Fermented beverages sales worldwide are estimated to hit the US$1.07tn mark by 2023 according to data from Statista, and in the APAC region this growth is predicted to be mostly driven by the rising health and wellness consumer trend – and especially a rapid increase in consumer demand for immunity-boosting products, in the wake of the COVID-19 outbreak.

“The health and immunity trend is expected to remain at the forefront of consumer demand, sustaining growth in the fermented drinks segment,” International Council of Beverage Associations (ICBA) Asia-Pacific Regional Group Executive Director Geoff Parker told FoodNavigator-Asia.

“General consumer health consciousness and demand for ‘natural’ foods and ingredients have supported the sustained growth of fermented drinks, with these [being viewed] as a health, wellbeing or dietary supplement.

“The rise in gut health [and immunity within the] health and wellness trend has also driven the demand for these drinks, which are recognised for their probiotic [and immunity-boosting] benefits.”

This is particularly so in Australia, where fermented drinks fall under the functional beverage category and are defined as a brewed soft drink and make up 27.7% of the functional beverage category.

Fermented tea beverage kombucha is the frontrunner within the sector, and ICBA expects this to continue to lead the charge within the APAC region over the next few years at over 20% growth between 2019 and 2025.

“[The] expansion into the mainstream retail channel has been driven by kombucha,” said Parker.

“The perceived health benefits of kombucha including detoxification, probiotic components for gut health and immune support – all of which are continuing to drive strong demand for the products and coincide with increasing consumer health consciousness.”

Many firms are also seeing potential for fermented drinks in relation to the health and wellness trend - taste and nutrition ingredients giant Kerry agreed with Parker that the correlation between gut health and overall wellbeing that was driving the consumption of fermented beverages in the region.

“[Consumers are] looking beyond taste and indulgence in what they choose to eat and drink - They now seek 'smart' or natural ingredients known to have health benefits, [and] fermented beverage is one of these," Kerry Beverage EUM Vice President and General Manager Daniel Sjogren told us.

Kombucha specialist brand Remedy Drinks also concurred with this, telling us that the pandemic had driven rapid growth in its online platform, with consumers choosing to stock up on their kombucha in bulk and have these home-delivered, particularly in Australia.

“The Australian functional health category compared to other markets in Asia, is in a different stage of maturity. [In] just three years, the household penetration of kombucha in Australia has grown from 6% to 14%,” Remedy Drinks’ Co-Founder Emmet Condon said.

“The traditional method of making kombucha involves a natural fermentation of sweet tea with a live culture known as a SCOBY (Symbiotic Culture of Bacteria and Yeast) to get a sweet and sour sparkling drink that contains [live] cultures, tea polyphenols and organic acids, which gives it [those sought-after health benefits].

“We are starting to see kombucha become increasingly popular in markets like Hong Kong and the Philippines too – Starbucks Philippines recently started ranging Remedy Kombucha, which is a great example of how kombucha is taking off in more mainstream, every day outlets – but category awareness is still relatively low [compared to Australia].”

Other countries such as Malaysia are also seeing rapid growth in the kombucha market - local brand Wonderbrew Kombucha has such faith in this, that it is looking to double its sales this year.

“The pandemic has shifted consumer preferences worldwide. We have also observed increased consumption and sales, [thus] are working towards doubling our sales in Malaysia,” WonderBrew Founder Joseph Poh told us.

“The health and wellness trend is growing locally, and the government has also implemented a sugar tax on sugar-sweetened beverages in the country to encourage local consumers to move away from these as Malaysia is also known to be the most obese country in South East Asia.

“Kombucha is a good alternative to usual soda drinks that are typically high in calories and sugar – our products are definitely low in sugar and not affected by the sugar tax, in addition to containing additional health benefits for immunity and digestion.”

Over in India, where many consumers are vegan or vegetarian for either religious, cultural or ethical reasons, Mountain Bee Kombucha Founder Honey Islam has also pushed kombucha as a suitable beverage for such consumers.

