With continued growth on the horizon for the segment, in this edition of the FNA Deep Dive we take a closer look at the juices industry in APAC, and examine how such trends are driving product innovation in the region.

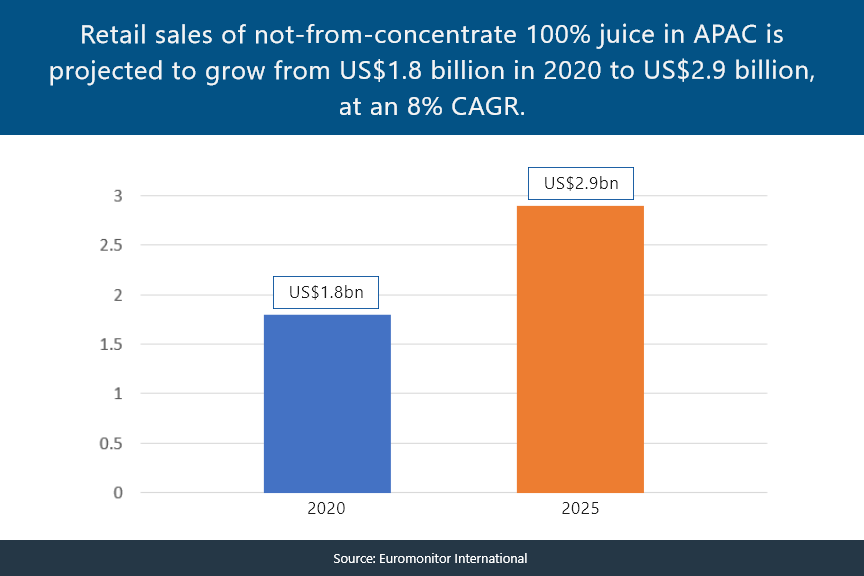

Within the juice industry in APAC, fresh, not-from-concentrate juices in particular are predicted to see a healthy 8% growth over the next few years to hit US$2.9 billion in 2025.

The ability of juices to carry added functionality and health benefits are a significant driver here, as consumers are now consciously searching for ways to make the most out of their food and beverage options, and in response to this manufacturers big and small across the region have been developing product variants to meet these needs.

“What a lot of consumers are looking for these days are things with functionalities and in particular inherent nutrients - the trend is really towards functional juices and drinks,” Bega Juice Drinks and Water Ice Senior Marketing Manager Jennifer Perry told FoodNavigator-Asia.

“This includes the inherent nutrients in the fruits such as vitamin C when it comes to oranges, and also makes the case for the use of more functional ingredients such as vegetables which have known functional benefits.”

Bega operates a number of well-known juice brands in Australia including The Juice Brothers, Mildura, and Daily Juice – collectively, the firm claims to be the top supplier of chilled juice in Australia.

Other forms of functional juices cater to specific demands, such as Frucor Suntory’s The Real McCoy Plus juice range, focusing on specific blends of fruits and vegetables for vitality (beetroot, raspberry, pomegranate), immunity (carrot, orange, lemon, ginger) and balance (apple, pear, rhubarb mint).

“The Immunity juice blend has vitamin C to support immunity, the Vitality blend is about reducing fatigue, and the Balance blend contains prebiotics and fibre,” Dr Lesley Stevenson, Frucor Suntory Scientific and Regulatory Affairs Manager told FoodNavigator-Asia.

“It can be seen that functional offerings will evolve in the future, especially in the chilled juice space – I’ve recently seen a new protein ingredient that could potentially allow added protein in juices, so that could be [a possible functional development moving forward].

“How Frucor Suntory goes about our juice innovation is to follow a consumer-led approach, by directly talking to consumers, getting insights and working on products based on these insights [in addition to developing tools] such as our ‘Wheel of Pulpy Goodness’ which have been really useful in juice innovation.”

Watch the video below to see more on Frucor Suntory’s juice innovations.

Immunity and gut health

Immunity in particular is exceptionally popular these days due to the COVID-19 pandemic, with even smaller players developing entire product concepts based on this theme.

One example is New Zealand’s ‘73 citrus, a functional beverage brand which has launched a better-for-you orange juice with liposomal vitamin C to boost immunity.

