In this edition of the FNA Deep Dive, we take a closer look at the sector to find out how companies in the region are conducting product innovation to meet consumer demands in these areas as tastes and preferences continually evolve.

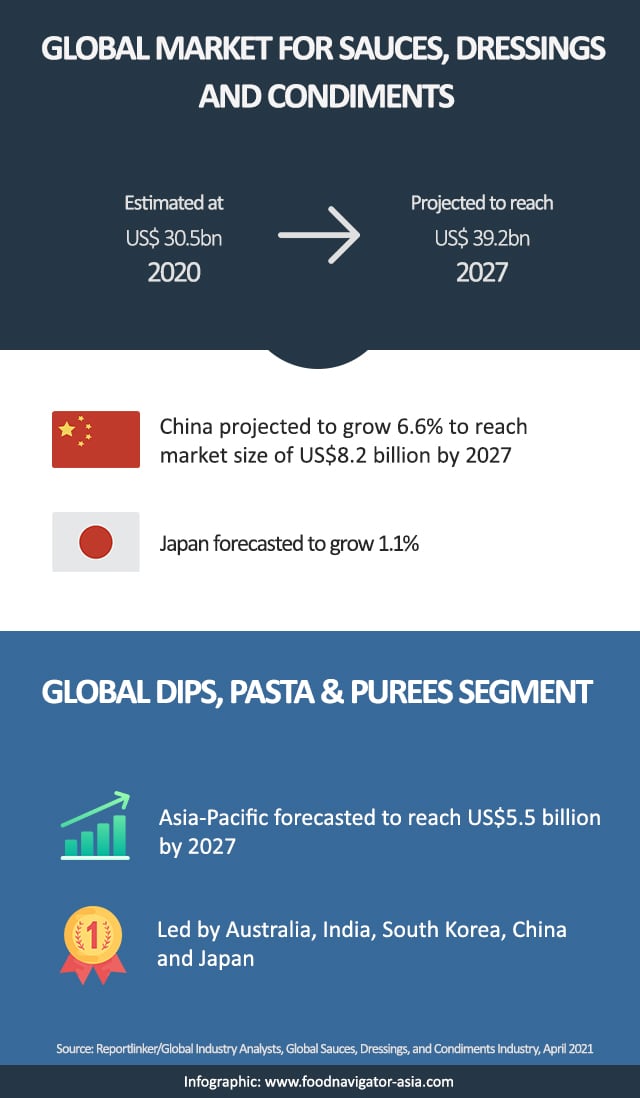

As a whole, the market for sauces, dressings, and condiments is a very sizeable one, estimated at US$30.5 billion globally in 2020 and projected to reach US$39.2 billion by 2027, according to Global Industry Analysts.

Within the APAC region, China is projected to grow 6.6% to reach a market size of US$8.2 billion by 2027, with Japan forecasted to grow 1.1% whereas in the dips, pasta and puree sector alone, the regional market size is expected to hit US$5.5 billion by 2027, led by Australia, India, South Korea, China and Japan.

One key trend leading product innovation within the market is the emergence of novel and unique flavours allowing consumers to customise their food as they like, with brands also striving to maintain convenience and versatility in their innovations.

For example, even within Asia’s most staple condiment soy sauce, companies such as Singapore’s traditional soy sauce firm Nanyang Sauce are attempting to provide as much choice as possible for consumers in terms of flavours.

“There is very strong potential in the customisation and premiumisation of sauces and condiments that can meet changing needs of consumers, especially for a traditional item like soy sauce, in order to meet the changing needs of consumers,” Nanyang Sauce Director Ken Koh told FoodNavigator-Asia.

“Nanyang Sauce [has been around for] over 60 years since 1959 and we still produce soy sauce the traditional and natural way [by] fermenting soya beans in vats under the sun for about nine months, [but innovation is crucial to keep consumers interested].”

As such, the firm has created a ‘bespoke vat service’ for soy sauce - the first of its kind in the world – which allows consumers to customise their soy sauces to their liking.

“People have done [customisation] for alcohol such as whiskey by the barrel, but this is the first time people can now buy customised soy sauce,” said Koh.

“Consumers are able to customise both dark and light soy sauce according to the five basic tastes, sweet, sour, salty, bitter, and umami, as well as the origin of any particular ingredient.”

Watch the video below to find out more.

