FNA DEEP DIVE: UPCYCLED FOODS AND BEVERAGES

From waste to wonder: Upcycled products gaining traction with APAC food firms keen to maximise processing potential

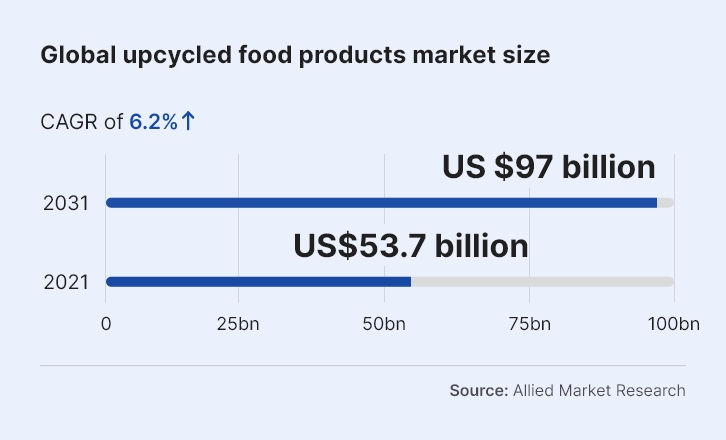

Although firms created upcycled foods and beverage products have been around for several years, upcycling in general tended to be considered more as an ‘afterthought’ for sustainability purposes. But today, with the value of processing efficiency higher than ever, it is emerging as an increasingly viable strategy to help firms maximise processing potential.

According to Singapore’s KosmodeHealth which specialises in using spent barley grains to make various food items, the upcycling sector has value even beyond the efficiency and sustainability benefits as there are also health and nutritional benefits to be reaped.

“Using barley as an example, spent barley grains are what are left behind and considered food waste after the production of beer or malt drinks such as Milo – and these actually contain even more protein and fibre than the original unspent barley grains,” KosmodeHealth Co-Founder and CEO Florence Leong told FoodNavigator-Asia.

“It’s all an issue of ratio, because in the production of beer or Milo they remove the starch as this is what they are interested in fermenting this to make their products – the spent grains are left behind, and these are enriched in the fibre and protein, which we can then extract to make new food products.”

The firm works with companies such as Nestle and Asia Pacific Breweries Singapore (brand owner of Heineken and Tiger) to collect spent the barley grains for upcycling in their W0W zero glycemic response, zero starch noodle brand - and this in turn helps these firms to maximise the efficiency of their processes as their waste is thus reduced.

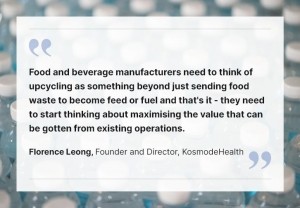

“There is a lot of discussion and concern about how to provide more nutrition for the global population without burdening the planet further, and upcycling is a good strategy to put more protein and fibre back into the food supply,” Leong added.

“In APAC there is now more focus on this upcycling into food products for human consumption, and not into animal feed or fertiliser – we do believe that there is a need to really maximise the value of current food processing streams, and human nutrition really is the greatest value of all in this case.

“A lot of staple foods in this region are high in carbohydrates and starch from rice to noodles to bread, and at the same time one of the biggest health issues here is diabetes, but it is not realistic to expect all consumers to take staples out of their diets, so the best way is to make these staples better.

“We’ve gotten the noodles right, and now we are also working on bread and rice, and once we have all of these right it will mean essentially removing a large portion of starch away from staple foods in this region, which means helping both human nutrition and public health.”

Watch the video below to find out more:

Coming from the other end of the equation, upcycled fruits and vegetables firm Confetti Snacks firmly believes that snacking is currently the way to go to grow the upcycling industry within the food and beverage space, particularly with the younger generation of consumers having a stronger focus on such sustainability-focused products.

“There is more of a push for sustainability-focused products [such as upcycled foods] in overseas markets such as the United States, because here [in APAC] people aren’t as conscious, or if they are maybe are not as willing to or don't have the means to spend a bit more on these sort of products,” Confetti Snacks Business Development & Media Spokesperson Jiyin Low told us.

“But with more time and education, the younger generation [of consumers] especially is more aware and we are hoping that with these consumers going into the workforce and having purchasing power, they will be the movers and shakers [and snacks] really appeal to this group.

“So although there’s definitely the hope for upcycled foods to move from being niche to breaking out into the mainstream, it probably won’t happen quite so soon – five years is a little bit of a push here in APAC, maybe it can be done in 10 years or so.”

The snacking sector also has the added advantage of being able to utilize multiple food waste streams as opposed to focusing only on certain ones, as long as the taste and format of these appeal to consumers.

“In terms of product development, we started off with mushroom and veggie chips, wand we thought that vegetables were the way to go. But then this year we started with mandarin orange chips, and it has been quite eye-opening to see people’s reactions to not just vegetables but fruits as well,” she added.

“So although when we first started the focus was only on upcycling vegetables, we now realise there are actually other things that we can use to reduce food waste such as fruits so we are looking at making a whole range of fruit chips soon.”

Of fruits and beans

Confetti Snacks is not the only firm with its eye on the upcycling of fruit, with sector heavyweight Dole having established a dedicated arm within the company to focus on the upcycling of its fruit waste back in 2021.

Dole is employing yet another different approach to upcycling, with its focus not so much on the creation of foods from specific categories, but instead on using the waste generated from its large canned fruits, juices, snacks and other businesses.

“The major purpose of the specialised Dole Specialty Ingredients venture is to focus specifically on upcycling and repurposing waste into high-value products,” Dole Specialty Ingredients Managing Director Wei Tze Ooi said.

“Research and development is key, as new technology needed to be developed for the specialty ingredients such as enzyme extraction technology which is different from the manufacturing technology that Dole was using all along.

