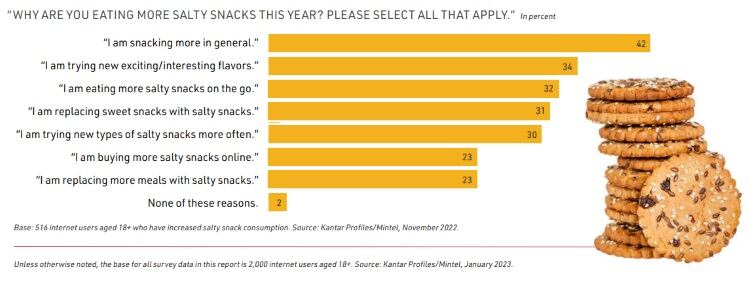

According to the California-based flavour house, consumers are more willing than ever before to be adventurous with snacks. A recent Mintel survey found that 42% of snackers admitted to eating more salty snacks than last year, while 34% are trying new, exciting flavours.

The excitement of flavour is driving trial in the snack category, reinforcing the idea that consumers are willing to take risks and opening an opportunity for brands to pull out all the stops.

Flavour is the common ground between BFY and indulgence. Despite increased interest in healthy and functional ingredients in snacks, this does not have to be mutually exclusive with indulgence. A recent Mintel survey indicated that 37% of consumers feel that unique flavours make health snacks feel more indulgent, suggesting a balanced approach to both flavour and ingredients can an appeal to consumers from both ends of snack spectrum.

The power that interesting flavour holds with consumers is able to transform and blur lines in snack perceptions and the roles that snacks can play alongside meals, as meal replacements or simply as an enjoyable treat.

That said, familiarity is driving consumer flavour exploration.

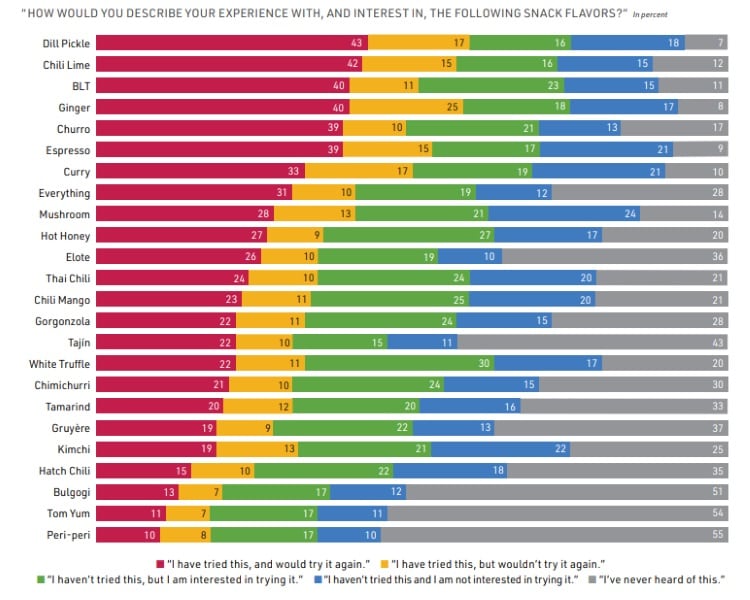

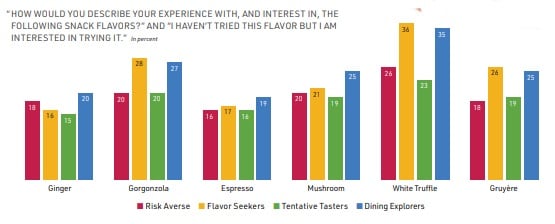

Consumers are most likely to have a positive experience with flavours that have some grounding in the familiar, such as ‘BLT’ and ‘everything’, which are based on other foods.

For more risk averse consumers, this can feel comforting, while more adventurous consumers see novelty in a familiar flavour in a surprising format. Creating familiar descriptions or combinations are paramount for emerging ingredients, such as white truffle and bulgogi, when motiving for new taste trials.

