The Japanese government has not yet formally introduced regulations to mandate alcohol firms to include alcohol content by grammes, and not just ABV %, on product labels, but according to local industry experts major industry players such as beer breweries have already been asked to add by-gram information on their labels.

“The way things work in Japan is that the government will ask the major players to do something like this first – and major beer manufacturers would have received this request to start labelling with grammes in addition to ABV,” local alcoholic sector consultant Lee Reeves told FoodNavigator-Asia.

“The government’s reasoning behind this is to first catch up with European regulations (which go by serving units), and the second is likely that the situation is getting a bit scary with local RTD alcoholic beverages.

“For instance, a few years back these canned products would range around 5% to 6% ABV, but in the past two to three years it’s been going up, to 9% or even 10% to 12% – and these are easily accessible items, found at just about any convenience store for less than JPY200 (US$1.84) per unit.

“So in a way Japan hasn’t been that strict about this sort of alcoholic sales enforcement at the retail point, and now the government is looking to portray more responsibility about high alcohol, as much as they can.”

Reeves added that these regulations haven’t been put to the actual vote by the government yet, but that ‘all the major breweries except Suntory’ are more or less on board.

“When one of the big four brewery players do something, others will follow – that is the way things happen in Japan,” he said.

“Suntory is probably going to just wait and see first, and I believe Asahi will be the first company to start with this.”

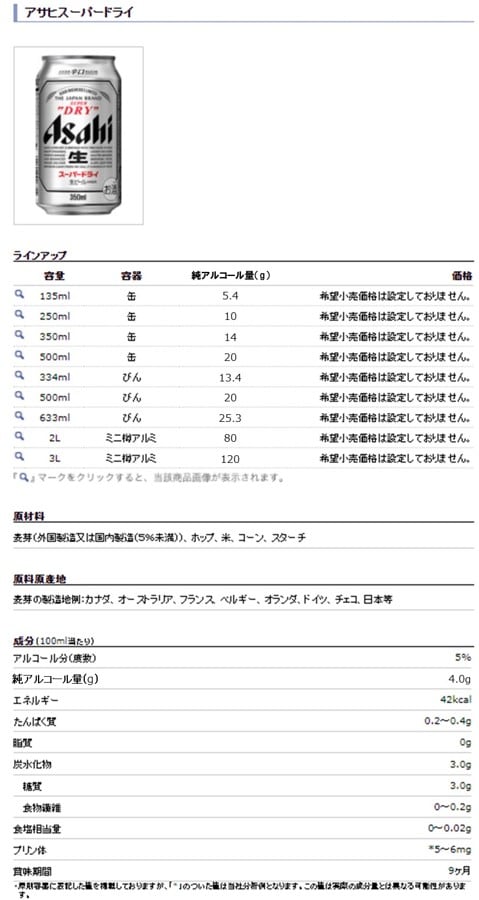

That said, Asahi has told FoodNavigator-Asia that the implementation of this is ‘still under consideration’ for actual products, although it will be implementing alcohol-by-gramme labelling on its website first.

“Regarding the Japanese government’s plan to change alcohol labelling to include the amount/grammes of alcohol, nothing has been decided yet – [Putting] the information of grams of alcohol on label is under our consideration,” Asahi Group Holdings PR Manager Kristin Chiu told us.

“That said, [in line with our ‘Smart Drinking’ initiative], as of March 30 Asahi Breweries will update products information on our website featuring the grammes of alcohol of each product.

“By updating the website, consumers will be informed that how many grams of alcohol are contained in the products so that they can choose the appropriate products for themselves.”

On the other hand, Kirin has confirmed that it will be providing the alcohol-by-gramme information requested by the government on its products – but will be taking a cautious approach by implementing this much later.

“Kirin will start labeling alcohol amounts [by gramme] on product packages by 2024, and aim to achieve this labeling for 100% of canned products by 2027,” Kirin Holdings Corporate Communications Assistant Manager Namika Nishiyama told us.

“We believe that labeling on the product itself is an effective way to ensure that information is conveyed to consumers who purchase and drink the product, and to prevent overconsumption.”

According to Nishiyama, Kirin will be implementing this labelling first for some of its most popular products including 350ml cans and 500ml cans of beer (beer, happoshu, new genre) and RTD (ready-to-drink cocktails).

“In order to promote [our zero harmful drinking concept], Kirin has decided to start with our mainstay drinking products and containers that have the greatest impact,” she added.

“No commitment has been made for other items at this time - Wine spirits and liquor will be considered in the future.”

Major challenges

One major hurdle preventing companies from making quick labelling changes is undoubtedly the associated cost – according to Reeves, space on labels is ‘already very tight’ and there are costs that would be incurred from redesigning and reprinting if any such changes were to be enforced immediately.

“Already in Japan different labelling requirements apply depending on which city you’re in, and making changes to each label will definitely have final cost implications,” he said.

“Also a lot of alcoholic products are already finding it difficult to compete with RTD drinks – we’re talking JPY600 (US$5.53) to JPY700 (US$6.45) for craft or imported products vs JPY200 for RTD – and adding any more cost would make a difference at the end of the day.

“In the long run this isn’t really a huge deal and people would comply, but if we had to make these changes immediately then there would be a lot of associated trouble.”

Nishiyama concurred that costs are also a major concern for Kirin, and stressed the importance for the government to set a grace period before any mandatory changes kick in.

“[It is important that] the government set a grace period for manufacturers to conform to changing the labeling of the alcohol amount on products in order to reduce the costs of changing labels on already-produced products,” she said.

“This [would give] manufacturers time to change over future packaging, until current non-labelled products have sold out [which would] mitigate any costs that would have come with the relabelling of already-produced products, otherwise, manufacturers would have to recall all of their current products, relabel them, and distribute them again.”

Associated costs she pointed out included change costs such as reprinting costs and material disposal costs.

It was also highlighted that relying on labelling alone to prevent alcohol-related harm or damage to public health was not enough, and the government would also need to look at fostering more consumer awareness.

“[Ultimately], the purpose of the labelling of the alcohol content is to prevent any potential harms that come from excessive alcohol consumption, which could create adverse health consequences and social issues,” she said.

“[So] in addition to labelling, [we believe] the government is aware of the need to promote awareness of the precise amount of alcohol among consumers.”