In this edition of the FNA Deep Dive, we take a closer look at this trend and how it is evolving the spreads industry in the region, with more and more firms opting to reformulate their products to meet consumer wants and needs.

The spreads market in APAC is estimated to hit the US$4.6bn mark by 2025, growing at a CAGR of 2.75% driven by an increase in convenience food products such as bread, which require spreads to increase palatability.

Spreads are a common household staple, especially for breakfast or as a snack, and consumers in the region have incorporated a rising awareness of health and wellness into their spread demands, a situation that the COVID-19 pandemic has only exacerbated as of late.

“[Consumers in APAC] are seeking healthier products because they want to avoid over-processed food types with undesirable ingredients,” Lyn O’Sullivan, Senior Brand Manager at Prolife Foods, owner of widely-sold peanut butter brand Mother Earth told FoodNavigator-Asia.

“Natural nut butters such as peanut butter are increasingly gaining popularity over mainstream, processed butters, and a strong push for healthy products by governments in several countries have also contributed to this trend.

“Some examples include Singapore’s Healthier Choice Symbol products and the introduction of sugar taxes on goods with added sugar in the Middle East.”

“Key health benefits of natural peanut butter include a high level of protein (average 25%), and the good fats – plus Mother Earth’s peanut butter is made with high oleic peanuts, a type of peanut that naturally contains more of the essential, good fats as compared to standard peanuts.”

Natural peanut butter refers to varieties that contain only two or three ingredients (peanuts and salt and maybe sugar) or even just peanuts alone, as opposed to conventional peanut butter which also includes additives and hydrogenated vegetable oil to prevent the product’s consistency from being affected by temperature or time.

One way peanut butter consistency is known to change with time if no additives or oils are added is that a natural separation will occur, leading to a layer of oil above the peanut butter, but this is actually normal and just needs to be mixed back together, according to Jobbie Nut Butter CEO Victor Chin.

“A lot of market education is still needed to inform consumers about the properties of natural peanut butter, such as the natural oil separation which is actually a normal thing,” he said.

“That said, as consumers progress to a healthier lifestyle and get more educated on food consumption, we have observed that the buying behaviour is shifting towards natural peanut butter too.”

Jobbie Nut Butter is one of the top-selling online peanut butter firms in Malaysia, with quite a significant presence in supermarkets like Jaya Grocer too, and it also has a line of ‘Jobbie Pure’ peanut butters which contain no sugar or salt added at all.

“The no-sugar, no-salt line was developed in response to consumer demand, and we have really seen the popularity of this vary depending on consumer demographics and by country,” Chin said.

“In Singapore for example, Jobbie Pure is seeing a much better performance than the classic variants (containing salt and sugar added) as compared to in Malaysia, where the classic variants are doing really well.

“So from a demographic [and consumer] perspective, there are differences in the health and wellness trend for spreads and especially peanut butter too.”

Watch the video below to see more of Chin’s insights into the peanut butter and spreads markets.

Jams

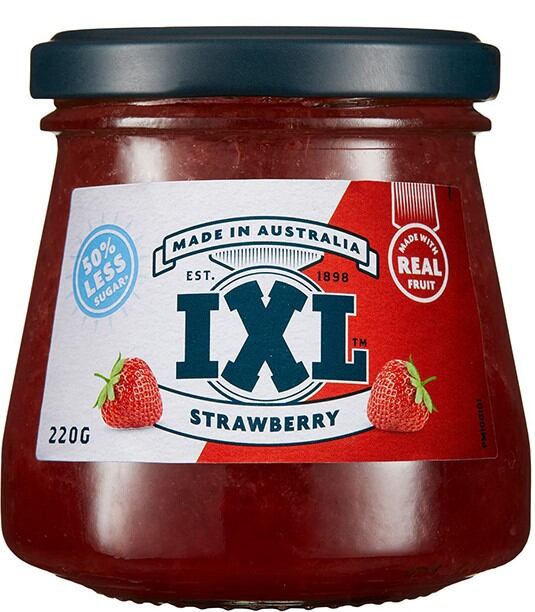

The same sort of trends are also being seen in the jams sector, where brands, including big brands such as Australia’s iconic IXL are also seeing a shift in consumer interest towards low-sugar products.

