In this edition of the FNA Deep Dive, we take a closer look at the non-alcoholic beverages sector and see how consumer awareness of not just reduced sugar content, but also healthier processing methods and more sustainable production supply chains are playing an important role in influencing consumer choices and thus beverage firm innovation in the region.

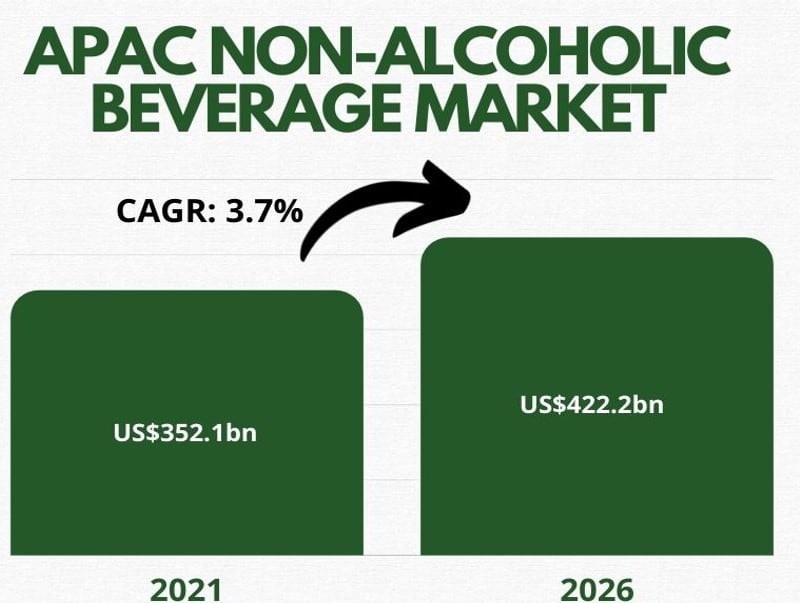

Non-alcoholic beverages make up one of the largest food and beverage sectors in the Asia Pacific region, and the regional market is on track to grow at a CAGR of 3.7% to hit US$422.2bn by 2026, from US$352.1bn in 2021.

Consumer health and wellness concerns have been amongst the top industry drivers in recent years, with sugar reduction being one of the most significant particularly since the COVID-19 pandemic hit, but more recently there has also been a rise in interest regarding healthier processing techniques to ensure even healthier beverage consumption.

“Definitely we are seeing that the cold brewing (for RTD teas) and cold pressing (for RTD fruit and vegetable juices) sort of approaches are ones that are trending currently and more and more consumers are finding to be particularly interesting,” Singaporean juice firm Imperfect Drinks Product Manager Andrew Lim told FoodNavigator-Asia.

“There are more and more of such products popping up from markets like Australia and the United States popping up on shelves here, and [these are trend-setting markets too], so I think that is something that more and more people are getting into versus the more off the shelf ambient products.

“One reason for this is that there’s a perception of these being fresher and also it having more nutrients and more minerals retained. Traditionally drinks have been heat-pasteurised so heated to high temperature and pretty much everything dies in there, including the nutrition people are looking for – cold-based processing is healthier in that sense.”

In addition, the use of cold processing technology allows manufacturers to reduce the use of flavourings and preservatives to retain the desired product taste, which contributes to the ‘fresher’ quality.

“Everything is done in the cold and just high pressure is used to deactivate any bacteria so as to extend shelf-life – so the shelf-life isn’t as long as a hot-processed product which can be a year to 18 months, but cold-processed products are still good for a few months – but that fresher perception is really a huge point of interest for consumers,” Lim added.

Watch the video below to find out more.

The trend for cold processing is not just limited to smaller firms – larger brand names such as Frucor Suntory have also realised the benefits and appeal of this for consumers in the Oceania region.

“All of our fruit juices are actually cold-pressed, and I would actually say that’s not unique to just us, a lot of beverage firms in the region are also doing this,” Frucor Suntory Head of Scientific, Regulatory Affairs and Innovation Lesley Stevenson told us.

“A key point for us with well-known brands such as The Real McCoy, Simply Squeezed and NZ Natural is to not add artificial colours or flavours, and focus on the real juice itself.”

Sugar reduction still a big deal

That said, the importance of processing techniques does not at all mean that sugar reduction is not an important point for beverage manufacturers, from the perspectives of both regulators and consumers.

Indeed, sugar reformulation still remains on top of the list for many beverage firms, particularly for firms with a large stake in the soft drinks category such as industry heavyweight Coca-Cola.

“Since COVID-19 hit, consumers [have been] taking their health more seriously and this has accelerated the trend towards healthier options,” Coca-Cola Singapore and Malaysia Marketing Manager Rustam Gabaydullin told us.

“In ASEAN especially, Coca-Cola has observed an increased demand for Coca-Cola Zero Sugar as this health consciousness rose and continues to rise amongst consumers. Younger consumers in particular have mostly begun to demand for healthier, lower-calorie options

“Coca-Cola Classic still maintains its popularity in general [but in markets where the zero sugar version] is available, demand for this is on the rise and we see the market for this continuing to grow.”

