“In 2018 alone, the number of notable investments was equivalent to the sum of all notable deals that had taken place in the past nine years (from 2009 to 2017),” according to the Good Food Institute’s China Plant-based Meat Industry Report 2018.

Plant-based snack companies were amongst the biggest beneficiaries of these investments, which is unsurprising given that China’s snack category as a whole is predicted to grow at some 20% a year, to reach US$444 bn in market value by 2020.

“The market today is largely fragmented, creating an opening for new brands that satisfy a combined consumer craving for health, convenience, and innovations in ingredients and product formats,” said the report authors.

“New plant-based snack brands are emerging as a result to give consumers new options “to snack without guilt.”

The largest investment deal overall in 2018 was acquired by Haocan (Beijing) Food Service Management Co Ltd at US$7.4mn for its PavoMea brand of chickpea snacks. Within the same category, the Chizhai Food Technology Development (Beijing) Co Ltd also managed to obtain over US$1.5mn in funds for its Guzi Guzi mushroom-based snack.

The plant-based beverage category has seen a slightly different growth trend, with many existing big F&B brands in China targeting this space.

“Most major food brands in China now have a plant-based beverage strategy. Some, such as juice giant Huiyuan and snack conglomerates Dali Foods and Want Want China, have used internal R&D to launch new brands. Others have pursued partnerships with emerging companies,” said the authors.

These bigger companies were much earlier to the party as can be seen by the investment patterns across the years: 2014 saw Mengniu and WhiteWave Foods join hands over plant-based milk brands Silk and Alpro and 2015 saw Coca-Cola acquire multigrain-beverage company Xiamen Culiangwang.

Last year instead saw specialist nut-based beverage brand Yangyuan successfully obtain some US$630mn in funding for its walnut beverage.

“[Yangyuan has now] become the largest walnut beverage brand, with a mainstream customer base sold by its image of protein and brain health benefits,” said the report.

The tech-enhanced protein alternatives sector, including plant-based ingredient innovation firms and cell-based meat firms, also saw a boost in 2018, with Chinese food tech venture capital firm Bits x Bites pouring investments into this area.

The first recipient of this was Israeli firm Future Meat Technologies, which received US$2.2mn in a joint investment with Tyson Ventures from the United States, and the other recipient was Israeli chickpea protein firm InnovoPro which received US$4mn in funds.

Soy leading by huge margin

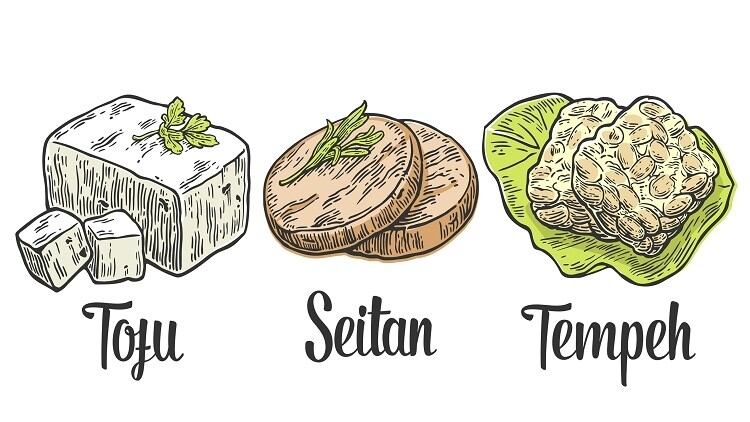

In China, the most common materials used to make plant-based products were soybean, konjac and wheat.

Soybean remained the clear market leader by a huge margin at 75.8%, followed by wheat (15.9%). Konjac only contributed some 4.7%, whereas all other material together (including chickpeas, nuts, mushrooms, etc.) made up 3.6%.

According to GFI APAC Managing Director Elaine Siu, this is likely because soy products such as tofu have traditionally been considered a major part of the Chinese diet.

“In Chinese cuisine, tofu is not treated as a meat substitute as in the West, but rather an important, versatile mainstream ingredient in its own right,” she said.

The majority of other plant-based materials are used to make plant-based foods mimicking meat textures, e.g. konjac flour in China is used to mimic seafood or animal fats, whereas edible fungi like shiitake mushrooms are used to make vegetarian meat floss, jerky, brisket, etc.

“Notably, since Chinese plant-based meats were born out of the Buddhist tradition and have primarily served the vegetarian inclinations of [these estimated] 245 million consumers, replication of the taste and texture of meat was never pushed past a relatively basic level,” said Siu.

“In fact, being too similar to real meat could be deemed non-religious.”

Significantly, the report cited a CEVSN consumer survey stating that although over 90% of 6,000 participants surveyed did not identify as vegan, ovo-lacto vegetarian, or pescatarian, 86.7% had experience consuming plant-based meat products

These plant-based meat consumers were also found to be mainly concentrated in first-tier cities (Beijing, Shanghai, Guangzhou, Shenzhen), and made up 43.6% of total 2018 sales.