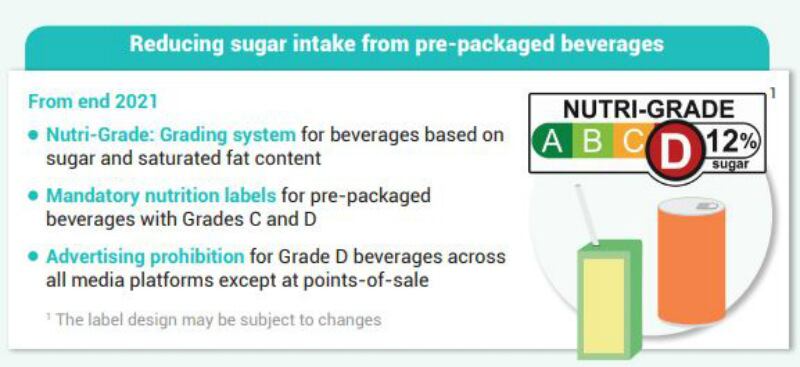

The Singapore government introduced the Nutri-Grade concept as far back as 2020, and after several pushbacks due to the COVID-19 pandemic, it is now slated for implementation in December 2022.

The Nutri-Grade scheme will involve nutrient labels with four different grades: ‘A’ (dark green), ‘B’ (light green), ‘C’ (yellow) and ‘D’ (red), going from lowest to highest sugar and saturated fat content. The use of this front-of-pack label (FoPL) will be mandatory for Grade C and Grade D beverages.

Many beverage firms producing drinks that fall in the Grade C and Grade D categories such as fruit juices and soft drinks have had to make changes to adapt to this upcoming system via either reformulation or new product innovation, especially due to fears that having C or D labels on their products will negatively impact consumer perceptions of these.

One such firm is Imperfect Drinks, which specialises in making fruit juices from ‘ugly’ fruits and vegetables.

“Although all of the sugar in our fruit juices is only natural sugars (fructose) from the fruits, and not added or artificial, what happens is that when you have a C rating or D rating on the label of the product, what will happen is that a consumer will automatically have a shift in perception of it,” Imperfect Drinks Founder and CEO Andrew Lim told FoodNavigator-Asia.

“So what’s likely to happen is that this product, say an orange juice, is going to go from something they thought was very healthy and drinking it daily, to something that they think twice or more times about before they even want to drink it when they see that label.

“And there’s really no way to run away from sugar in a fruit juice as it’s really naturally occurring, and if you want it to be sweet and fresh and natural. But at the same time, we have things like diet coke being seen as the healthier choice, and it seems that is being viewed as a healthier or better drink to consumer as opposed to fresh orange juice, which is in itself really bizarre.”

Nonetheless, Imperfect Drinks has had to make adjustments in order to continue viably doing business in Singapore, and some of the ways it is planning on doing this includes reformulation, launching a new range of low-sugar products, as well as focusing on existing low-sugar items in its portfolio, all of which would not require C or D labels to be attached.

“One method which a lot of commercial juice companies are doing anyway that we are looking at is to potentially add water to the juices, so that it becomes a little bit less sweet,” said Lim.

“We also have a range of teas which we add upcycled fruit juice too, and that definitely has lower sugar content, so that’s a space in which we feel there is still a lot of room for us to grow in.

“But most significantly to solve the sugar problem, we are looking at this growing segment in Singapore of flavoured, fruit-infused sparkling drinks, as this would solve the sugar problem whilst still enabling us to provide consumers with refreshing, guilt-free fruit beverage options.”

Indeed, Imperfect Drinks is not alone in its efforts to assimilate to the new FoPL scheme – even bigger names such as Yeo’s and POKKA have been working to roll out reformulated low-sugar options of its beverages, so as to avoid the dreaded C or D labels. Last year, Yeo’s launched zero-sugar and low-sugar variants of its popular chrysanthemum tea products.

“The criteria for a beverage to be labelled a Healthier Choice under the government scheme is to have 5% or less of sugar – the original chrysanthemum tea already qualified for this, and so the less-sugar (2.5%) and zero-sugar (0%) options definitely also qualify too,” Yeo’s Singapore CEO Angela Lu said.

“Similarly for Nutri-Grade, Grade C is where drinks have above 5% sugar content and Grade D beverages have more than 10% sugar content.”

POKKA has also moved in this direction with many reduced-sugar alternatives in its portfolio e.g. Kiyo Kyoho Grape Juice vs Kiyo Kyoho Grape Juice Less Sugar.

“It is evident that consumers’ behaviour and expectations have evolved over recent years, and innovation trends are skewed toward better-for-you, botanical, healthier ingredients and the less-sweet direction,” said POKKA Senior Product Manager, Marketing Division Irene Ee

“The pandemic has changed and influenced ways of life globally, [which] has in turn altered consumers behaviours as well as companies’ business perspectives - protecting [consumers’] health and interests are new expectations, so adaptability is a crucial driving force [for us] to push forward for the years to come.”

Overseas opportunity

Apart from being an opportunity to assimilate to the Nutri-Grade scheme, Lim also believes that sparkling waters represent a huge chance for the firms to achieve its export ambitions, and the plan is to introduce localised flavours in order to stand apart from current existing options.

“A key point here is that in Singapore a lot of the sparkling drinks we currently get are from overseas brands such as Perrier, very few are from local firms, and I was really thinking it would be interesting to explore local flavours such as say lemongrass and ginger sparkling water, or butterfly pea infused water – things like that,” he said.

“The idea is to have that local twist, something very South East Asian. And the added advantage here for us is that sparkling waters are, unlike fruit juices, an ambient product, so it would very much help us with our export plans and looking at more overseas markets, as supermarkets and cafes tend to have a limited amount of fridge space and want options that they can keep in the storeroom before they are ready to display these."