Apart from sugar reduction in Coca-Cola itself, the firm has also reformulated in terms of product sizes and the recipes of several other popular soft drinks in its portfolio, including Sprite and Fanta, to meet the rising sugar reduction trend.

“Coca-Cola Classic has also been made available in 180mL mini-cans [as opposed to the regular 320mL] which have proven to be popular among consumers [and] we have introduced new recipes for Sprite and Fanta which have about 50% less sugar,” he added.

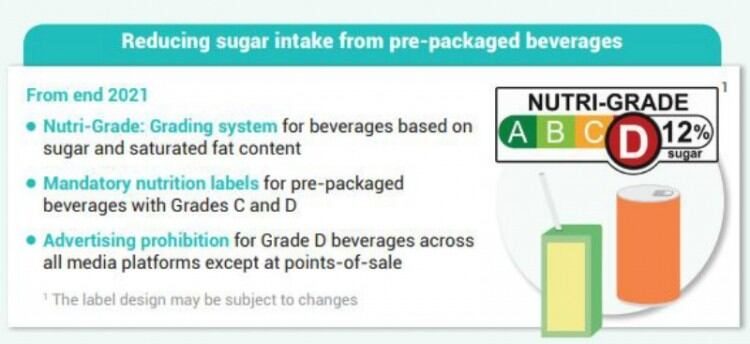

One of the main drivers for this has undoubtedly been regulatory mandates in the region, such as in Singapore which will be enforcing its Nutri-Grade labelling system for all pre-packaged non-alcoholic sugar-sweetened beverages come December 2022.

This labelling scheme will impact just about all non-alcoholic beverages in the market from soft drinks to juices to milk beverages and instant powdered beverages, where beverages will be graded from A to D according to sugar content, and those with a C or D grade must be labelled with a Nutri-Grade mark on the front-of-pack of the package.

“I think in Singapore what is going to happen when they introduce the health rating at the end of the year is that there is going to be another shift in perception [towards beverages like] juices because although these are only natural sugars, the content can be considered quite high,” said Lim.

“So everyone’s been drinking orange juice for years and thinking that it’s super healthy – but there is no way to run away from sugar in a fruit juice if you want it to be sweet as there’s that natural fructose in it, so when consumers see that C or D rating, the perception is going to change from happily drinking it daily to thinking twice about it.”

The firm is looking at producing a range of fruit infused sparkling waters to remain relevant and meet the Nutri-Grade requirements for higher grading in terms of sugar content.

In Australia, the government recently also hinted at price increases and tax hikes for sugar-sweetened drinks as part of its new national obesity strategy, which has drawn ire from the local beverage industry.

“According to global, evidence-based data, major cities do not have tax placed on sweetened beverages - For example, UK companies attempted reformulation of beverages, but the overall sugar consumption of UK citizens still did not decrease [and] different conferences organised by the UN also have always dropped the idea of taxing sugar,” Australia Beverages Council Limited (ABCL) CEO Geoff Parker told us.

“The industry has already achieved an impressive 30% sugar reduction to 32 teaspoons per person annually or 127g for non-alcoholic beverages in Australia [as] a result of reformulation, marketing and offering low-calorie to no-calorie beverages.