“Kombucha is a good source of vitamin B which is especially important for people on plant-based diets who tend to be deficient in this,” Islam said.

“I have actually also seen a new audience emerge for kombucha post-COVID-19 – in addition to the original consumers who were already interested such as fitness enthusiasts, now more and more consumers are interested due to the health benefits, and they tend to be looking for alternatives to soft drinks, tea, coffee and even alcohol.”

Watch the video below to find out more.

Kombucha in Japan

In Japan, kombucha does not mean the fermented beverage as we know it, but instead refers to a tea made with ‘kombu’, which means kelp or seaweed in Japanese.

What the rest of the world knows as kombucha is known as ‘mushroom tea’ in Japan, attributed to the shape of the SCOBY - but this difference in names has not stopped its growth locally.

Local beverage giant Asahi has already hopped on the bandwagon and launched its first fermented ‘kombucha’ drink earlier this year - According to Asahi Coporate Communications Manager Kristin Chiu, the kombucha product is made from kombucha extract, lemon and apple juice, and apple and mango fermented juice.

“We add carbonic acid during the producing process, so it tastes lightly sparkling. There is no alcohol in the product,” she said.

Kefir: Dairy and fermented benefits rolled into one

Another of the most popular fermented beverages today is kefir, generally made from a milk base and fermented by kefir grains. These are basically colonies of bacteria and yeasts living in a symbiotic relationship - similar to a SCOBY, but in grain form rather than a single mass.

“The number of bacteria and yeast strains between a SCOBY and kefir grains are different, hence their nutritional properties also differ. Kefir would contain more different strains of friendly bacteria (more than 50 strains) and thus is a better option for the strengthening of our immune response,” Malaysia-based MyKefirWorld Founder CY Wong told FoodNavigator-Asia.

“Milk kefir also holds an added benefit as it contains all the nutrition of milk without the lactose content, as the lactose would have been ingested by the kefir grains. Kombucha generally contains less than 10 bacterial strains.”

The kefir industry in Malaysia is also one of the fastest-growing in the region, especially in urban areas where consumers have higher health and wellness awareness. Many businesses here started off with homemade production before moving into more commercial production, such as halal kefir firm MayKef, which is one of the most established kefir firms in the country with almost 100 distributors nationwide.

“Kombucha has some caffeine in it since it's made from tea, but kefir does not. Plus, kefir is a good source of calcium and has more lactic acid bacteria as it's made from milk,” MayKef Director Asri Othman said.

“During the COVID-19 lockdown in Malaysia, we found that a lot of consumers came to us after spending more time on the internet studying healthy foods that could strengthen their immune system, and finding kefir to be one of them.

“I believe that this trend will continue as more people become aware and actually try to consume kefir, because once they have felt the positive effects after trying it, they tend to recommend it to others as well.”

Wong also agreed that health awareness, especially related to immunity boosting foods and beverages, increased rapidly during the COVID-19 lockdown, although she believes there is still much more room for the local market to grow.

“The kefir market in Malaysia has grown leaps and bounds over the last 10 years, and certainly over the last few months as consumers looked for immune-boosting drinks, [but] it is still more like a niche market here as compared to countries like the US and Europe,” she said.

“This is similar in Singapore, whereas in Indonesia kefir has taken an interesting twist and become more of a key skin care component, so things like kefir masks and creams are better known there.”

Apart from milk kefir, there also exists water kefir which is fermented from water and fruits, which Wong said is generally preferred by vegan consumers who want a probiotic non-dairy beverage and seek specific antioxidants and vitamins from the related fruit used to make it.

Localised kombucha flavours and non-dairy kefirs

A major ongoing trend when it comes to kombucha development has been that of localised flavour creations, regardless of the country it is being brewed in.

For instance, Mountain Bee Kombucha has been working to create products with ingredients that local Indian consumers would find familiar, such as ginger and rose.

