Although Nestle is one of the largest food and beverage companies in the world with one of the most extensive product portfolios, the firm is still facing significant challenges in the vast China market when it comes to its dairy business.

“Nestle faces two major challenges in China, the first being market penetration,” Nestle Greater China Senior Vice President and Dairy Business Executive Officer Rebecca Wang told the floor at the recent Food and Beverage Innovation Forum (FBIF) 2023 in Shenzhen, China.

“The overall penetration of dairy to households in China is around 99%, but at this point in time Nestle only has about 8% penetration, and this is mostly milk powder for adults.

“The other major challenge we face is that of awareness, a troubling ‘big but small’ paradox – firstly we are a big company but have small dairy market penetration; and secondly we are a big brand but have small awareness amongst consumers when it comes to dairy, i.e. the many consumers know Nestle, but most will relate this to coffee and rarely ever dairy.”

In a market where domestic leaders such as Yili and Mengniu have already firmly staked their dominance, it is undoubtedly a challenge for Nestle to try to carve out a larger piece of the pie for itself but Wang believes that this is not impossible.

“The only way to overcome these challenges and ask consumers to choose Nestle when making a dairy purchase is to play to our strengths,” she said.

“Nestle has been around for over a century, and we have several core strengths to take advantage of such as having Swiss quality behind us, having a strong nutritional foundation, and various products proven via clinical trials.

“So when innovating products for Chinese consumers, we realised it would be prudent to look inward at our existing core capabilities first, as opposed to creating various newfangled products and losing our identity.

“This has led to the integration of dairy with other Nestle products such as Milo or China flavoured UHT milk brand Whole Milk; as well as the creation of probiotic-enriched dairy products, which we have seen good response to from consumers.”

Nestle’s position as a 150-year-old brand also allows it a level of consumer acceptance and recognition, which the firm believes it can also capitalise on to boost sales and market penetration.

“We all know that in part times, China’s dairy industry often came under fire for food safety issues and left many consumers very concerned,” Wang added.

“This means that when it comes to dairy products, it is even more important to ensure good quality products, and Nestle’s longstanding position in the market shows consumers they can trust in the quality and safety of our products.

“When Henry Nestle started the company back in 1867, it actually started with dairy products like condensed milk, but that story has not been told for a very long time – so we decided to bring this story back to life but inject new meaning into this to appeal to Chinese consumers.

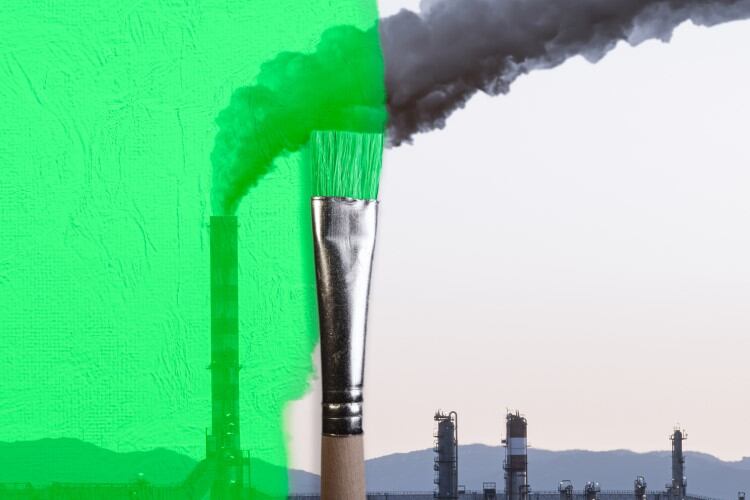

“This includes elements such as wide open green plains and the use of traditional logos with modern communication – all in an effort to tell the story well to gain that trust and confidence.”

Plant-based for protein

Nestle China also sees plant-based dairy as an important opportunity for it to expand its dairy business.

“We see plant-based ingredients such as peas, soy, and oats able to be part of the dairy business because just like conventional dairy, these are also good sources of protein,” she added.

“As such there are definitely many good opportunities in this area, and Nestle is responding by launching soy milk powders, probiotic products, oat milk products and more.

“This comes back to our core capabilities and looking inwards to innovate once again, using existing resources to boost our further growth and development.”