One of the most-debated food industry topics in recent years has been around the use of plastic: On the one hand, sustainability-conscious consumers are concerned about the environmental impacts of these, but on the other the food industry has yet to find an alternative that is cheap and safe enough to replace it.

So although the concepts of food safety and sustainability are not diametrically opposed to one another, the current state of technology means that prioritising one is likely to come at the expense of the other – a dilemma that seems to have no solution yet.

“The area of plastic use is a prime example of these contrasting priorities,” Australian Institute of Food Science and Technology (AIFST) scientific advisor Deon Mahoney told us.

“Eliminating or reducing plastic usage is a big sustainability goal for food industries in many markets and tends to pop up a lot in the targets for many food firms, but the fact is that there are no good, safe alternatives for mass usage to replace it right now, particularly for fresh foods.”

Plastic is the main material of choice for packaging and transporting food products due to its airtight and protective properties, which offer a level of food safety that cannot be achieved by other existing materials, such as paper.

“The other major area of ‘conflict’ is the use of price look-up (PLU) stickers on fruit, which has been a common means of stock control and traceability for many years,” he said.

“But now there is a lot of talk about these being banned as well because the stickers are not bio-degradeable and affects sustainability achievements – the main alternative in the market now is laser printing on the fruit, but this comes with the downsides of being expensive and running the risk of damaging the fruit.”

Is it possible for both food safety and sustainability to co-exist?

For both plastics and PLU stickers, the majority of alternative solutions to these issues come at either higher cost or still face various challenges preventing implementation on a large scale.

These include bio-degradable packaging material options such as alginate, which still have durability and water permeability challenges; or Bio-Polyethylene (Bio-PE) which is made from renewable material like sugarcane but is more expensive than existing polyethylene.

However, Mahoney believes that all of this can be remedied if the right investments are put in place.

“What is undeniably clear is that science is the most important factor moving forward, in ensuring that sustainability and food safety can co-exist,” he said.

“As such, I believe that more R&D funding needs to be funnelled into food safety research in to accelerate progress – in Australia for example, there are many organisations that are funding different research areas, but food safety is not always the priority.”

What are the potential risks of neglecting this technology?

He highlighted this as a ‘risky’ situation, due to Australia’s ongoing challenges with food contamination and product recalls.

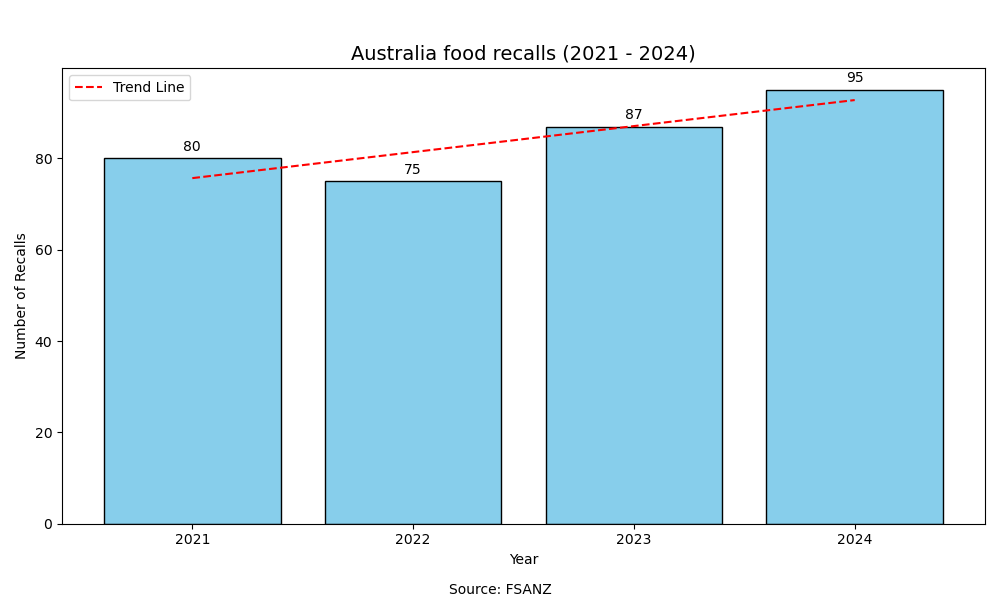

According to data from Food Safety Australia New Zealand (FSANZ), there were a total of 95 food recalls in 2024 – the highest recorded in the past few years (80 in 2021, 75 in 2022, 87 in 2023).

“While the number of recalls fluctuates year-to-year, the average annual number of recalls has shown an upward trend over the past decade,” the food safety authority stated.

“In 2024, the top reason for food product recalls was undeclared allergens (54 cases) followed by foreign matter contamination (14 cases) and microbial contamination (nine cases).”

Australia has also long seen food poisoning cases rise and ebb seasonally over the years, with many of these attributed to microbe infections such as salmonella and norovirus.

“Australia’s biggest microbe challenges come from salmonella and campylobacter – I would describe the current situation as the authorities having a lid on outbreaks so numbers are not increasing, but are not actually reducing either,” he said.

“This is placing an increasing burden on public health costs – the economic cost from food poisoning is somewhere between A$2.6bn to A$7.8bn (US$1.69bn to US$5.07bn) yearly as a result.”