APAC confectionery is one of the most varied in the world, with different cultures having their own specialities, such as traditional kuih desserts in Malaysia, sweet treats like jalebi in India, and traditional Japanese confectionery termed wagashi, in addition to standard sweets, candies and jellies.

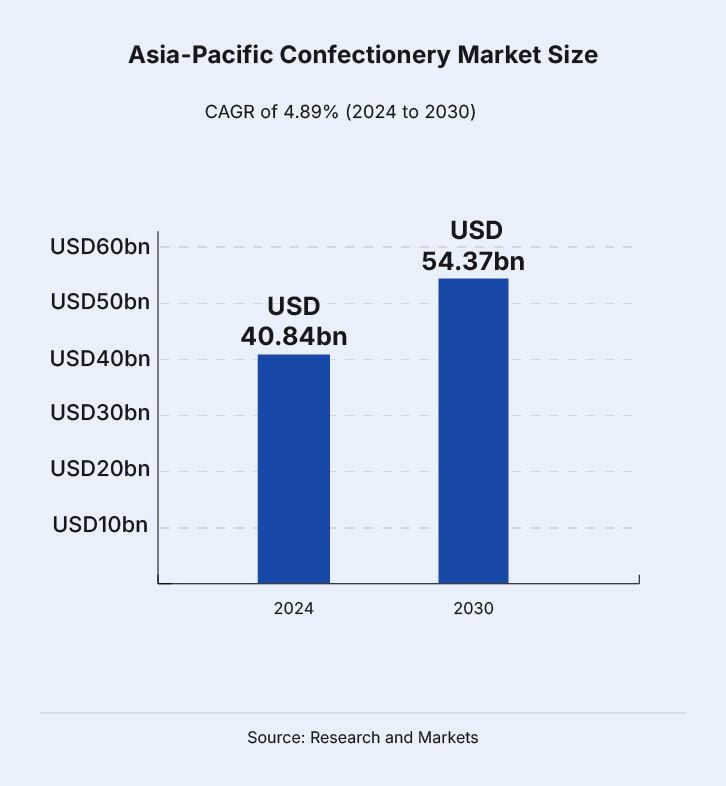

According to 2024 data from Euromonitor, confectionery was the second largest snack category in Asia covering 33.4% of the market (behind savoury snacks which held 35.1% of the snacking market), and price growth in this sector has been outpacing other categories.

Multiple confectionery leaders in the region have highlighted a need to focus on key drivers such as healthier innovation and adaptability in order to secure a piece of this pie.

“This space in APAC and AMEA is evolving rapidly, driven by diverse consumer needs and cultural influences in the region – The role of snacking as a whole is expanding as these lifestyles evolve, with 41% of people eating fewer traditional meals, and confectionery is a big part of the snacking sector,” Mars Wrigley Global Emerging Markets (GEM) President Gabriel Fernandez told FoodNavigator-Asia.

“As populations age across Asia Pacific, more than 58% of Asians prioritise physical and emotional health; and similarly in MEA, health and wellbeing is becoming as significant as economic stability increases.”

For many players in the confectionery sector, healthier innovation tends to involve the introduction of healthier options of standard products, portion control as well as a combination of physical and mental wellbeing – the latter being a need that confectionery can effectively fulfill.

“Consumer perception of healthy eating has evolved to encompass balance – including a variety of foods and occasional treats,” he added.

“We have introduced healthier options such as half-sugar dark chocolate Snickers and KIND bars with fewer than 200 calories to address this consciousness - In Asia, we have introduced smaller packs and also recently introduced KIND into the Middle East.

“We are continuing to explore how we can meet the demand for healthier snacks with health ingredients like nuts and fruit, and see the role of our gum brands like Orbit and Extra as a way to boost mental wellbeing, relieve stress, and boost concentration, which also addresses this desire for greater mindfulness and wellness.”

