This is why in this edition of the FNA Deep Dive, we take a closer look at the state of the alcohol industry in 2022, the major trends driving its growth, and the challenges that still lie ahead.

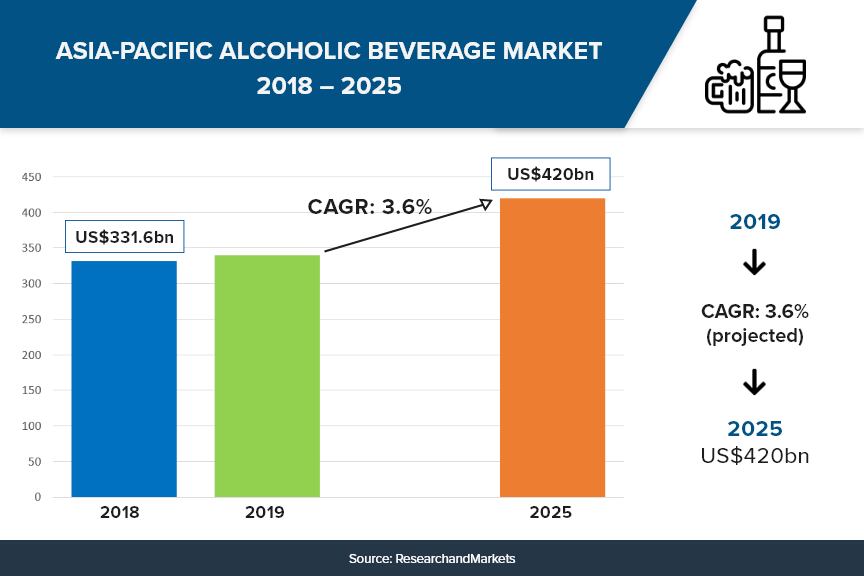

Despite having encountered its share of troubles due to foodservice lockdowns and alcohol bans in various country across the region, the APAC alcoholic beverage market is still estimated to see growth of some 3.6% up until 2025 to hit a value of US$420bn.

Alcoholic beverage firms in the region are striving to drive this growth as much as possible by evolving product and packaging offerings according to post-COVID-19 consumer demands, for example in terms of product formats where ready-to-drink (RTD) alcoholic beverages are seeing a leap in demand in many markets.

One of these markets is Japan, where it has now become the ‘new normal’ for local breweries to have their own canning lines or at the least access to this in order to bottle or can their product.

“Pre-pandemic, local breweries would usually focus on selling from the tap or selling kegs, and most were not focused on packaging their own product to sell directly to consumers as compared to international brands – COVID-19 has very much changed that, as they’ve had to go DTC in 2020 when only takeaway liquor licenses were allowed,” local cider firm inCiderJapan owner and cider industry expert Lee Reeve told FoodNavigator-Asia.

“So canning and bottling were scarce back then, but nowadays it’s a new standard practice for breweries to install or have steady access to their own canning machines – it’s a big change here as previously RTD drinks were very much limited to imported products only.

“This is really happening across the alcoholic beverages industry, from craft beers to wines to cocktails, and many big retailers are also shifting their models to carry more of these RTD products, such as certain 7-11 outlets, some AEON stores and also newer supermarkets like Yodabashi Camera in Kyoto.”

Similarly in China, RTD products are also increasingly in demand due to the convenience factor and increasing number of consumers drinking at home, with hard seltzers in particular seeing rapid development.

“China’s hard seltzer market is going to be different from other markets [where hard seltzer is popular] such as the US, [but] we’re seeing big brands entering the space and educating the market in addition to local players like ourselves,” said Eric Hoang, Co-founder of Shanghai-based ZEYA, launched China’s first locally made hard seltzer in 2020.

“We cannot point to seltzer’s success in the US and expect to translate the same impact in China. It’s more about finding a product that fits with the local consumer.

“For instance, in Asia, there are increasingly more female drinkers, who are looking for products that are lower in alcoholic, healthier options, generally products that resonate with them.”