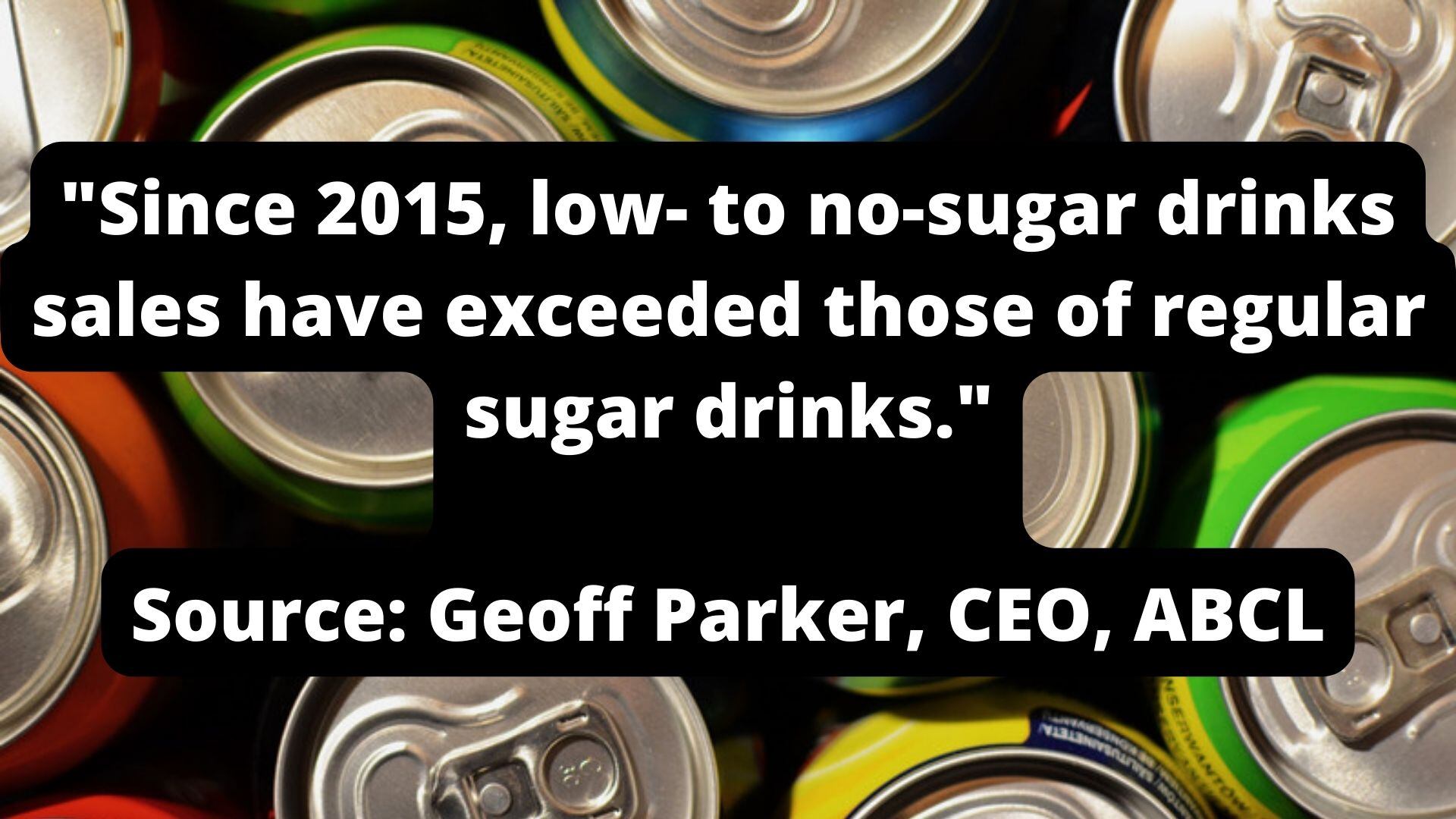

“Since 2015, the low- to no-sugar drinks sales have exceeded those of regular sugar drinks. Sales of bottled and packaged water are also more than sugar-sweetened carbonated soft drinks – [These are all due to valid industry efforts with real results seen and] we would be asking what [more] the government would achieve by implementing [policies to govern this].”

Looking good

In addition to sugar reduction, consumers are also on the lookout for products with labels that are as easy to understand as possible, making it more difficult for manufacturers looking to produce eye-catching products, such as brilliantly colourful drinks for example.

However the visual aspect of products is also emerging as a very important trend to attract consumers in this age of social media, so there remains a push in the sector to seek out eye-catching yet natural options to colour these products.

“The visual appeal of drinks is really increasing in terms of importance due to the parallel increase in online engagement by today’s consumers,” natural colours specialist firm Oterra’s APAC Marketing Manager Carel Soo said.

“Everyone wants to post visually appealing products on their social media [so] many beverage brands are looking for ways to improve their visual appeal and also link their product development to positive moods and emotions.

“Consumers now really want transparency in the making of their drinks and to know what ingredients are in there - natural ingredients are also always associated with being safer, and brands need to respond to this.

“[Using] natural colours for drinks can also help firms that wish to make clean label claims for their products [in this sense], as it means they will no longer need to include [the dreaded] E-numbers onto their labels.”

Sustainable sustenance

Another major driver in the beverage industry, especially amongst younger consumers, is the pursuit of products that have been made in a sustainable method, using sustainable ingredients at best.

One way that beverage manufacturers have been innovating in this area is by producing drinks from upcycled ingredients, which would normally have been discarded in their regular supply chains, so as to reduce food waste and increase sustainability credentials.

Imperfect Drinks makes its beverages from - as its name states - imperfect fruits and vegetables, upcycling these into juices and fruit-infused teas, but though this business model is more sustainable than average juice manufacturing, it brings with it a unique set of challenges.

“For us, we have to see what is available on the market and then turn the available defective fruit into a product – so this means that supply is not always constant, as it really doesn’t make sense to have say a reliable source of defective fruits,” said Lim.

“So being in the manufacturing business and not say foodservice where recipes have more leeway to be flexible daily, we need to be really even more flexible than average and when we work with our suppliers we have to just tell them send us what they have and we will just use these to make into our products.

“So on the whole, stability of supply is still the biggest challenge for us in working with upcycled products.”

This is not the same for all of the firms in the upcycling space though - larger firms that do already have a required steady supply of such ingredients from existing waste streams can certainly benefit from using these to create new upcycled products, such as fruit firm Dole has done.

“Our regular fruit-processing operations generate a lot of fruit by-products such as pineapple juice concentrate and clarified pineapple juice [which] would normally be discarded to landfill or sold off very cheaply,” Dole Packaged Foods APAC VP and Managing Director Aashim Maholtra told FoodNavigator-Asia.

“With the demand for sustainable product manufacturing on the rise, we realised that upcycling these by-products that would normally be wasted into a range of products that are priced more affordably was a [good way] to not only cut down our waste generation but also benefit consumers in search of healthy yet affordable options.”