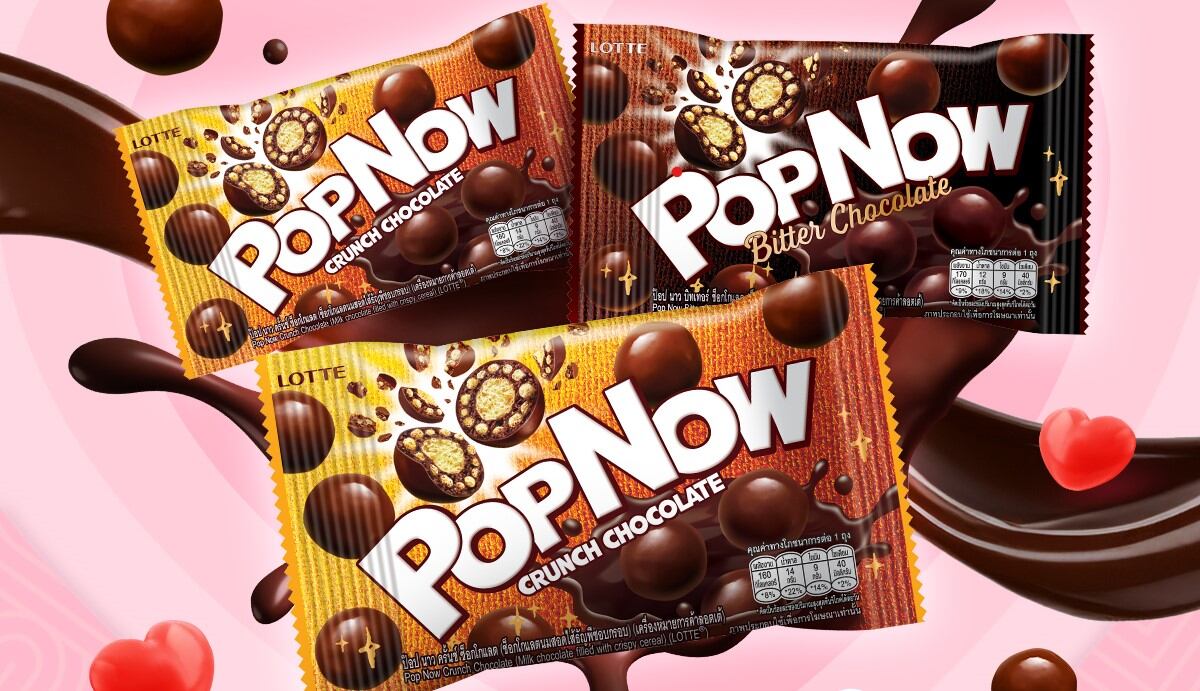

This is a similar route being taken by Lotte in Thailand, where the company is looking to build up its chocolate business a new business pillar away from the saturated biscuits market.

“Lotte actually has some 60 years of experience in chocolate production from a global perspective, mainly in Japan and South Korea, but this is our first entry into the Thai chocolate market in terms of local production,” Thai Lotte Marketing Division Manager Mao Ogino told us.

“Health is still a very important driver here, and here we look at not only the physical health but also mental health – here, chocolate plays important role as can deliver relaxation and refreshment to consumers.

“Additionally, chocolate has many grades and our PopNow brand uses real chocolate to ensure richness in its taste which is also a very important factor in the ASEAN region.

“Chocolate is a very important market to us here, as Thai Lotte has been mainly developing biscuit business in Thailand so far, but this space has been getting increasingly saturated with many competitors producing at very competitive prices, and an abundance of SKUs being launched.

“For chocolates, the market is still mostly amongst a limited number of global brands, and Lotte already has the existing knowledge and expertise to try to capture more of this market so we want to make the most of it.”

Lotte’s PopNow has also been tweaked in terms of format and packaging for the Thai market where convenience stores are the main retail route for many chocolate brands, so that these can be sold at a mainstream affordable price range.

“Affordability is very important in this market as well, and we need to ensure that we are offering good quality products here but also cannot expect consumers to purchase at premium prices daily,” he said.

“This is why PopNow packaging and format has been set at 30g packs with about 10 pcs in each pack, so we can still keep the pricing affordable for the average consumer whilst giving them high-quality chocolate.”

Watch the video below to find out more.

Traditional confectionery making a comeback

Various companies are also seeing opportunity in the traditional confectionery space, with many adding a touch of modernisation but generally maintaining the cultural value of these products to capture consumer interest.

“There is healthy demand for snacks and confectionery in Japan and in Asia as a whole, so much so that we currently do not face any challenges in terms of consumer demand,” traditional Japanese confectionery (wagashi) firm Tachibana Tenshinan Director Yoshizaki Tohru tolf us.

“The main growth potential we see in Asia for sweets and desserts is with personalisation – we are bringing more confectionery products such as ningyoyaki and dorayaki to other Asian markets, and plan to customise them by printing logos or images such as cartoon characters.

“There is also a lot of experimentation going on in confectionery – for instance, ningyoyaki is historically filled with traditional adzuki or white bean paste, but many ningyoyaki producers are now experimenting with more universally appealing flavours, such as fruit jams, to cater to non-Japanese tastes.

“Consumers are getting more adventurous in terms of seeking new tastes and flavours, but we’re not sure if the sweet and spicy combo will take off in APAC - We do have a spicy sweet cake that is selling quite well in Japan, but we’re not exporting those outside of Japan yet because we don’t know how receptive consumers are to this flavour combination.”

A major confectionery driver in a market like Japan lies in its tourism-driven demand for cultural experiences, which calls for an increased need to be adaptable in its innovation but not lost the original essence of the traditional product.

“Wagashi has a Japanese appeal which resonates with many around the world who are captivated by the Japanese culture, [so culture is very important],” he added.

“It is also imperative to be adaptable, which we focus very much on - For example, we developed a vegan version for the US market and for APAC, we are working on popular flavours such as kaya, orange marmalade, chocolate, or cheese.

“That said, we still offer the Japanese traditional favourites such as white bean paste, matcha, and adzuki beans, because these are authentic Japanese tastes that tourists like and again, culture is essential here.”

Adaptable assimilation

This has resonated in many other markets as well, such as in the Middle East where one of the most common sweet treats is in fact a date.

“When you think of a date, it’s more of a superfood but it is actually also a confectionery sweet item for many consumers here,” Agthia President of Water and Food told us.

“Is it as tasty as chocolate? Many think so, yet, it’s natural so it might not be [considered as ‘indulgent’], but sometimes, the consumer just wants to indulge.

“This may not be every day, but there are always some days such as for a birthday or a celebration, and this is why we offer various options in our portfolio - Taking dates for example, we have chocolate dates and natural dates so consumer can choose a basic date or go to the extreme with such as nuts-filled dates or dates with various different fillings.

“So it is all about providing consumers with a choice and letting them still feel the indulgence of a sweet treat – are these the healthiest possible foods? No, but it’s a healthier option, and at least they have that option.”

Adaptability has also come up as an important driver in Mars Wrigley’s innovation, particularly when considering products that require reformulation or dairy-free ingredients.

“We are also seeing a surge in demand for plant-based options and snacks with reduced sugar or healthier ingredient profiles and have adapting our innovation strategy accordingly,” Fernandez added

“To date, we have produced vegetarian and eggless products such as Snickers, Twix, Bounty and M&Ms for consumers in Middle East and India to make them more accessible to consumers there.”