The RTD hard seltzer sector is seeing a lot of innovation in flavours, but ZEYA is looking at innovating in terms of functional benefits as the next stage of the sector’s evolution.

International award-winning distillery Kavalan also sees RTD products as an important post-pandemic trend within the industry, and has launched its own RTD cocktails in response to this trend as well.

“The Covid-19 pandemic has led to a change in consumer behaviour with increasing numbers of people drinking at home – this has benefited categories such as spirits and RTDs that are more suited to at home drinking during lockdowns,” Kavalan Brand Ambassador & Global PR Officer Kaitlyn Tsai told us.

“A growing number of people are more focused on health and well-being, embracing mindful drinking and choosing lighter, more refreshing drinks, [qualities which RTD products also fulfil].

“This is why we launched our Kavalan Bar Cocktail series with two low-alcohol beverages - Kavalan Highball Whisky Soda and Kavalan Gin & Tonic using our Classic Single Malt Whisky and Gin as the alcohol base to recreate classic cocktails.

“Last year, we also launched a Kavalan Gin Soda Oolong Tea, featuring a combination of Kavalan Gin and charcoal-roasted oolong tea.”

Unusual product innovation

Many alcohol firms are also innovating products to contain elements of surprise or non-conformity in hopes of catching consumer interest.

One example is New Zealand gin firm Scapegrace Distilling, which is known for its Black Gin – a flavoured gin that gets a black appearance from natural botanicals and changes colour to shades of red or purple when mixed with tonic, depending on the pH levels.

“Whilst many other brands were exploring the flavoured segment of the category and dipping their toes in the ‘pink-gin’ craze, we wanted to participate in this space but to provide a clear point of difference,” Mark Neal, Scapegrace Distilling Co-founder and Marketing Director said.

“We now have distribution across 45 markets globally and are posting triple digit growth YOY. Consumers continue to embrace unique attributes [in alcoholic beverages which] challenge the space in which they play.”

Another example of unique innovation is Australia’s Hartshorn Distillery, which developed a vodka made from sheep milk whey, the only one of its type in the world.

“Consumers don’t want something that everyone else is already doing, not just another vodka made from potatoes that has flavours added into it to be different – they want something unique and different,” Hartshorn Distillery Executive Director Nicole Gilliver said.

‘This vodka is double-distilled and 100% non-filtered to maintain the unique character of the milk sugar which makes the product texture and mouthfeel so special compared to fructose or other sugars, and any unbottled vodka goes to make our Sheep Whey Gin, which is another world-first product unique to us.”

Over in Japan, Yoshino Spirits launched a premium whiskey made using desalinated filtered ocean water last year, using water from 200 metres below the Pacific Ocean where ‘no sunlight can penetrate’, producing low-mineral ocean water that gives its whiskey a smooth mouthfeel.

“Our unique production gives the 46% ABV Umiki Whiskey a hint of sweet floral and seaweed notes [whilst also] sharing the importance of living in harmony with nature [and] emphasising the importance of sustainability,” Yoshino Spirits Asia and Pacific Regional Manager Ersoy Serdal said.

“The sustainable aspect of the brand has brought various new consumers into the category [and] Umiki is also attracting great interest in Asia and rest of the world.”

Serdal also believes that more innovation can be brought to the sectors of Japanese wine and sake to widen its exposure to the global market.

Big brands are also getting in on this, such as Heineken which launched a new Edelweiss wheat beer last year with an emphasis on bringing a ‘fresh contemporary twist to a 375-year-old’ recipe, using mountain herbs as a standout point.

“Edelweiss is made from all-natural ingredients and a unique blend of mountain herbs including sage coriander and elderflower – It is easy to drink and has a refreshing finish with a subtle, fruity aftertaste,” Heineken APAC Marketing Transformation Director Sarah Maddock told us.

“There is a growing appetite amongst more progressive consumers to explore and experiment with new tastes and flavours within beer [and] as a result we have seen wheat beer growing at a CAGR of 39% over three years.