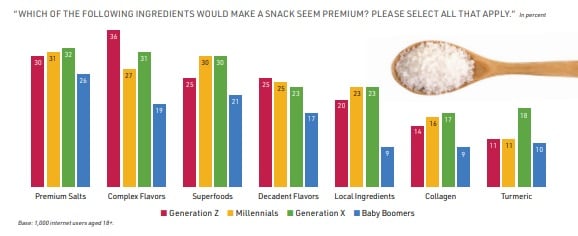

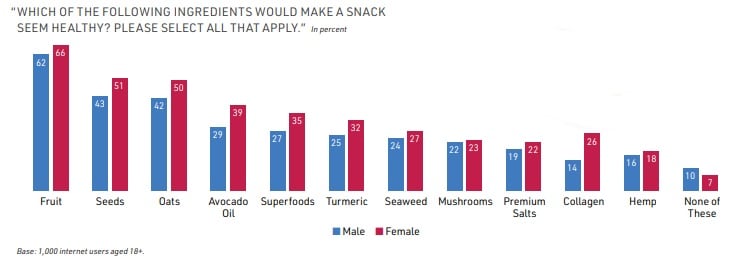

Consumers are seeking clear flavour and ingredient messaging. According to T. Hasegawa, ‘naturally flavoured’ and ‘recognisable ingredients’ signal ‘premium’ for snackers across the generations. In fact, more than 60% of consumers in a recent Mintel survey cited fruit as an ingredient that would make a snack seem healthy, along with an average of 40%-50% for seeds and oats - across both male and female consumers.

The added value of health benefits helps to justify premium price points, and brands should be clear in their messaging regarding better for-you claims and ingredient listings to capture most consumers.

Healthier snacks with indulgent flavours or indulgent snacks with healthier ingredients can appeal to a broad section of snackers and may nudge some teetotalers in their product choices. Think classics like a mac and cheese or tacos for broader audiences and trending global options like tom yum, elotes or bulgogi for more adventurous palates. - T. Hasegawa’s Flavour Flash, Salty Snacks

Social media, as always, is influencing flavour innovation, especially when it comes to extreme flavours. As such, savvy snack brands are looking online to foster their boldest and most expansive flavour ideas, and even tap into the opportunity for online retail channels.

The power of collaboration

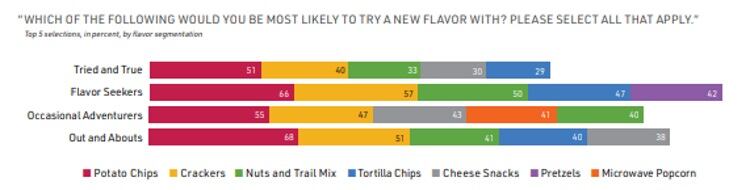

The Tentative Taster segment of consumers shows much higher interest in exotic flavours, especially when it’s associated with brands or restaurants they know. And when it comes to dipping a toe into a new pond, consumers are most likely to try new flavours with potato chips (60%) and crackers (48%).

Collaborations are not a new concept, but they are a solid game plan when budgets are stretched, especially when they combine popular well-known snack formats with equally popular well-known flavours to create novel experiences.

In fact, according to T. Hasegawa, menu-inspired flavour profiles are likely to have more traction with Tentative Tasters than with Dining Explorers among these snack segments.

A not-so-hidden bonus of collabs is the instant doubling of distribution and promotional efforts, often engaging the full breadth of each partner brands retail and social media networks.

Trending flavours

Brands are betting on popular Mexican-inspired foods like elotes, while churros-flavoured options are blurring the line between desserts and snacks, and even health and indulgence. New product introductions featuring churro flavour have grown by more than 400% since 2020.

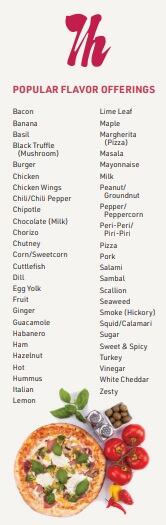

Heat remains hot. In an increasingly busy environment where snack brands are fighting for their share of occasions, many are using the intrigue of trending pepper varietals to create unique spicy experiences once dominated by jalapeno and habanero.

At the crux of these flavour combinations lies tanginess, a flavour profile that has seen impressive growth among snack launches. While nascent flavours such as chili mango (25%), Tajín (15%) and tamarind (20%) pairings are garnering interest among snackers, there is still much work to be done to educate the snacker on these options.

Interest in dill pickle snacks is strong and rising across the generations. The flavour is bold enough to entice younger consumers while still being recognisable enough not to deter typically less-adventurous older consumers. Dill pickle as a flavour has the advantage of pairing well with trending cooling ranch and spicy flavours, fiving it extra versatility.

Fuelled perhaps by the power of pop-culture exposure, Korean cuisine was one of the few international cuisines to grow user base in 2022. Two staples - bulgogi (or Korean BBQ) and kimchi - are driving brands to tap into the more adventurous palates of Gen Zs, while embracing the less intimidating nature of barbeque, for example, to align with more conservative snackers.