Asia’s organized retail sector to propel global sugar confectionery sales, predicts Technavio

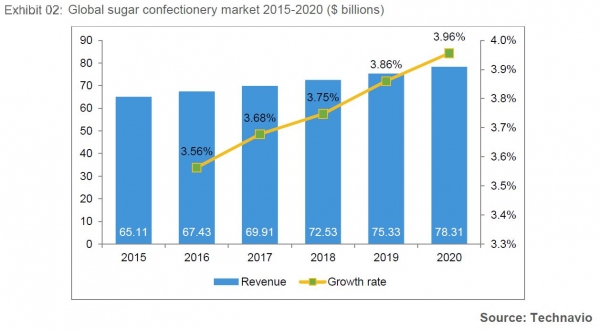

The organization’s latest report predicts global sugar confectionery value sales will move from $65.11bn in 2015 to $78.31bn in 2020.

This represents a compound annual growth rate (CAGR) of 3.76%.

Asia-Pacific: The epicenter of candy growth

The Americas accounted for the bulk of sugar confectionery sales in 2015, followed by Europe, but Asia-Pacific (APAC) is expected to drive growth.

"The demand for sugar confectionery products is increasing due to the rise in disposable incomes, urbanization, and hectic lifestyles there,” said Technavio’s report.

“The growing retail market, increasing population, and increasing trend of gifting confectionery items will also contribute to demand," it continued.

It said China and Japan were the major contributors in APAC’s sugar confectionery market.

“The current shift in the retail sector to organized retail has accelerated the availability of sugar confectionery products, driving its sales,” added the report.

Hard-boiled sweets set to profit

Companies such as Haribo, Nestlé, Wrigley and Mondelēz International are among the biggest players in the sector.

According to Technavio, hard-boiled sweets accounted for the majority (24.77%) of sales in the global sector in 2015, followed by caramels and toffees (22.5%).

Hard-boiled sweets are expected to extend their category lead to account for 25.09% of sales in 2020. It comes as the gum and jellies' contribution is predicted to fall from 21.27% of category sales in 2015 to 20.38% in 2020.

Technavio expects a 4.03% CAGR in global hard-boiled sweets up to 2020 to reach $16.13bn. The research firm said the sub-category stood to benefit from organized retail as products become readily available in impulse channels.

Source:

Global Sugar confectionery Market for 2016-2020.

Technavio