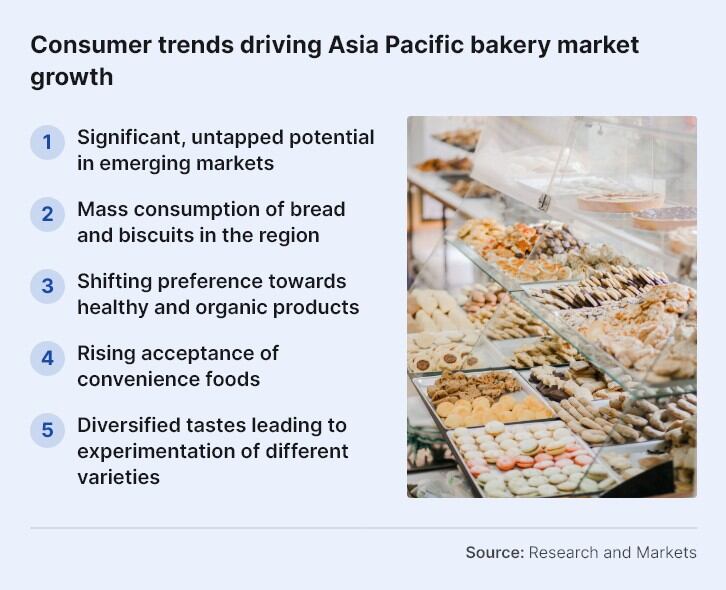

Bakery items such as bread and biscuits may seem top of mind as a staple breakfast or snack product for many consumers in the APAC region, but over the years it has become clear that the popularity of these remain very limited to specific items such as Hainanese loaf bread, sliced white and wholemeal bread, or cream crackers.

There is no shortage of bakery items and varieties in supermarkets all over the region, which also means there is no shortage of competition – so in order to stand out, especially in a time when inflationary pressures are increasingly challenging consumer spending, leaders in the bakery sector believe that brands need to have some way to stand out in order to being stomped out.

“One strategy we have realised to be very important in this region is emotional marketing, which we have done in our Koala’s March brand by introducing the koala mascot, March,” Lotte Thailand Marketing Research and Analysis and New Product Development Manager Mao Ogino told FoodNavigator-Asia.

“Lotte has printed over 200 variations of March the koala to fit multiple occasions as well as cultural contexts, so he could be swimming or cycling or eating or sleeping or dressed in a Thai traditional costume or as a pilot and so on.

“We have found this strategy of characterisation to be very important and effective in establishing good communication with consumers – and even more crucially, it has even acted as good means of communication between mothers and children via cartoonisation at times.”

Ogino added that this sort of marketing and communication has become increasingly important in the market during these times of relative economic instability when costs and prices are going up, particularly in the bakery and snacks industry which is impacted by multiple ‘high-risk’ ingredients from wheat flour to sugar.

“During these sorts of conditions, all food and beverage companies need to take extra care when it comes to market visibility as that is how consumers know us,” he said.

“It can be very difficult to adjust product prices just like that – for example in Thailand we are already selling Koala’s March products at THB20 (US$0.57) so there really isn’t that much room for change or reduction, but we still need to make sure that we remain [front and centre when it comes to consumer purchases].”

Watch the video below to find out more.

Julie’s, one of the largest names in the bakery sector for many decades, also invested significantly a while back in a complete brand makeover that tapped on consumer emotions to evoke memories and nostalgia.

“Julie’s is well-known as a nostalgic brand and many younger consumers have memories of eating our products as children,” Director Tzy Horng Sai told us.

“We realised that despite this, this remains a childhood experience that they may not bring over into current consumption and purchasing decisions – in fact, in Malaysia it was found that often the older generation of consumers were the ones who would buy our products, and even if younger ones would still eat these they wouldn’t always buy them.

“So with this makeover, the idea was to refresh not only the spirit of Julie’s after some 30 years in the market, but also bring it back into the contemporary lives of all consumer segments and also bringing that nostalgia to the fore.”

With Koala’s March having retained its strong presence globally in over 150 markets even throughout the pandemic, and Julie’s having done the same in over 80 countries as well, it is hard to disagree with these arguments – but Singapore-based bakery firm Baker & Cook believes that this also needs to be augmented with deep understanding of the sorts of ingredients and health/nutrition trends driving the consumer market.

“Right now, the key word for bakery is ‘whole foods’ or wholesomeness’ here in the APAC region, not just ‘healthy’,” Baker & Cook Founder Dean Brettschneider told us.

“People wants grains and seeds in the whole format, wholesome things that are good for digestion and can help this function – this goes all the way to an increased demand for sourdough today, which many consumers are looking for due to these benefits.