“Consumer palates are evolving beyond the traditional, with tastes diversifying from sweeter and less bitter to richer and more complex – providing experiences for which they are willing to pay a premium [and] one of the ways we’ve responded to this is by leveraging our brewing expertise to brew [innovative new] products resonating with these needs.”

In addition, a lot of demand is still being seen for what Heineken calls ‘easy drinking beers’, which tend to be low-alcohol, smoother options.

“One of the fastest growing areas within the beer sector is easy drinking beers which are also typically lower in alcohol,” said Maddock.

“One of our easy drinking options Heineken Silver has gained many fans in markets such as Vietnam, China and Taiwan over the past two years [and we are looking] to introduce it to many more consumers across the region this year.”

Sustainability

Sustainability is top of mind for many companies due to rising consumer demand for this, and this is no different for alcohol brands as well – one of the most common ways to do this is in terms of packaging, and this is particularly pertinent for wine which uses heavy glass bottles that cause some 50% to 70% of the industry’s carbon footprint to come from the bottles and transport.

Garçon Wines has developed flat PET wine bottles which can fit twice the amount of wine on a single pallet (96 cases of 12 bottles each) compared to around 50 cases of typical glass bottles.

“[Our] focus is on innovating in wine packaging with flat, 100% recycled PET bottles that save space, weight and energy to significantly slash carbon footprint,” said Eleanor Brooker, Senior Marketing Manager at Garçon Wines (UK branding)/Packamama (Australian branding).

“This helps reduce transportation cost, and because it’s made with 100% recycled PET, lesser energy is required to produce and recycle. We will be launching with brands in our better bottles from Accolade Wines and Taylors Wines this H12022 in Australia, [a market that has] have traditionally been more accepting of introducing innovative packaging, such as the screw cap closure and bag-in-box.”

Beyond packaging, some firms have also moved to look at sustainability from a raw materials point-of-view, such as Singapore’s SinFoodTech which has produced alcoholic beverage Sachi brewed from soy whey, a by-product of tofu manufacturing.

“Consuming a product from a sustainable brand expresses the consumer’s desire to make a positive impact in the community,” SinFoodTech CEO Jonathan Ng told us.

“We have positioned Sachi as a premium brand that uses the best raw materials to produce Soy Wine via a patented zero waste sustainable technology. Soy Wine is lower in alcohol (each bottle is 5.8% ABV) and has just 70 calories per serving, so we also hope to target people who are looking for a healthier alternative to enjoy.”

Sachi is said to have a fruity and floral, sake-like flavour profile, is rich in soy antioxidants, and is free of gluten and any flavour additives.

Challenges

That said, the alcohol sector is still facing several challenges in its quest to return to normalcy, not least the impacts and ongoing hurdles caused by COVID-19, with the most obvious effects seen on out-of-home dining and foodservice.

One market which is continuing to feel the strain of COVID-19 lockdown measures is Japan. The local alcohol sector faced a serious setback back in April/May 2021 when the government implemented an alcohol ban and prohibited alcohol sales past 8pm, even asking distributors not to sell alcohol to foodservice players at one point.

“This hit the industry badly and upset a lot of people, as basically there was just no business for anyone for two to 2.5 months,” Reeve told us.

“Many foodservice people, the bars and restaurants, opted to close as they were being subsidised by the government, but us distributors and manufacturers couldn’t do the same as there were no subsidies to help us through.

“This lasted until August/September, then when the state of emergency was lifted in October everything just sprang back vert quickly and November especially saw a very strong rebound for the alcohol sector in Japan.

“But just recently on January 19, 14 prefectures in Japan have been placed back in a ‘quasi-state of emergency’ until February 13. The government is asking places to stop serving alcohol at 9pm, which is slightly better than the 8pm previously, but we’re now all worried and many people in a bind as to what to do as there were many events planned for January.”

