Promotional Features

How innovations in dairy proteins can meet consumer needs and unlock opportunities

Consumers around the world are looking to eat more healthfully, including boosting protein intake as part of an active and healthy lifestyle.

Southeast Asia is no exception, offering formulators promising opportunities to tap consumer demand for increased protein consumption. Recent studies show that consumers in this region have a desire to increase protein intake and a need for a greater variety of high protein products that are convenient and aligned with their taste, dietary preferences and habits.

A consumer desire to increase protein intake

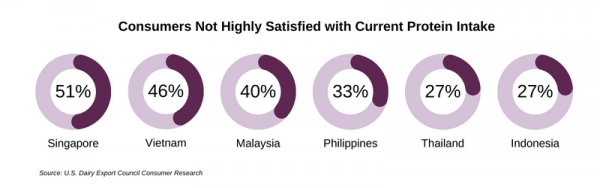

Recent consumer research by the U.S. Dairy Export Council (USDEC) reveals that there is room to improve consumer satisfaction with protein intake. The online study surveyed consumers across six Southeast Asian markets drawn from middle to high income urban households. While individual markets vary, the average score across Southeast Asia shows that more than one-third of consumers are not highly satisfied with their current protein intake. Expressed differently, this group has only moderate to low satisfaction.

The same study found that the top sources of regularly consumed (at least once a week) self-reported protein consumption across the Southeast Asian markets are mainly traditional food sources, including eggs, dairy, meat, seafood, and soy-based foods such as tofu. Consumption frequency of protein fortified foods and protein powders is significantly lower.

Innovating with protein

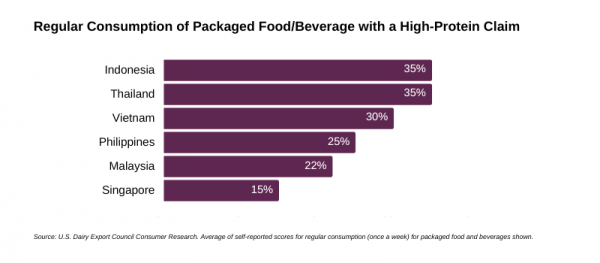

The consumer-reported lower consumption of higher protein foods is not unexpected given lower familiarity and marketplace availability of protein boosted packaged goods in the region. It also reflects an opportunity for food formulators to develop new products or reformulate existing items with added protein for health.

U.S. dairy protein ingredients such as whey protein concentrate (WPC) and isolate (WPI), as well as milk protein concentrate (MPC) and isolate (MPI), offer a formulator-friendly complete package of nutritionally high-quality protein together with multifaceted functionality, a neutral flavor profile and wide usage versatility across diverse applications such as beverages, snacks, soups, sauces, and desserts.

Key functional properties include high solubility, water-binding, gelation, thickening, foaming and emulsification. These are all characteristics that are advantageous for creating on-trend higher protein products that maintain consumer appealing tastes and textures.

According to data from Innova Market Insights, new whey protein product introductions in Southeast Asia accounted for 23% of total tracked whey protein product launches in Asia during 2022.1 Considering the region’s population, economic potential and dynamic food and beverage industry, this low share regionally reveals untapped opportunities for Southeast Asian food and beverage manufacturers to innovate healthful protein foods and beverages made with dairy proteins.

“When launching a new product, remaining consumer centric can go a long way in helping food and drink manufacturers increase the odds for in-market success,” says Anoo Pothen, Director of Consumer Insights for the U.S. Dairy Export Council in Singapore. “Sound research conducted with industry-leading partners helps uncover not just what consumers say they want, but also the underlying motivations and unmet needs.”

Pothen and her colleagues at USDEC Singapore engage in multiple initiatives that support manufacturers in Southeast Asia along the innovation journey – from consumer insights to product prototype development. One such area is health and wellness in a convenient format.

A consumer desire for convenience

In a post-pandemic environment, consumer needs are also evolving when it comes to health, wellness, and convenience. Although consumers recognize the importance of protein, understanding varies on the right amounts and types of protein to consume. Optimizing intake conveniently can also be a challenge, given the limited number of higher protein products currently available in the region, especially beyond the sports nutrition category.

Choosing the ideal protein ingredient means considering the wide variation in the quality of different animal and plant-based protein sources in terms of the amino acid composition and protein digestibility. Dairy proteins stand out as easily-digestible, high-quality, nutritionally-complete proteins containing all the essential and non-essential amino acids and high levels of branched-chain amino acids (BCAA).

With soy as an exception, plant proteins are often nutritionally incomplete proteins and less efficient than animal sources at providing comparable amounts of essential amino acids. Consequently, a larger quantity, and possibly a mixture, of protein sources may need to be used in formulations to match the essential amino acids dairy proteins provide. This, in turn, could have nutrition and flavor implications for formulators and impact a product’s ultimate cost and consumer appeal.

Innovating with high-quality proteins

The rise in global accessibility of a broad variety of dairy ingredients can be leveraged to develop new packaged foods and beverage products that satisfy individual and unique taste preferences. Innovating with nutritionally high-quality proteins can also suit the special needs of populations with nutrient requirements or restrictions, such as fitness enthusiasts, older adults and seniors, those watching their weight or following low-salt, low-sugar or low-fat diets.

For example, the neutral flavor profile of milk and whey proteins can be leveraged to enhance the nutritional profile of a favorite regional snack without sacrificing flavor. Formulators can also leverage the functional properties of dairy proteins to achieve the texture and viscosity consumers normally enjoy in an indulgent dessert, delivered in a better-for-you package. And pairing the high-quality protein of dairy ingredients with the health benefits of popular fruits helps satisfy multiple nutrition goals within one convenient eating occasion.

“From morning through to night, consumers never stop looking for food and beverage options that fulfill their taste and nutritional needs,” says Pothen. “Food product formulations for all eating occasions – breakfast, working out, snacking and dining out – require ingredients that meet these nutritional needs while offering the necessary functionality.”

Good for people, good for the environment

Together with increasing consumer interest in protein, environmental consciousness is also on the rise in the region, although not yet a key purchase decision for food and beverage products.

Another recent study conducted by USDEC sought to better understand what Southeast Asians know, think, and do when it comes to food sustainability. Consumers were surveyed online across six markets in the region: Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam. The survey found that good value (67%), taste (61%) and freshness (59%) are still king when it comes to what drives shoppers’ purchasing decisions. Environmentally friendly (40%) did not rank among the top ten deciding factors in four out of the six markets. Some barriers to adoption were ‘environmentally friendly products are not easily available’ (49%) and ‘it is too costly’ (45%).

The same study identified that health and nutrition also strongly influence what consumers buy and that some regional consumers are willing to pay more for healthier and environmentally-friendly foods. The percentage of consumers indicating they are very likely to pay more for ‘higher protein content’ foods was 30%, the same percentage as those who indicated a willingness to pay more for ‘environmentally-friendly’ food and beverage products.

“U.S. dairy farmers and processors have a long legacy of improving their environmental impact, producing high quality dairy products and ingredients while also committing to the ambitious goal of greenhouse gas neutrality,” adds Pothen. “U.S. dairy proteins are a promising ingredient solution to address nutrition, innovation and environmentally conscious attributes that consumers desire. New food formulations that appeal to all three will help Southeast Asian consumers fulfill their protein intake deliciously and responsibly.”

References

1. Innova Market Insights, New Products Databases.