“We’re also looking to create a kombucha vinegar, which is essentially over-fermented kombucha with a higher acid content that can be used for hair care and other purposes,” she said.

Poh added that for Malaysia, a lot of imported kombucha products come from Western countries and tend to consist of flavours such as pomegranate or blood orange, which are unlikely to match the local palate.

“Malaysians have heavier taste buds, and those flavours would not be well-received,” he said.

“It’s why we’ve instead looked to create local flavours such as butterfly pea lemongrass, passionfruit spearmint and Tambun pomelo.”

In the kefir category, what’s looking to be more popular is a move towards non-dairy alternatives which remain high in the gut and immunity benefits but are able to cater to consumers with dairy allergies or who are following a plant-based diet.

“We’ve created a goat’s milk kefir, one of our most popular products. It is less allergenic compared to the regular cow’s milk kefir as it is an A2 milk and does not contain the allergenic A1 casein protein that cow’s milk does,” said Asri.

“Goat’s milk also contains more prebiotics, vitamins and minerals than cow’s milk [so we view it as] the most powerful and least allergenic base for kefir.

“To cater to our vegan consumers, we also have a coconut milk kefir, which is the most powerful vegan probiotic on the Malaysian market, based on a lab test report on it produced by the Melaka Biotech Corporation showing trillions CFU of beneficial bacteria per serving.”

Wong also has plans to develop non-dairy alternatives to cater to as many consumers as possible.

“At the moment, we are looking into making non-dairy kefirs using nut and grains,” she said.

“Also in the pipeline is to develop water kefirs to aid in specific conditions such night urination, inflammation and so on.”

New age fermented drinks

In addition to kombucha and kefir, a newer age fermented beverage known as enzyme fruit drinks are also gaining popularity in the region.

One of these is Cio, the beverage arm of Tellus Biotechnology which specialises in enzyme fermentation technology and retails fermented fruit drinks through its takeaway outlets in Malaysia, Singapore, China and Taiwan.

According to the firm’s Business Development Manager Tan Zhi Hao, enzymes are proteins that help in various bodily functions such as digestion, detoxification, and strengthening the immune system, but humans tend to lose these enzymes over time due to factors such as ageing, poor nutrition, and a stressful lifestyle.

Based on this, the firm’s main target consumer demographic are consumers between 25 to 65 years of age.

“These are the group of people who will require replenishment of enzymes in their bodies. People who have certain unhealthy habits like smoking, drinking, sleeping late and poor diet tends to lose enzymes in their bodies faster than they can produce,” he told us.

Cio is the first in Asia to introduce an ‘on-tap’ concept, which is a more food service oriented concept that dispenses the drink via taps into cups and allows consumers to drink straightaway, much like beer.

The firm also sells its enzyme drinks, pineapple grain rolls, supplements as well as its latest sports beverage (Cio Energy) as packaged retail items for consumers to purchase and bring home, or via social media

“We believe that there are no other enzyme drink companies that has the ‘On-Tap’ concept so far in Asia,” said Tan.

“We use our flagship pineapple reserve (fermentate) in our products, which is diabetic friendly and suitable for people with gastrointestinal issues.”

Another interesting beverage here is cider - most consumers would not normally relate this as being a 'fermented beverage' along the lines of kombucha or kefir, but fermentation is used to create this, and the category is generally viewed as either traditional or new depending on the market, according to beverage giant Heineken.

"There exist different types of cider markets [in the APAC region] - there are some APAC markets like New Zealand and Australia where cider has existed for a long time and it remains popular till this date, [and] also many markets without a traditional cider culture," HEINEKEN APAC Marketing Transformation Director Sarah Maddock told us.

"In countries like this, Cider is seen as a new category in the last few years and we [have seen]really exciting growth – Vietnam would be a great example where our Strongbow brand is really popular."

Heineken owns both the Strongbow and Apple Fox cider brands. Its cider is obtained from the pressing of fruit to form a liquid which then undergoes a natural fermentation process into cider.

