Revealed in Rabobank’s Beef Quarter Q1 2019, China has been the worst international market affected by ASF, which has caused significant problems for some of the Asian countries’ major meat firms such as WH Group.

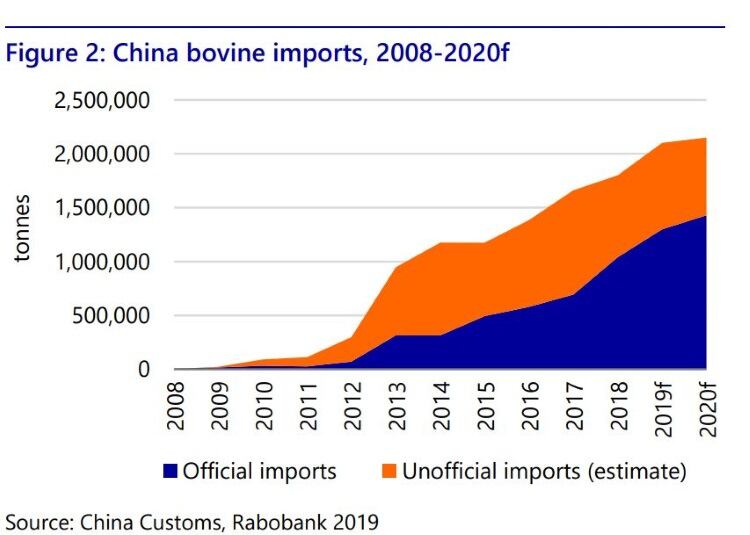

In recent months, ASF has forced China to ramp up its border controls, which has added to its trade problems – leading to a sharp decline in bovine trade from neighbouring nations such as Hong Kong and Vietnam.

Subsequently, Rabobank reported that Vietnamese imports of Indian carabeef in Q4 2018 were down 60% year-on-year at 120,370 tonnes and in turn Indian buffalo prices also dropped.

Commenting on the ASF situation in China, Rabobank’s senior analyst for animal protein Angus Gidley-Baird said: “Despite pork consumption dropping, we estimate that production drops will be deeper, leaving a supply gap of some 1m to 2m tonnes for 2019.

“This will be partially filled by other meats, including poultry, beef, sheep meat, and seafood. Due to the size of the pork market in China, additional imports and meat substitution cannot make up for the decline in pork production, and we expect all meat prices to rise in Q2 of 2019.”

Other areas concerning important international developments include Brexit, USDA decision on Lean Fine Textured Beef and the recent floods in Australia’s northern territory impacting cattle numbers.

Brexit concern

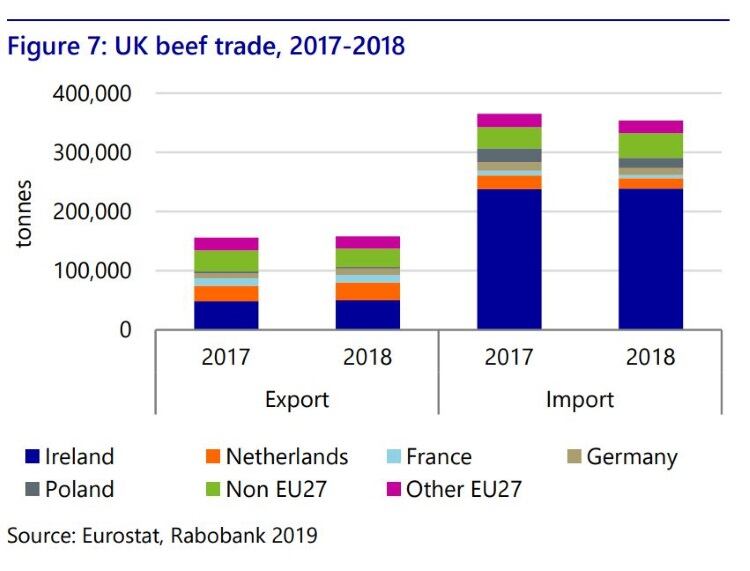

The Brexit deadline of the 29 March is drawing ever nearer, and with just under a month to go, the UK beef industry still remains in the dark about what the future holds and is still demanding answers from the government.

According to Rabobank, the Brexit uncertainty has the potential to “significantly disrupt” the European market. The organisation predicted that UK beef imports will change little, if at all, during 2019. However, a hard Brexit would bring changes over time as beef exporters compete to access the relatively high-value UK market, with intra-EU trade flows potentially disrupted as a result.

Meanwhile, in December 2018, the US Department of Agriculture (USDA) reclassified Beef Products Incorporated Lean Fine Textured Beef to meet the definition of ground beef. This means that Lean Fine Textured Beef can be incorporated into lean beef without separately disclosing it. Rabobank believed that the reclassification would provide “opportunities for better use” of fattier grades of trim and will influence the demand for leaner trim.

Finally, large numbers of cattle were killed during the northern Australian territory’s floods in February, which will significantly disrupt the market, according to Rabobank.

Rabobank estimated that the area that received heavy rain contained about 1m head of cattle, but it was difficult to determine whether those numbers would rise over the coming months.