According to alternative protein industry expert Olivia Fox Cabane, China is unparalleled worldwide when it comes to reducing manufacturing costs, a challenge that just about all companies in the alternative protein market are currently trying to overcome.

“Cost, especially manufacturing cost, is one of the main barriers to scaling for all the current startups working in this field [of plant-based or cell-based protein], and there is no country in the entire world better and faster than China at reducing manufacturing costs,” Cabane told FoodNavigator-Asia.

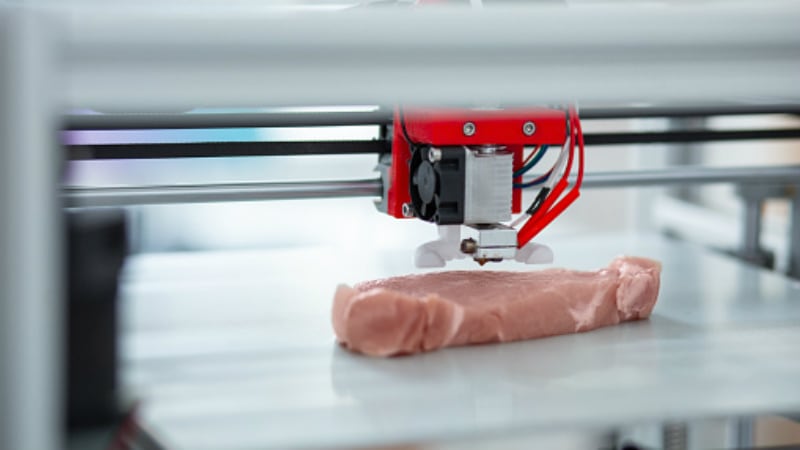

“3D food printing is [one of these areas that need cost-reduction] and is already experiencing an incredible growth. The products filling the cartridges can be both plant-based such as NovaMeat is doing, or cell-based as Future Meat Technologies is working on.”

Despite its current challenges, she added that China also has a lot of potential to own the 3D meat printing market as opposed to other big meat-eating countries like Australia or even others in APAC due to its ability to move very quickly in just about every industry.

“The speed and scale at which China operates is truly breathtaking. They built an entire hospital in 8 days, which is simply astounding,” she said.

“I can only imagine the speed and scale with which they could take over the 3D food printing market if they wanted to.”

Boundless benefits

Given the virus-induced economic downturn, it would also be very beneficial for China to seek novel ways of beneficial trade, and Cabane believes that the area of 3D printing could be a good answer to their woes and reducing their dependency on imports, particularly on meat imports.

“If China wanted to, (i.e. were willing to learn enough about and invest enough in 3D food/protein printing), the country could theoretically go from being one of the world’s largest meat importers to becoming one of the world’s largest meat exporters,” she said.

According to Bloomberg, China’s pork imports hit a record number in November 2019, jumping 151% year-on-year to hit 229,707 tons. As a whole from January to November last year, a total of 1.7 million tons of pork were imported, an overall increase of 58% from the previous year.

Beef purchases also rose by some 80% year-on-year in November 2019 to hit 186,984 tons, whereas frozen chicken imports rose by 71% to 77,895 tons. Total chicken imports came in at 693,443 tons from January to November, a 51% increase year-on-year.

Overall meat and offal imports in the first 11 months of 2019 were 5.5 million tons, a 42% growth from 2018.

A possible reason for this growth has been cited as the African Swine Fever outbreak last year that diminished existing supplies. With this in mind, Cabane believes that plant-based 3D printing could hold even larger potential in terms of food security and self-sufficiency for the country.

“Plant-based 3D printed food, if it could be made cheaply enough, would have an absolutely revolutionary impact not just on China’s dependency on foreign imports, but also in its vulnerability to livestock-related pandemics. No animals, no infections - at least none related to live animals, which are always the worst, [as we have seen lately],” she said.

“In addition, whereas cell-based meats will need a huge amount of investment to be scalable, China already has centuries of culinary experience with plant-based meats and these can already be produced at a huge scale.

“China could thereby meet its goal of reducing meat consumption by 50% by 2050 as well as drastically cutting their national emissions levels.”

Analysts also feel that plant-based is the way to go for China, and more specifically, the emergence of local brands in this field would be key for the market to move forward.

“Local brands like Zhenmeat have an advantage as they benefit from cultural understanding and domestic economies of scale,” said Global Data Consumer Analyst George Henry.

“Foreign brands may enjoy a reputation abroad for meat-free western ‘fast food’, but success in China will require deeper consumer understanding of a more conservative society in which family and home-cooking are part of the social fabric.”

Pork the biggest beneficiary

Given the import numbers above, it is also not surprising that pork is expected to be the most impacted if 3D meat printing were to become mainstream in China.

“Pork would without a doubt be the most-impacted meat if 3D meat printing technology and were developed and made mainstream in China,” she said.

“China could produce its own plant-based (and eventually cell-based) cartridge fillers and printers cheaper than anyone else, and thus could absolutely have a quasi-monopoly on that market.

“[Another ingredient to be considered here is] fungi, which is playing an increasingly important role in texturisation. China, like Europe but unlike the US, has a long culinary history with fungi, [so could definitely utilise that].”