and find new markets to break into, then this will remain forever stagnant and Malaysia will remain at this 27%. So we need to diversify to break away from traditional markets and this stagnation [and although] India and China remain very important markets to us and will continue to be a focus, we are also focusing energies on other parts of the world [including] Middle Eastern counties such as Saudi Arabia and Iran.”

MPOC Deputy CEO Belvinder Sron stressed this objective again in a recent MPOC virtual event focusing on palm oil trends and potential in the Middle East, saying that the council was looking at the developing the region further as a major export market.

“MPOC is increasing our efforts to increase market share in the Middle Eastern region as it is very important to us,” Sron told the floor.

“Overall, the Middle East imported over six million MT of oils and fats last year of which 41% was palm oil, and we believe there is a lot of potential for further growth here.

“One of the driving factors for us is that there are rising expectations for health and wellness in the region, such as Saudi Arabia raising concerns over trans-fats in foods – palm oil is trans-fat free, which is a big advantage for us as many food firms are already phasing out trans fats in their food formulations as hazardous to health.”

Malaysia exported some 2.5 million MT of palm oil and palm oil products to the Middle East in 2020 – but this number is not a reflection of the norm, as imports were heavily influenced by the impacts of COVID-19 lockdowns in the region.

“Palm oil has been the largest imported edible oil into the Middle East for many years, averaging at some 2.7 million to 2.8 million MT a year – last year, this saw a decline of some 300,000 tons due to the COVID-19 pandemic,” said MPOC Director of Marketing and Marketing Development Faisal Iqbal.

“In this region, palm oil consumption is very dominant in the food manufacturing and HORECA sector, whereas sunflower oil is more dominant when it comes to home consumption, so when lockdowns affected food product manufacturing and foodservice, the demand for palm oil inadvertently also went down whereas sunflower oil saw an increase due to in-home consumption.

“That said, we do foresee this trend reversing in favour of palm oil in 2021 as we are already seeing that demand is returning in the region, [especially when] in countries like Turkey and the UAE, life is getting back to normal faster than any countries in Asia.”

Within the Middle East, just five countries - Turkey (35%), Iran (26%), SA (11%), Iraq (10%) and the UAE (4%) - make up 86% of the demand due to being the most populous and having the most established food industries.

Cost advantages

Palm oil also holds the distinct advantage of being cheaper in price than most other edible oils – for example, as of 21 September 2021, the price of crude palm oil stands at US$1,230 per MT, as compared to US$1,391 per MT of soybean oil, giving it a price advantage of US$161 per MT.

“In countries like Turkey, palm oil holds an advantage in being cheaper and more affordable than other oils, which is very important in this market,” Culinary Products and Margarine Industrialists Association (MUMSAD) General Coordinator Ebru Akdag said.

“There are also increased no trans-fatty acid expectations for products in the country, and new regulations have stated that this needs to be less than 2%, so palm oil can definitely play to this – especially when considering the importance of the margarine to the local food industry, where it is going to some 92% of households in the country.”

Alami Commodities Managing Director Ahmad Alami concurred on both points, adding that in addition to palm oil’s lower price due to lower production costs, the rising prices of other oils are also increasing the contrast.

“There has been a rise in soft oil prices in the region, making palm oil more attractive to consumers – and the benefit of this is that they will try it, use it and then see the efficiency and economy of it, thus converting them to continue to use palm oil,” said Alami.

“[A good example of how important oil prices are] to markets like Saudi Arabia can be clearly seen in the numbers – in 2020, even with COVID-19, Malaysian palm oil took up 70% of the country’s edible oil imports compared to 30% the previous year, more than doubling in number due to the levy imposed by Indonesia on its palm oil exports which raised its prices.”

Challenges and opportunities

That said, Akdag highlighted that a number of challenges still exist for palm oil in the region, particularly in Turkey where sunflower oil is the dominant go-to oil.

“We know from previous local trials that Turkish consumers have been resistant to using palm oil at home as they are not used to the colour, which is not bright yellow like sunflower oil is,” she said.

“There has also been prejudgements created by some media, so many consumers have a negative image of palm oil, including misleading reports that palm oil equals trans-fatty acids, which is of course untrue but has affected consumers negatively.”

Alami added that another big hurdle to solve is that of freight costs which continue to be on the rise since the pandemic hit.

“Although palm oil has a distinct cost advantage as a commodity, the rising freight costs to bring it over from Malaysia have sometimes made other packed, imported oils from neighbouring countries cheaper due to the logistics,” he said.

“For instance, it could cost some US$6,000 to bring in a container of palm oil from Malaysia to Saudi Arabia, but just US$1,500 to bring in the same amount of sunflower oil from Turkey – these higher costs could erode palm oil’s existing cost advantages.

“It would also be wise to not forget that there is still regional instability and tensions here, which could restrict trade, so all exporters should be mindful.”

Despite these hurdles, Iqbal expressed confidence that the Middle East region holds huge potential for Malaysian palm oil.

“The Middle East is one of the very few markets that have registered Malaysian palm oil import growth in 2021, both in terms of volume and value – in the first eight months of 2021, they imported 1.77 million MT, up 3.9% in the same time frame in 2020, and major markets such as Iran and the UAE in particular grew significantly by 80.4% and 10% respectively,” he said.

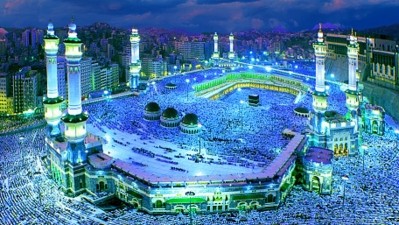

“Markets are opening up and there are many festivities and events on the way such as World Expo Dubai, FIFA 2022 in Qatar, and possibly the full resumption of Hajj and Umrah pilgrims – all of these are factors that provide a positive outlook for palm oil in the region, [so] we still believe the Middle East is a consistent and reliable export destination for palm oil.”