This need for flavour innovation is recognised not just by traditional sauces like these, but also newer up-and-coming types of sauces like the most recently on-trend hot sauce – According to Malaysian hot sauce firm Molli, even when it comes to spice, consumers have differing tastes and firms need to have multiple flavours to keep up.

“We have seen strong demand for hot sauces in Malaysia this past couple of years - probably due to Korean influences where spicy noodles were and still is a hit – and the ability to stomach spicy food/ hot sauces has a source of pride of sorts for many,” Molli Co-Founder and Director Jorge Bernal told us.

“We have five different types of sauces, from Extra Hot which contains ghost peppers and is really hot, to Green Salsa which is spicy and tangy, and these five sauces were created to suit different consumer profiles.

“The need for this variety is obvious, as in terms of popularity we’ve seen more than one variant become a hit with locals, from our most versatile Hot Tasty to the less-spicy Guacamolli (guacamole in a bottle) and Tomato Salsa (salsa in a bottle) flavours all become hits among locals.

“There will always be a trend and a need for hot sauces, especially in countries like Indonesia, Malaysia Thailand and so on which traditionally have spices in their foods.”

Versatility and convenience

Larger firms are also recognising the need for flavour innovation and Masterfoods, owned by industry heavyweight Mars Food Australia, has added an extra ‘need-to-have’ dimension to this in the form of versatility and convenience.

“Condiments and sauces are key to delivering flavour with ease and speed. The key shift we’re seeing in the sauce category is a move from versatility, such as one sauce for many meals like tomato sauce, to a range of meal-specific sauces,” Mars Food Australia General Manager Bill Heague told us.

“This means that rather than two or three sauces in the fridge, consumers have a ‘stash’ of different sauces for individual meals and eating occasions – [increasing the need] for developing more unique flavours and options.

“Consumers are also looking for flavour that recreates their ‘out of home’ eating experiences, whether that be café quality or diversity of cuisines [and] our research shows that chicken, pasta, and Asian meals are the top meals prepared at home [in Australia].

“So our challenge is to deliver flavour that is easy, versatile, and diverse for our consumers. We want to make cooking from scratch just that much easier with the ability to deliver flavour fast via condiments.”

MasterFoods is currently launching a range of Asian-inspired sauces such as Thai Style Sriracha, Vietnamese Style Hoisin, and a Japanese Style Tonkatsu sauce.

“Many consumers were also the ‘craveable’ flavour of a burger during the pandemic, so we created a ‘fake-away’ range – this aims to recreate the sauces from consumers favourite take-away meals at home, starting with burger sauces,” said Heague.

“We will be releasing a range of premium burger sauces (e.g. tangy herb, maple bacon, spicy jalapeno) later this year, which will come in glass jars instead of plastic - These premium sauces are ‘spoonable’ and designed to tap into the growing ‘indulgent’ trend, reproducing gourmet food truck and café style burgers.”

Similarly, Taiwanese noodles and condiments brand Kung-Fu Mama (known as Shuangrenhsu in Asia) has also made convenience a key part of its sauce innovation, with a main focus on the busy and working moms demographic.

“With our sauces, the aim has always been to provide easy, convenient, tasty options which are quick and easy for busy mothers to save time in the kitchen,” Shuangrenhsu Founder Evelyn Hsu told Foodnavigator-Asia.

“It’s also really to help those who don’t know how to cook that well make delicious dishes which children will love – in our case, our best-sellers include a mapo sauce (Sichuan spicy sauce) to make mapo tofu, and a ginger-based sesame oil sauce to make jiangmuya (ginger duck) which would both usually require a lot of ingredients to make but now need just this one sauce pack.”

Shuangrenhsu has over 10 types of sauces available both online and in major Taiwanese supermarkets such as PX Mart, which has about 1,000 chain stores locally.

Healthier innovation

In addition to flavour innovation, Heague also highlighted innovation towards healthier products as an important driver for the category, calling this an ‘everyday expectation’ by consumers.

“Current consumer trends are also largely focused on good health factors such as no artificial colours, flavours or preservatives,” he said.

“These have almost become a ‘hygiene factor’ and an everyday expectation in sauces - we are seeing consumers also looking for ‘added’ benefits beyond this, such as reduced sugar and salt.”