The firm’s liposomal technology slows down the digestion process in the body, increasing the absorption of encapsulated vitamin C – and orange juice in particular was selected due to its widespread availability and popularity in the country.

“In New Zealand, oranges are growing all the time, and people drink orange juice for breakfast a few times a week. It deserves to be looked at and be innovated,” said ’73 citrus co-founder and managing director James Crow.

“While orange juice naturally contains vitamin C, it is only in minimal amounts - Each 330mL can of ‘73 citrus orange juice contains 1,165mg of vitamin C, of which 1,000mg is from the liposomal vitamin content.”

Gut health is another area of focus for juice firms, and fruits with naturally high benefits in this area such as kiwifruits have been at the heart of such innovation – NZ Juice, which operates across New Zealand, China, Taiwan, Hong Kong and Japan, told us of its aptly named ‘Functional Food’ which comprises three whole kiwis in a 180ml bottle and has been selling particularly well as of late.

“Kiwis have seen a steep rise in popularity recently as its benefits are well-known, including high vitamin C levels and polyphenols which help with immunity and high fibre content as well as enzymes good for gut health,” NZ Juice General Manager Owen Parks said.

“We are able to call this a functional food as the benefits are backed up by government research. [Especially] in Asia, there’s a really high demand for juices and products made from kiwifruits and berries here.”

Other functionalities

In addition to immunity and gut health, juices have also been used as a vehicle for other functions such as with South Korea’s Bae Juice, which has developed a Korean pear juice claiming to reduce hangover symptoms.

“Within juices, marketing claims for gut health, immunity and skin health are taking off - these functions have always existed in the juice industry, but a lot of people are now leaning towards buying juices with a functional benefit as opposed to just a juice to taste,” Bae Juice Director and Co-Founder Liam Gostencnik told us.

“For instance, the [hangover drinks] market is a big one in South Korea, and Korean pear juice is commonly taken here to reduce hangover symptoms.

“Korean pears act on two enzymes, alcohol dehydrogenase (ADH) and aldehyde dehydrogenase (ALDH) which help to speed up alcohol metabolism and inhibit alcohol absorption, allowing for a reduction of hangover symptoms like headache, dry mouth, and sore throat.”

Better-for-you

Over in Asia, juices giant POKKA has won over a large part of the market with an extensive array of juice products and has also enriched several of these with nutrients that appeal to consumers.

“Our Carrot Fruit Juice is enriched with beta carotene and antioxidants D and E, whereas all fruit juices contain vitamin C to support the immune system and some also have additional antioxidants, vitamins B3 and E to [build up] wellbeing and immunity,” POKKA Senior Product Manager, Marketing Division Irene Ee told FoodNavigator-Asia.

“[Research has shown that] one in two global consumers have increased their consumption of functional foods or drinks.”

In addition to providing extra benefits in their juices, POKKA also has a strong focus on better-for-you products with many reduced-sugar alternatives in its portfolio e.g. Kiyo Kyoho Grape Juice vs Kiyo Kyoho Grape Juice Less Sugar – highlighting that these are also attributes that consumers are on the lookout for currently.

“It is evident that consumers’ behaviour and expectations have evolved over recent years, and innovation trends are skewed toward better-for-you, botanical, healthier ingredients and the less-sweet direction,” said Ee.

“The pandemic has changed and influenced ways of life globally, [which] has in turn altered consumers behaviours as well as companies’ business perspectives - protecting [consumers’] health and interests are new expectations, so adaptability is a crucial driving force to push forward for the years to come.

“POKKA’s number one priority is to ensure that our innovations meet [consumer needs] in terms of nutrition, flavour, and convenience with [authentic] and nutritional ingredients, [and] no preservatives – this consistency has made us the No. 1 [brand] in the non-chilled juice drink category based on Nielsen Market Track in Singapore.”

Dr Stevenson added that Frucor Suntory is also working on sugar-reduction technologies to improve its better-for-you range.

“Consumers are undoubtedly looking for better-for-you options, and concerns about sugar do restrict the amount of juice that some consumers choose to drink,” she said.

Local sourcing and provenance

Local ingredient sourcing has also been a key theme for the juice industry at this time, particularly in countries like Australia and New Zealand where provenance has almost become a necessity to attract consumer attention.

