The Food Safety and Standards Authority of India is currently seeking comments from stakeholders over its proposals.

"Only such articles of food or food ingredients which have not been permitted to be manufactured, stored, sold, distributed or imported under any other regulation under the Act shall require prior approval for being manufactured, stored, sold, distributed or imported” under the new framework, the draft said.

“Such articles of foods and food ingredients shall include novel foods or foods containing novel ingredients not having a history of human consumption in India; food ingredients with a history of human consumption but not specified in any other regulation under the Act; new additives and processing aids; foods manufactured or processed using novel technology.”

Manufacturers and importers will be required to submit an application, along with requisite documents and fee to the FSSAI for approval.

"Based on the safety assessment of the food product, the chief executive of the FSSAI, or an officer authorised by him, may either grant approval or reject the application.

"Where approval is granted, the [company] shall submit certificate of analysis of the product on parameters relating to chemical, nutritional, microbiological, heavy metals, pesticide residues and naturally occurring toxicants to FSSAI," the draft added.

Elsewhere, the FSSAI has directed food-safety commissioners of all states to review pending cases against operators after old laws were repealed. It appropriate, the regulator has advocated the withdrawal those cases, it said.

In a letter to food commissioners, the FSSAI asked them to look into pending cases for offences alleged to have committed under laws, including the Prevention of Food Adulteration Act and the Food Safety and Standards Act 2006.

“The pendency of such cases for a long time not only burdens the judicial system but also diverts the scarce resources of the government in pursuing these matters rather than deploying them in effective implementation of the FSS Act to ensure safe and wholesome food for the consumes,” the regulator said.

More stories from South Asia..

Yum! does well in India with local offerings

Yum! Brands’ Indian operation has reported a significant improvement in current business, with Pizza Hut indicating a rise of 6% and KFC doubling that performance with a 13% improvement, with new menus and promotions driving sales.

Though Indian fast food companies look good this quarter, they face competition from of PE-funded online players like Swiggy and Zomato in the near future, according to Research & Markets.

“We expect Yum’s competitor JFL to add some 20 Dominos stores in the second quarter of the next financial year,” the analyst reported. It expects some 12.4% growth next year for Dominos as the group closes in on sales with Yum.

“We perceive this as the right strategy given: i) a jump in store employees’ salaries due to the bonus act; and ii) JFL’s employee cost over the past four years has ballooned by around 500bps, which has eroded margin,” Research & Markets found.

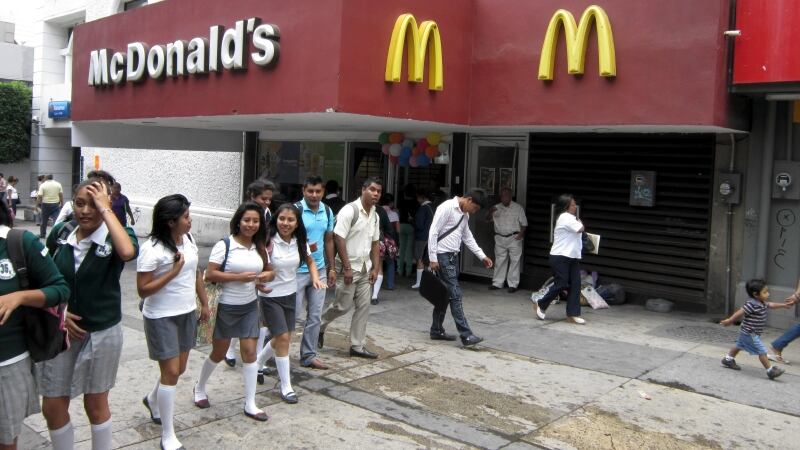

It said that menu innovations will now drive growth in the fast-food industry. JFL’s new Dominos offerings, Burger Pizza and Pizza Mania extreme, as well as McDonald’s McAloo Tikki in Mexican & Lebanese flavours and Mexican Cheesy Fries, bear testimony to this emerging development.

In a note, Edelweiss Securities said that the frequency of “buy-one-get-one-free offers” surged in the second quarter of this financial year. Global player Wendy, the world’s third-biggest burger chain, has cut prices to shore up India sales.

“QSR players will face rough weather in the medium-term,” the note said.

“However, improvement in consumer sentiments over the next two-to-three years, aided by good monsoon and the Seventh Pay Commission payout, are anticipated to benefit QSR companies in the long-term.”

The quick-service business is currently worth some INR3bn (US$45bn) and is expected to grow to almost INR5bn by 2021, Research & Markets found.

"Key trends emerging in the space include virtual kitchens, stores at travel hubs such as airports, railways and highways, ordering-in and food trucks,” it added.

“India's exponential growth and consumption in terms of frequency of eating-out and experimentation with cuisines and concepts have given the services sector a huge fillip. The restaurant industry is estimated to contribute close to 2.1% to India’s GDP by 2021.”

Market update: Beer in India

India is among the top five beer markets in Asia-Pacific in terms of volume. Four large global players—Heineken, Budweiser, SABMiller and Carlsberg—together control 86% of India’s market and account for eight out of the 10 best-selling beer brands.

According to analysts, the size of India’s beer market will be expected to have doubled this year to approximately US$9bn, compared to 2012.

Beer is globally the third most popular drink after water and tea. Growing at an annual rate of 2.4%, market analysts Research & Markets projecte that the global beer market will reach approximately US$636bn by 2020—from US$567bn last year.

While in 2014 the global beer market grew by 1%, this growth doubled in 2015. The slow growth of recent years has been due to a slowdown in beer consumption by world's five largest markets, China, America, Russia, Germany and Brazil.