IXL has been manufacturing jams since the 1800s, and has switched ownership several times but is now owned by Henry Jones Foods, the largest jams manufacturer in the country.

“When the company purchased the IXL brand in December 2019, there was only a full sugar range of jams, as well as a 25% less sugar series retailing in major supermarkets Coles and Woolworths in Australia,” Henry Jones Foods National Sales and Marketing Manager Gabriella Suriano told us.

“However at the time, the jams had been showing poor performance, leading the supermarkets to pull the products off the shelves, so we realised we needed to be different.

“We noticed that there was a strong health trend in the supermarkets in Australia, so we thought we would try and leverage that trend to try and stay on shelf – So with two months of R&D, IXL launched a 50% less sugar series in May 2020 to replace the 25% less sugar range.”

The improved IXL range also does not use any artificial sweeteners to lower sugar content, falling on less overall sugar usage and the increase of other ingredients (pectin, fruit, water) in the jams. At present, Coles and Woolworths only stock the 50% less sugar range.

“We have found some new health-conscious customers who appreciate the lower-sugar jams as they had previously avoided jam due to the poor health credentials [but] we have some very loyal customers that don't like the taste because it's not as sweet,” said Suriano.

“As such the original 100% sugar jams are still available in other supermarkets like IGA and Foodland, but Coles and Woolworths only stock the healthier versions now.

“We’re still working on perfecting the new range though – reduced sugar makes for a more watery texture, which some consumers are concerned with, and we are also trying to make the colour more vibrant.”

The healthier jams trend is also being seen as far as the Middle East, where Turkish organic and natural products firm Polenkoy (which also exports to the APAC region) has developed three series of healthier jams to cater to different consumer demands.

“We have Premium Series jams which are made from organic fruits and juices with no sugar, glucose, artificial sweeteners, or additives; Form Series jams which are sweetened with stevia and are suitable for diabetics, but has no artificial sweeteners of any sort; and a Pure Series which do not use any granulated sugar but are naturally sweetened by boiling with the fruit sugar itself,” Polenkoy CEO Mikail Cosar told FoodNavigator-Asia.

“All three series are suitable for consumers conscious of healthy nutrition, and are suitable especially for the breakfast occasion, where jams can be said to be irreplaceable.”

Localised products

In addition to peanut butter and jam, which are internationally popular spread options, some regions also have their own localized versions of spreads such as tahini (toasted ground hulled sesame) in the Middle East.

“Tahini has very high protein content (25%) and about 60% sesame oil, which is rich in unsaturated fatty acids,” Cosar added.

“It also contributes to the prevention of cardiovascular diseases because it contains oleic and linoleic acids but not cholesterol, and also has a rich content of plant sterols known to have a positive effect on blood cholesterol levels, in addition to other antioxidant compounds.”

Over in South East Asia, a coconut jam spread known as kaya is popular as a staple breakfast item in countries such as Singapore and Malaysia, with kaya firms usually having long legacies (Fong Yit Kaya) or branching out from bakeries or eateries (Gardenia, Wang’s Kaya, Yakun Kaya).

That said, even brands with long legacies or histories are hopping onto the healthier alternatives bandwagon – Fong Yit Kaya, which dates back to 1945 and still follows its founder’s traditional recipes, has also released a 25% less sugar version of its traditional kaya.

Localisation is not just found in these traditional products though – Jobbie has developed a localised version of peanut butter dubbed ‘Monkey King’ by adding coconut crisps to the product.

“Peanut butter has remained largely unchanged for many decades, so this is a way to mix it up –Monkey King is essentially peanut butter with coconut crisps, a very different Asian twist to peanut butter and one of our most premium offerings,” said Chin.