“All of NZ Juice’s products use locally-grown fruits, but kiwifruits in particular are really important to New Zealand as we are one of the largest exporters via Zespri – so for our Functional Food we use all Zespri fruit, and offer the added benefit of making kiwis available all year round as opposed to seasonally,” said Park.

Dr Stevenson added that provenance is a very big thing in the Australia and New Zealand region, highlighting that there is also a strong emphasis on local sourcing in Frucor Suntory for its chilled juice products.

“We make the chilled juices in the Hawke’s Bay region of New Zealand and we have long term partnerships with local growers to source the ingredients for these such as apples and oranges where we can,” she said.

The trend for local sourcing is making its way over to Asia too, even if provenance has not yet had quite so significant an impact as compared to Oceania just yet – for instance, all of Bae Juice’s products use pears sourced in South Korea.

“The pears are sourced, squeezed and packaged in Naju, South Korea, which is famous for its Asian Pears,” said Gostencik.

Processing

Because of the current trend for functional, better-for-you products, Perry highlighted how important it is to ensure that the nutrients consumers are looking for are lost in as minimal amounts as possible, and this is where the processing of the juices plays an important role.

“[To maintain functionality], it is very important to retain as much of the natural benefits of the juice as possible – for The Juice Brothers for instance, we use a special process called reaming when extracting the juice,” she said.

“Reaming is different from the regular process – it is similar to how one would juice oranges at home, just cutting them in halve and twisting in a commercial sense, which is much gentler [than crushing].”

Park concurred that the juice processing is crucial, not just for maintaining functionality but also characteristics that appeal to the consumer such as colour and flavour.

“Kiwifruit is one of the most difficult fruits to process - we do minimal processing, and also went with the cold-pressing technique for the remaining processing needed as we found this helped to protect the colour and flavour of the green kiwis, in addition to retaining polyphenols and vitamins,” he said.

“Regular juicing of a fruit would destroy the organic compounds we hope to preserve. There are also no shelf life worries – based on ambient shelf-life studies over the past two years, we found there was no change in flavour, microorganism or organoleptic properties for 15 months post-processing.

“This may sound like a long time, but the reasons for this were a combination of processing the fruits at the right maturity, the cold processing I mentioned, and our bottling process to protect the juice – minimum processing at the right time can lead to extended shelf life when done right.”

Main challenges: Regulations and supply chains

Despite its upward trajectory, the juice industry is also facing a number of worrying concerns when it comes to forward-looking growth – in Australia and New Zealand, one of the main ones is in the recent change to the Health Star Rating (HSR) system for juices, which shifted all fruit juices including 100% fresh ones down the scale based on natural sugar (fructose) content.

The Australian Beverages Council Limited (ABCL) previously suggested that impacted fruit juice companies could try to blend high-fructose fruits juices with lower-fructose fruits or vegetables, but acknowledged this would not be realistic for brands which have already established themselves in particular categories.

As it is, brands such as The Juice Brothers would find it hard to adjust, and Perry said that the firm did not intend to make any changes to the portfolio.

“We will opt to highlight the natural benefits of juices as opposed to fructose content as the HSR is emphasizing,” she said.

“We will continue to use the HSR or course, as it is more or less expected by consumers today, but will not be doing anything to increase the health star rating as that would entail things like adding water to the juices and making it a fruit drink, no longer a pure juice.”

Park added that NZ Juices does not use the HSR so it was not affected per se, but highlighted that recent research has already shown fruits, even those high in sugar, would not affect weight like as opposed to general sugar.

“However, our main challenge has come in the form of shipping as of late – this is a huge challenge these days as we export a lot and before, we would be able to get our products on a ship an hour after leaving the factory and to Asia in about 11 days – but now things are all over the place and timelines are more like three weeks,” he said.

Over in Asia, although firms do not have the HSR to deal with, sugar is still considered part of the challenge as various local governments implement different forms of sugar taxes and restrictions on beverages in the region, such as in Singapore and Malaysia.

“We believe that upcoming government initiatives for Singapore such as for Sugar Sweetened Beverages (SSBs) with the display of the Nutri Grade label on all beverages in would have a significant impact on the industry players,” said Ee.

“[POKKA’s response will be to] continue to innovate and reformulate our beverages to suit the everchanging landscape.”