Regulatory standards are generally similar across Asia, though some adjustments may be needed for specific markets.

“Around 80% of regulatory standards are common across Asia, covering food safety and environmental care,” said Malcolm Ong, founder and CEO of The Fish Farmer, a Singapore producer of fish and fish-based products.

He was speaking at a panel discussion on consumer insights on F&B Products at this year’s Seafood Expo Asia at the Sands Expo and Convention Centre in Singapore.

Ong added that the remaining 20% will be unique to different countries, and businesses will have to adapt accordingly if they want to enter specific markets.

“This is where non-governmental organisations (NGOs) and government bodies must communicate to ensure reasonable standards, so that businesses will not face difficulties entering different markets.”

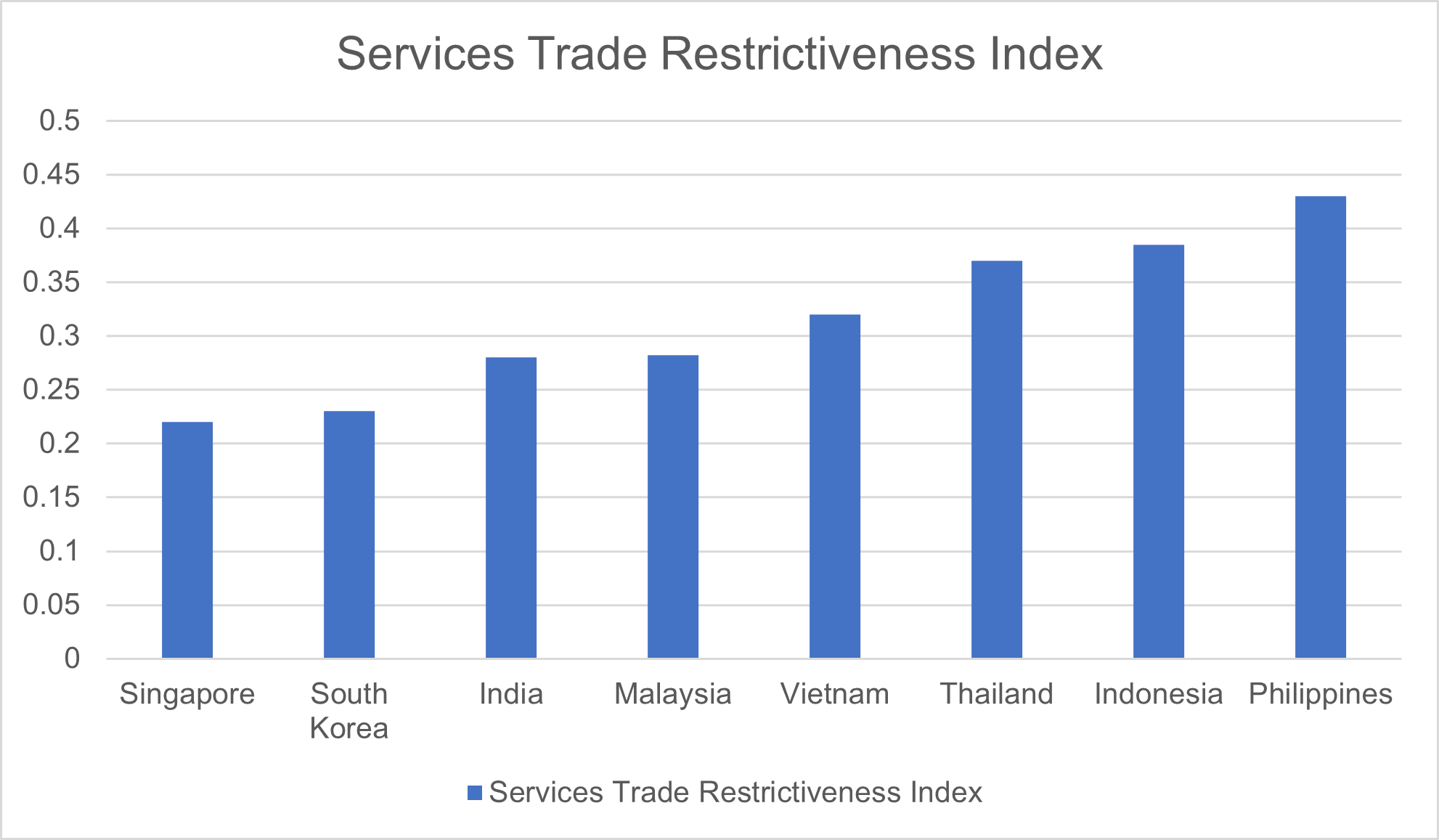

Regulatory standards affect market openness of a country, which is key for ensuring growth in a currently volatile economic climate.

Ong’s remarks align with insights from Manu Bhaskaran, partner at policy advisory firm Centennial Group, who said in a separate presentation that regulations and governance are key to helping Asian economies prevail in a riskier and more competitive world economy.

Ong also noted that sustainability is increasingly integrated as part of regulatory standards in Asia, where consumers are getting more conscious of eco-friendly practices.

Localised solutions for sustainability

Consumers have preferences for certain body parts and that results in portions that could go to waste. This is where businesses must come up with localised solutions that are practical for specific markets.

Salmon fillets, for example, generally see higher demand due to widespread preference for convenient, ready-to-cook forms of fish. This leaves behind “good food that is not in demand”, said Ong.

Unsold salmon can be converted into animal feed, but this is not practical in places like Singapore, where there is inconsistent supply of trash fish.

“It is not that straightforward to convert food waste because we need volume to make such conversions worthwhile. Instead of converting unsold fish parts into feed, we package the heads, for example, to make soup for restaurants and consumers,” Ong said.

“That’s the importance of employing localised solutions for food waste, because what works for other regions might not work elsewhere.”

Food waste is one of the major issues that seafood businesses face – 59% of food and beverage companies recognise that this is a significant issue, according to panel moderator Xaviere Lagadec, global aquaculture manager of global R&D firm DNV.

She was citing ViewPoint’s 2025 survey on food loss and waste, conducted across 375 companies spanning Europe, Americas and Asia.

Other sustainability measures include moving towards smaller, resealable packs to reduce packaging material, said another panellist Leslie Phua, technical advisor to the Seafood Industries Association Singapore.

Phua added that social requirements in regulatory standards – such as sustainability and staff welfare – are unavoidable, as institutions worldwide are placing increasing emphasis on these aspects.

Businesses can demonstrate their commitment to fulfilling environmental, social, and governance (ESG) performance through platforms such as EcoVadis, which helps companies benchmark ESG performance and provide verified data to stakeholders.

However, while there is increasing concern over environmental care, health and food safety remain top priorities among consumers.

What matters to consumers

The primary focus appears to be on what impacts consumers directly.

Top priorities include health-related issues, product content, and ingredients’ origins, followed by proper hygiene to prevent contamination and food safety.

Food safety is clearly the primary concern for consumers, and they tend to trust brands to provide it, said Lagadec.

According to DNV’s research, consumers tend to trust that branded products are safer than unbranded ones.

In a survey with 4,500 participants aged 18 to over 55, results show that respondents have a higher trust in packaged products from brands (85%) than packaged unbranded products (69%).

The study – What matters to consumers when buying food & beverage products? – was conducted across the Americas, Europe, and Asia over the last five years.

When asked about the topics for which they would like more information, consumers are most interested in food safety (55%) and health (53%).

Broader sustainability issues, such as environment (38%) and social (35%) aspects are lower on their list of priorities.