Asahi recently announced its H1FY2024 financial results, reporting an overall 3.8% year-on-year increase in revenue to JPY1.38tn (US$9.4bn) and 6.2% year-on-year growth in core operating profits to JPY115.9bn (US$790.6mn).

The firm has attributed this to increases in unit prices and an overall premiumisation strategy.

“In Japan, the shift in demand towards the beer category following liquor tax revisions, and the expansion of the premium category including our global brands in Europe, both contributed to higher unit sales prices,” Asahi Group Holdings President and Group CEO Atsushi Katsuki told the floor at the firm’s H1FY2024 financial results investors call.

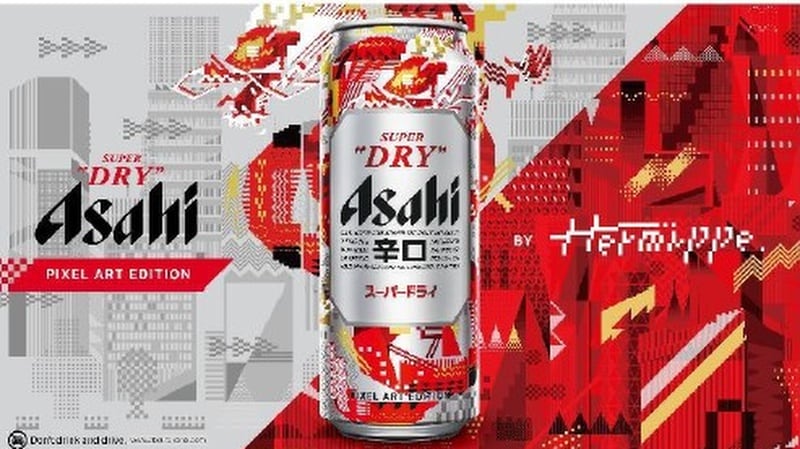

“The total sales of all five of our global brands saw 11% growth year-on-year, particularly Asahi Super Dry which is a top priority in our global portfolio and grew 27% year-on-year fuelled by sales expansion in major markets including Asia and especially South Korea here.

“Asahi has been focusing on strengthening our Beer Adjacent Categories initiative as a key growth strategy, [and these] first half results indicate that these efforts are showing results [with] growth in the non-alcoholic beers and RTD alcohol beverage categories contributing to the increase in earnings.”

Non-alcoholic beers and RTD yielded the biggest growth for the company in its home ground Japan, growing 21.4% to JPY22.1bn (US$150.5mn), followed by RTD alcohol products which grew 18.3% year-on-year to hit JPY20.2bn (US$137.6mn).

The firm also saw its largest regional growth in South East Asia in the first half, at 6.4% year-on-year growth overall compared to other major markets Europe (6.0%), Oceania (4.6%) and Japan (1.3%).

Despite still generating growth here, Asahi has faced the most challenges with the Oceania region this year as profits here dropped by -11.7% year-on-year, with alcoholic beverage sales in particular declining by A$26mn (US$17mn) year-on-year.

“Profits in Oceania declined due to lower beer sales caused by a deterioration in the market environment [as well as] higher raw materials and other variable costs,” the company stated.

“That said, sales of RTDs and our main carbonated drinks brands have continued to prove strong [with] non-alcoholic beverages growing by 10.2% year-on-year.

“We have had to revise down our full-year forecasts for revenue and profits in Oceania so as to reflect the performance this half and remain in line with prevailing trends, but are also pursuing various cost efficiencies to push up performance.”

Full-year forecast

The performance decline in Oceania has also led Asahi to revise down its full-year forecast for the group’s overall revenue performance which is now predicted to be 2.7% growth but its core operating profit growth remains unchanged at 4.3%.

“Going forward, while market conditions and consumer trends across various regions do not warrant optimism, we will continue to invest in our brands and innovation to expand our competitive advantage and bolster our profit base,” Katsuki added.

“[The forecast for core operating profits] remains unchanged as we revised down our estimates for Oceania, but revised up our forecasts for other regions.”