ValueNotes’ recently published report ‘Chocolate Industry in India’ said that Mondelēz had proved chocolate could be popular in rural India by offering smaller products at lower price points.

‘Economic situation has changed’

Shilpa Eguvanti, an assistant project manager at ValueNotes, told ConfectioneryNews that now was the time for other companies to consider entry.

“The rural consumer was not previously able to afford chocolate because of the price point, but the economic situation has changed – they have more money on hand to spend on chocolate.”

“What you are seeing is that there is so much competition in the urban section and Cadbury wanted to be first to the rural market.”

India Fact file

- Population: 1.2bn

- $1,124 – annual per capita income

- 68% live in rural areas

- Milk chocolate represents 73% of value sales (Dark 9% and white 16%)

- Source: ValueNotes

ValueNotes said that chocolates under 30 g and priced between INR 5 and INR 10 ($0.08-0.16) were likeliest to succeed in rural areas.

Of India’s 1.2bn population, 68% of people live in rural areas compared to 32% in urban areas. However, urban areas still account for 80% of chocolate consumption in India.

Cadbury strategy

Mondelēz realized its regular sized Cadbury Dairy Milk (42 g) was out of reach of most rural consumers at around INR 45 ($0.74). It added a smaller 15 g SKU that cost as little as INR 5 ($0.08), which ValueNotes said had proved a success.

Indian chocolate consumption

Annual per capita chocolate consumption in India has risen from 0.05 kg in 2005 to 0.12 kg in 2013. Consumption is slightly higher in China (0.8 kg), but Western Europeans nations can consume as much as 5-10 kg a year. Source: ValueNotes

According to the research firm, Cadbury plans to cover 75-80% of the rural market in the next two to three years by targeting nine states with villages that have populations of between 5,000 and 10,000.

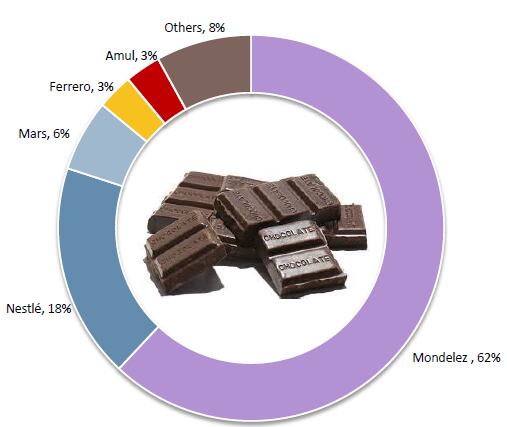

Mondelēz dominates the Indian chocolate market with a 62% share based on the strength of its Cadbury brand, while Nestlé is the second largest player on 18%.

Which companies are interested?

Domestic confectioner Amul has already joined Cadbury in the rural segment, but Eguvanti expects Nestlé could be interested too. However, she ruled out Ferrero and Mars due to their premium positioning.

Hershey setup an Indian subsidiary in 2012 after ending a joint venture with domestic player Godrej, but Hershey has earmarked China rather than India as the focus of its international growth strategy.

Eguvanti said that smaller local manufacturers such as Campco and SK Industries faced limited prospects of success in rural India when confronted by the might of Cadbury and other multinational players.

Geographic targeting

“The Western region is where the biggest market share is going to be, next is the North of India followed by Southern India.”

Western India accounts for 40% of chocolate consumption in the country, followed by 23% in North India and 22% in Southern India.

Consumption of chocolate by region

- Western India 40%

- North India 23%

- Southern India 22%

- Eastern India 15%

- Source: ValueNotes

Eguvanti added that people from the Western and Southern regions were likely to have travelled outside of India and tasted different types of chocolate.

Distribution network

Although ValueNotes’ report said that the infrastructure had improved in rural areas, Eguvanti said that the retail environment was still largely made up of small tin shacks.

“In the deepest rural areas, you don’t see a supermarket at all,” she said.

The ValueNotes project manager said that Tesco and Walmart had both tried to enter rural India, but had faced resistance from ‘Mom and Pop’ stores. Spencers, More, Reliance Mart are other established retailers in the country but Eguvanti said it was unlikely they would venture into rural India due a limited distribution network.

She added that manufacturers needed to think carefully about access to cool storage in remote regions.

Only 35% of rural India has electricity and the villages that do face load shedding problems, which could be a major problem for retailers stocking chocolate, particularly in the summer months. Many also don’t have access to telephones or mobile phones, making it difficult for manufacturers to take orders from retailers and distributors.

Growth prospects & consolidated market

India’s chocolate market has been growing at an annual compound growth rate (CAGR) of 15% in the last three years to reach INR 52bn ($851m) in fiscal 2014. ValueNotes expects the industry will grow at CAGR of 16% over the next five years to reach INR 122bn ($2bn) by fiscal 2019.

Demand for premium chocolate is expected to outpace medium and low priced chocolates, but the premium segment is becoming highly competitive.