“So there is a need for the bakery sector to look towards delivering more honest and wholesome, good-for-you products using food flavours rather than technology to deliver functional benefits.

“Consumers are increasingly associating standard white bread with being a heavily processed foods with no texture, seed or grain benefits and often just being sweet – the awareness now is that this has an impact on digestion, and they are now looking for less processed foods overall including in bakery, not only in the meat or pasta sectors.”

Has low-GI run its course?

It was not that long ago that low-GI was seen as a major trend in the bakery sector, but Brettschneider believes that the trend is essentially ‘gone’.

“I think the demand’s gone, in my personal opinion, [as someone who has] been involved in the baking industry for many years,” he said.

“The thing is, what is low GI in terms of ingredients? It’s about sunflower seeds, oats, a lot of whole grains and so forth – so essentially still the wholesome ingredients. It’s just that these were highlighted as what we should use [for low-GI then].

“So it’s not so much that the benefits of low-GI [are being disputed] but I think the demand is tapered off because the publicity has tapered off. The usage [of low-GI ingredients] has not tapered off though, because we're using them anyway.”

Two of the most significant issues that plagued low-GI bakery innovation – and continue to exist today – were texture and cost.

“We are still working on educating the public on their expectations surrounding low-GI bread – for example, these are not fluffy in texture like the conventional bread they are used to,” healthy foods firm Nova’s Chief Business Officer Nicholas Cheong said of its Healthy Joy low-GI bread range launched in 2021.

“We believe the health benefits received do outweigh the [added] cost, and we target middle to higher income stratas as well as consumers who are dealing with chronic diseases.”

Healthy Joy low-GI bread loaves range from RM8 to RM15 (US$1.72 to US$3.22) for about 300g, which is roughly three to five times the price of a standard 400g Gardenia white bread loaf at RM3 (US$0.64).

Flavour forward

That said, the taste profile of Asian consumers can be said to still remain largely traditional when it comes to flavour choices, with various firms seeing two of the most traditional flavours - chocolate and strawberry – remain top choices in various markets.

“The core flavours of Koala’s March are chocolate and strawberry, and these remain amongst our most popular variants today both in Thailand and across the region since first launched years ago,” Ogino said.

“Even when we enter new markets across Asia, we always start with these two first, and it is only after we have found stability and good market interest that we start to launch more of the other new flavours such as the Black (Bitter Chocolate) and White (Milk Cream) variants.”

Across the border in Malaysia, Julie’s has also found chocolate to be one of the most stalwart flavours in the country.

“We know that chocolate and particularly dark chocolate continues to be a trend in the Malaysian market,” Sai said.

“Our data has shown that the chocolate segment continues to be one of the most resilient [despite] the pinch arising from the rise of living costs, [and] is emerging to project more value in price.”

Such has the firm’s confidence been in this flavour that earlier this year it launched an entire range dedicated to chocolate biscuits, dubbed Charm and created to target indulgence-seeking consumers.

“Market research has shown that the Malaysian market has ample opportunities for this range [with a focus on] consumers aged 20 and above,” Sai added.

It is not only the biscuits segment that sees continued interest in conventional flavours – soft cake firm Fershay has also seen traditional flavours such as vanilla and pandan continue to draw in more sales than other novel ones.

“We are seeing vanilla continue to be the most popular for our rolled cake range Fershay Rolls, and the original custard do the best for the custard-filled cake range Fershay Custard,” Fershay Marketing Manager Amnat Srichuen told us.

“Fruity flavours are also performing well especially strawberry, and these preferences are similar across all the markets we have presence here in South East Asia such as Thailand, Myanmar, Laos, Cambodia and Vietnam.”

Sugar and spice

Many of these popular flavours quite obviously fall into the sweet segment, and Brettschneider added that this is unlikely to see any change as sweetness is closely associated with indulgence.

“The sweet trend is always going to be there in bakery as it usually does mean indulgence and consumers are always going to want to have a bit of that when it comes to these products,” he said.

“Things like cookies or cakes with icing and so on, these are very flavour driven and sometimes even seasonal driven, with many more new flavour variations and combinations available than there used to be years ago.

“When it comes to bread though, that is where savoury has its role, not just in terms of the obvious items like pies and quiches but also loaves of bread which are more savoury driven – these are the areas where consumers want things that have whole grains and cereals and less so on the sweet side in general, and that is also always going to be around.

“All flavours aside, I believe trends in bakery are going towards more ‘traditional’ as a whole, where consumers just want to have an honest product that our grandmothers would have made, an honest loaf of bread that comes out of a bakery – one that is not hyped up, changed or mass manufactured.”