“This sort of experimentation is really necessary, not only to stand apart from the competition but also to remain relevant to consumers moving forward.”

Unique spreads and flavours

Many APAC food firms have also come up with even more unique and unusual spread ideas that vary greatly from the traditional idea of what should go on bread or biscuits – for instance, CEIT Spreads has created a unique Matcha spread, taking matcha from a beverage to a spread.

“Many people we’ve spoken to haven’t really understood what we’re doing here, and we’ve had to explain that we’re making a spread from matcha, a green tea milk spread,” CEIT Co-Founder CG Soon told us.

But even the uniqueness of the product doesn’t detract from the importance of the health and wellness trend, with Soon saying: “We’ve also opted to go the healthier direction with our spreads – we only depend on the sugar within milk product for the product sweetness and don’t go adding extra sugar to it.

“The other important aspect here is of course providing consumers with the assurance that there are no artificial flavourings or preservatives in the spreads – all of these are very important to our consumers, who are usually a combination of those pursuing a healthy lifestyle and who have a love of matcha.”

Even in conventional products like peanut butter, it can be seen that the development of unique flavours is also trending alongside health and wellness – Jobbie’s Monkey King also falls under this trend, with Chin observing the updating of traditional spread flavours as a rising trend in the overall spreads market.

“I see a lot of mixing of flavours, updating these to make them ‘hip’, particularly making these appeal more to the younger generation by adding unique twists,” he said.

Mother Earth has also developed an interesting hemp seed peanut butter product which was launched recently, inspired by the growing interest in hemp as a food ingredient.

“We also have Chia Seed Peanut Butter, LSA (linseed, sunflower and almond) Peanut Butter, and Sesame Seed Peanut Butter – [unique products to provide consumers with interesting choices,” said O’ Sullivan.

Even in the longstanding traditional kaya industry, flavours are seeing significant updates with brands such as Fong Yit’s KayaMila launching new-age variants such as Sea Salt Caramel, Vanilla Pandan, and Calamansi Citrus.

Jams have an even broader area for flavour innovation, as it all depends on the type of fruit used with no dependence on a single ingredient such as peanut – Polenkoy has utilized this to the fullest.

“Our most popular variants are cherry, strawberry, apricot and peach, but some of the more unique flavours like watermelon, eggplant and figs are popular as well,” said Cosar.

“Jams are one of our most popular exports to the APAC region, and the variation of our jams is how we attract consumer interest.”

Apart from these, Polenkoy also has other unique flavours such as bergamot and plum in its jams portfolio.

The way forward for spreads

Spreads have always been seen as a very traditional breakfast item, but increasingly the uses of these are expanding beyond the breakfast table into areas such as snacking.

“[For instance], peanut butter is a traditional, pantry staple in New Zealand and most consumers use it as a spread [but] some also use it for cooking, baking, smoothies and snacks,” said O’Sullivan.

“The COVID-19 pandemic has accelerated the already rising trend in snacking, and peanut butter is a reliable and satisfying snack that really satiates – some snack examples include eating it by the spoonful or spreading it on crackers or cut fruit/vegetables such as celery and apples.”

Chin concurred that the way forward is likely to look beyond limiting the consumption occasion of spreads to breakfast, saying that Jobbie had already engaged in several marketing activities with eateries to promote peanut butter as a topping or a baking essential.

“The way forward is likely to position products beyond just as a spread – it can also be a topping, and ingredient, or more,” he said.

“For peanut butter especially, there are so many versatile uses and the key here is to get consumers to see these spreads as something that can be used in different baking and cooking recipes - even going as far as using with noodles.”

Another way forward for the spreads market is to ride on the plant-based and vegan/vegetarian trend, as this is rising at a rapid rate and most spreads fit right into such diets.

“More people are opting to become flexitarian, vegetarian or vegan so a good peanut butter [for example] can be an important source of plant-based nutrients for these consumers,” added O’Sullivan.