Sharing Reeve’s concerns is Kirin Holdings’ Assistant Manager, Management Planning Department, Kei Dobashi.

“The future of the alcohol industry [especially in Japan] is relatively uncertain due to the variants of concern emerging from the COVID-19 pandemic,” he said.

“What is definite is that many people are now turning to drinking at home, with online sales of alcohol accelerating over the past two years.”

Dobashi also believes that the way forward for the industry is to step up innovation. Watch the video below to find out more:

Apart from COVID-related challenges, the industry’s desire to meet consumer demands for sustainability also face another set of hurdles to be solved, which are unlikely to be overcome quickly due to the complexity involved.

“Producing alcohol sustainably requires significant innovation and change,” said Ng.

“However, there are many rules and regulations in place in the alcohol industry to regulate the industry and thus limits the change that a company can bring.”

Retail modernisation

In spite of the challenges above, the alcohol industry is in agreement that a crucial pathway forward for the sector lies in modernising its retail strategies, whether this be as simple as moving to e-commerce or other more advanced tactics.

“Since the COVID-19 pandemic hit, [there has undoubtedly been] an increase in alcohol purchases on online and retail platforms as more people are drinking at home compared to restaurants, bars or pubs,” said Ng.

“[So like many others,] we pivoted our retail strategy and put most of our efforts in making our products available online first - now we are found in 90% of the online platforms in Singapore in addition to our website.”

Another alcoholic firm that opted to switch to an online focus was Singapore’s Lion Brewery Co, which saw its e-commerce sales proportion shoot up to 98% from just 3% pre-pandemic.

“E-commerce sales in 2021 was a rollercoaster. We [saw] corresponding spikes during tighter restriction measures [in Singapore] when people spent more time and gathered at private residences, followed by dips whenever there was a return to more relaxed measures of eight or five people gatherings in social settings,” Lion Brewery Co’s general manager and co-founder Will Julius said.

“We’ve also seen increasing pandemic fatigue from consumers, which has of course been detrimental to sales [but] still there’s been a growth of over 600% from pre-pandemic e-commerce sales revenues.”

He added that the shift towards modernised digital retail was already taking place pre-pandemic, but was just accelerated when the pandemic hit.

“I do expect this to continue to grow as a new generation of beer-lovers accustomed to e-commerce become the main demographic,” said Julius.

“Nonetheless, off-trade and e-commerce cannot and will not replace on-trade sales, for the simple reason that alcohol is a social commodity and there is nothing quite like having a beer with friends.”

This sentiment was shared by one of APAC’s largest wine brands Penfolds, which opted to make a digital shift in its retail marketing strategy due to bans on wine tasting and sampling, but believes that a combination of digital and traditional physical retail is the way forward.

“We already know that most consumers feel very daunted when faced by a huge array of wines in stores, and find it hard to make a decision – a situation made even harder when unable to taste the wines prior to purchase, so many people just opt to choose the lowest-cost option,” Penfolds International (South East Asia, Japan, Korea, Europe, Middle East & Africa) General Manager Yodissen Mootoosamy told us.

“Our new phygital displays use technology to bridge the digital-physical gap, so for example at the physical stores we have displays allowing consumers to access information via short video clips regarding the wines they are interested in so they can be more informed and confident in their choices.

“What consumers don’t have right now that makes the wine-choosing so daunting is information, and the phygital concept solves this by quickly providing that data.”

The firm has also introduced a concept of stimulating consumers’ sense of smell by dispensing wine aromas onto scent strips and watch a video on the aroma notes, for them to gauge the wine profiles without needing to taste samples.

“And as for consumers wanting a more personal touch, we have also introduced pop-up store concepts where promoters will still be on-hand to help explain and, in markets where allowed, provide tastings in safe circumstances,” he said.

“All in all though, I believe the future of wine retail lies in a hybrid concept, much like work in general will be a hybrid of work-from-home and work-in-office – it will be the best way to maximise reach and connection with the consumers to help them make wine choices best for them.”