MasterFoods reacted to this healthier products trend by adjusting the content of some of its products such as tomato sauce, which has been validated as gluten free. The firm also exports to New Zealand, China, Indonesia, Malaysia, Singapore, Sri Lanka, and Thailand.

Another major brand with a strong focus on healthier innovation is Japanese condiments and seasoning firm Hinode Foods, which is best known for its Japanese teriyaki and mirin sweet sauces.

“The health trend is prevalent across Asia - In Japan, you can see many types products which emphasise “sugar free” or “less sugar” [whereas] in Singapore and Malaysia, many packages are displayed with healthier options such as “Healthier Choice” in Singapore or “Pilihan Lebih Sihat” in Malaysia,” Hinode Foods Assistant Marketing Manager Yusuke Katsuraku told FoodNavigator-Asia.

“This has become even more prominent after the COVID-19 outbreak as there are now more health conscious people who choose healthier products and cook at home.”

Hinode has also taken healthier innovation a step further by focusing on functional food innovation, which is believes to be a a growing sector within the food industry.

The firm utilises microbes to develop new products and elevate traditional foods, such as a new functional food it is researching made from the Koji fungus (Aspergillus Oryzae), which can be found in many Japanese fermented products such as sake, mirin and soy sauce.

“Koji contains enzymes and vitamins beneficial for health [and we are working on developing the functional food applications for this further]. Currently, Hinode’s meat tenderiser and karaage powders are made with Koji, where the enzymes in this help to break down protein and tenderise meat,” said Katsuraku.

That said, most firms still appear reluctant to directly discuss another important aspect of healthier innovation, which would be to remove actual salt content from sauces, as this would seriously impact flavour.

But inevitably, this topic will become more and more prominent, such as sugar reduction is in the limelight now, especially as salt is known to be a key culprit in chronic diseases such as high blood pressure and cardiovascular issues. As it is, experts are already advising the reduction of salt consumption.

In Singapore for example, Dr Salome Rebello from the National University of Singapore Saw Swee Hock School of Public Health has highlighted sauces as a major contributor to salt in local diets, calling for people to use lower-sodium options.

“In most Western countries, about 75% of dietary salt comes from processed and restaurant-prepared foods, however in Singapore, 75% of intake comes from table salt, sauces and seasonings added during food preparation,” said Dr Rebello.

Governments are also taking notice: The Singapore government has introduced a Whole-of-Government (WOG) Healthier Catering policy which will see caterers use lower sodium salt, sauces or seasonings effective from May 2021, whereas the Thai government is expected to implement a salt tax some time this year.

Traceability and localisation

Flavours and health aside, firms are also seeing the traceability and provenance trends pick up for sauces in the region, with Koh highlighting ‘farm to table’ as a major one in Asia.

“I think every country has its own specific trends but as a whole, people are now increasingly concerned with farm to table,” he said.

“Farm to table is not anything new - in the past when people lived on farms and cultivated their own foods, it was farm to table, but increasingly with urbanisation, there’s been a disconnect [as a] whole supply chain of players are involved before food gets from the farmer to the consumer.

“A lot of people are now very aware that we are losing touch with how our food is made [and as] affluence rises, people are willing to spend a few dollars more for something that is better because there's a lot of health scandals and food scares around the world, [so the] the general trend is that people are now more careful and selective of the food that they are consuming.”

On Masterfoods’ end, Heague added that provenance and product origin has also become increasingly crucial to consumers, especially in the case of Australia.

“Provenance has really increased in importance with consumers, and information that identifies the product as being ‘Made in Australia’, or ‘From Australian ingredients’, is very much sought after,” he said.

“Along with provenance, there’s also a growing focus on sustainability, which is why we have a packaging and sustainability roadmap which aims to transform our entire portfolio to be either re-usable, compostable, or recyclable by 2025. [and are] working on a project to reduce the use of plastic in our squeezy bottles.”

Another trend worthy of mention is that of localization, which Hinode Foods understands well after having operated not only in its home country Japan but also in the ASEAN region for some years now.

“Each market has its own local tastes,” said Katsuraku.

“We are a Japanese seasoning manufacturer from Japan, and know how to manufacture products that Japanese consumers like, but in other markets, what local customers want is not always what the Japanese want.

“So to address this challenge, it was important for us to get local feedback to help us develop products suitable for the local palate, [which is key when looking at product innovation].”

Hinode’s main base of operations in South East Asia is in Singapore and it also has a production facility in Thailand.