“We are looking to repurpose multiple food side streams including the peels, seeds, leaves, pomace, stems and other parts of the bananas, pineapple and papayas that are grown at Dole’s facilities in the Philippines; as well as rejected fruits due to factors like imperfections.”

Major products coming out from this facility are ingredients such as enzymes, fruit extracts, seed oils, fibres and more, which Dole plans to utilise for not only food and beverage applications but also in pharmaceuticals, nutraceuticals, cosmeceuticals and more.

In addition to fruits, soybeans have also become an increasingly popular ingredient in the upcycled sector, particularly okara (soy waste).

“The soybean waste (okara) generated annually worldwide is around 10 million tonnes, and it is used as animal feed or dumped and burned as waste, most of which is produced by Asian countries including Japan, Korea, China and Singapore,” Soilabs CEO Dr Mauro Catellani told us.

“Okara has a very high content of proteins, fibres, vitamins, phytonutrients and minerals, but the raw okara is rich in (50%) insoluble fibre due to the residues left after filtering soy slurry into soymilk, making it indigestible for us with an unappetising texture and taste – though with the right technology it is actually a very suitable ingredient to make clean-label foods with low saturated fat, high protein and high fibre.

“The tofu industry produces around 800,000 tons of okara in Japan, about 310,000 tons in Korea, and around 2,800,000 tons of okara in China annually – and though this poses a significant environmental impact, it also creates a significant opportunity for protein and nutrient recovery.

“I believe that we could witness an upward rise in the costs of ‘traditional’ foods such as meat, fish and cheese – so much so that ‘new foods’ from upcycled sources will in turn become the more competitive products in the industry.

“Even if not cheap, this is a trend that would push the market to come to terms with these new products, as ‘traditional’ foods are likely to rise in price so much that they become elite, premium items.”

Beverage bonanza

Not only foods but also various types of beverages are being made from upcycled ingredients in APAC, with this category diversification within the sector signifying a slow but steady maturation of this market.

One such beverage firm is CRUST, which has produced both upcycled beers and other beverages and has operations both in Singapore and Japan.

“There is a growing market for upcycled F&B in both Singapore and the wider APAC region, [driven by] an increase in sustainable offerings as well as larger and more well-established companies focusing more on sustainability,” CRUST Group Head of Marketing Low Jia Yu said.

“Japan is a very important market in this, as there is over six million tonnes of food and agricultural surplus produced yearly which leads to some US$19bn in the relevant disposal costs.

“We have run several pilot projects in Japan, such as with the Kita Kyushu City Council to launch a Tomato Beer brewed using surplus tomatoes from farms in Kagome; and the CROP Amanatsu Honey sparkling water that is made using surplus Amanatsu orange peel.

CROP is the company’s brand for non-alcoholic upcycled beverages, its first venture away from the beer category.

“CROP was established in order to develop a beverage that can be consumed by all, as sometimes events have restrictions when it comes to alcohol, so the beers were not allowed,” he added.

“We do believe that sustainable F&B offerings should be accessible to all hence decided to venture into non-alcoholic beverages [to reach more consumers].

The alcohol category is apparently a good source of upcycling ingredients, with Crafter’s Gin from Croatia also having launched a range of Junibeer zero waste drinks dubbed as ‘re-crafted Crafters’ by the firm.

“Junibeer is made by upcycling the juniper berries we use to make our gin and we have two versions – a 0% ABV one that is essentially a juniper soft drink; as well as a 3.2% ABV one that is really a beer,” Crafter’s Export Marketing Specialist Gloria Hallaste told us.

“The taste is refreshing and moderately sweet, as well as includes a unique taste profile that is characteristic of the juniper berry, which is bittersweet with wooden notes and a silky structure.”

Challenges

Despite the vast potential of upcycling, there are still many challenges that lie in the way of such products going mainstream – with cost, awareness and logistics at the top of the list.

“In Asia, it is the more affluent nations that have a better awareness about upcycled products, and places like Singpaore, Japan and South Korea do have more opportunities,” Low said.

“But at the moment if looking to South East Asia, it is a bit tougher – looking at markets like Malaysia and Indonesia, many of the snacks there are priced very low and consciousness towards health and environment is less, making upcycling less of a priority for consumers.

“The major hurdle with going mainstream is that it is very easy for people to just go back to a snacks aisle and pick up their Doritos and Lay’s – but the hope is that the preferences will change with the next generation of consumers.”

Even a large firm like Dole has not yet fully overcome all the hiccups that come along with this, particularly in terms of logistics, making the need for close co-location of its upcycling facility with its traditional fruit facility a high-priority need, limiting its scope of expansion.

“The pilot plant has been located within Dole’s existing Philippines processing facilities in order to eliminate the need to transport the fruit side streams over long distances, and we intend to make this the default for any other plants,” Ooi added.

“Transporting fruit waste in large quantities across countries would be difficult - In Dole’s case, around one million tonnes (1 MT) of fruit side streams are generated per year, which equates to approximately 50,000 40-foot containers.

“Not only will exporting so much fruit waste from one country to another result in high logistics costs, long distance transportation would also affect the quality of the fruit side stream, making it less viable for further use.”

The supply chain of upcycling itself must also be considered carefully before the sector can really go mainstream, according to NutriV Business Development Manager Olivia Said.

“One of the challenges that can impact a product from breaking into a mainstream category, has more to do with supply than demand, and that is with the supply chain,” she said.

“The supply chain of upcycled products can have more ebbs and flows than made-for-purpose products so that needs to be carefully managed as an important piece in the manufacturing journey [is] to ensure a consistent supply of the upcycled material, [particularly when dealing with] retailers and ensuring shelves are stocked.”