"One of the key trends that we have seen is consumers’ increased tendency to look for a variety of different choices and have diversifying needs when it comes to taste – Cider gives them a really accessible yet authentic option that particularly meets sweeter taste preferences," Maddock said.

Going online to grow

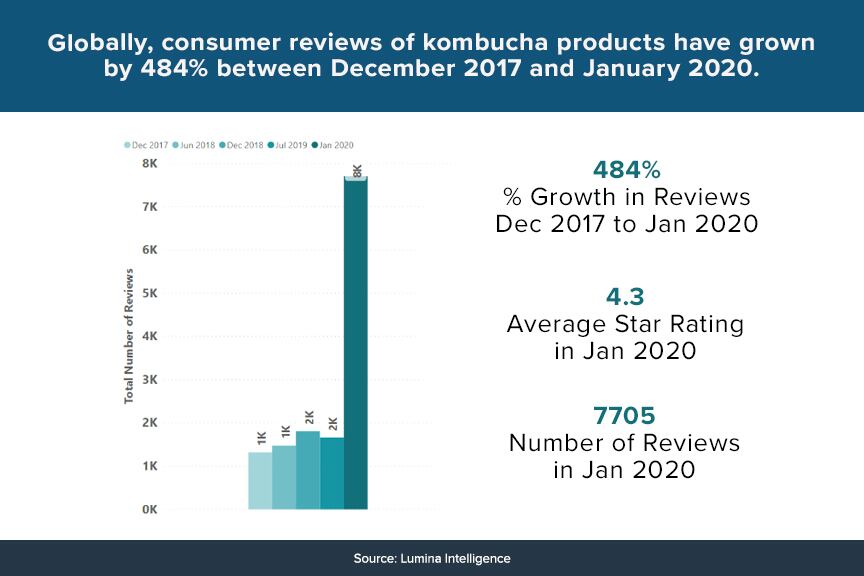

A kombucha-focused report by Lumina Intelligence has identified millennials as kombucha’s ‘number one’ consumer base, and also emphasised that a kombucha brand’s presence online is crucial to its growth.

“Online research is by far the most popular method nowadays for consumers who want to find out more about the benefits of a product and it plays a key role in deciding which brand/product they are going to purchase,” said report authors Ewa Hudson and Simone Baroke.

“An analysis of kombucha on social media shows that the hashtag #kombucha is often used in the same conversation as #probiotics, bacteria, fermented tea, fermentation, kefir, immunity and digestion/gut health [so] there is a clear health connotation.

“Millennials are kombucha’s number one advocates [and] the story behind a product is important to this young demographic. They like to support start-ups called into life by entrepreneurs who can convincingly demonstrate a high level of personal conviction, commitment and purpose behind their products.”

Parker concurred that many brands in this space are following this route, bringing the stories behind the brand establishment to the forefront to capture consumer attention.

“Manufacturers of fermented beverages place great emphasis on the provenance of the product, highlighting artisanal elements and the storied history of many drinks on the market,” he said.

Remedy Drinks is one such example – Condon’s website features an entire section on the story behind the firm’s conception, from how he started it with his wife Sarah ‘on their kitchen bench’ and ‘many products which claimed to be healthy weren’t’ so they made it their mission to ‘make kombucha more accessible to the masses’ – and is a good illustration of this.

All in all though, the industry expects the fermented beverages category to continue to record sustained growth over the next five years.

“The fermented drink segment has become the driving force for the functional drinks industry’s expansion over the past five years, and [this is likely to continue],” said Parker.

“There is strong evidence to suggest health-related functional beverages and fermented drinks, such as kombucha and kefir, will post some of the strongest growth in the drinks industry over the next five years with health consciousness remaining strong and increasing into the future.”

We’ll be shining the spotlight on Probiotics and Prebiotics in our Growth Asia 2020 interactive broadcast series. Register for free here.