Cocoa traceability to date has largely meant knowing how many tons come from a Fairtrade or Rainforest Alliance certified co-operative through a paper-based system.

This is otherwise known as physical traceability and is itself quite rare in cocoa as more than half of the global crop area is not certified.

Even when cocoa is physically traceable, companies know little about the individual farmers who grew it and cannot be sure if the cocoa has been smuggled from deforested areas or via a farm using child labor.

GPS coordinates of the farm

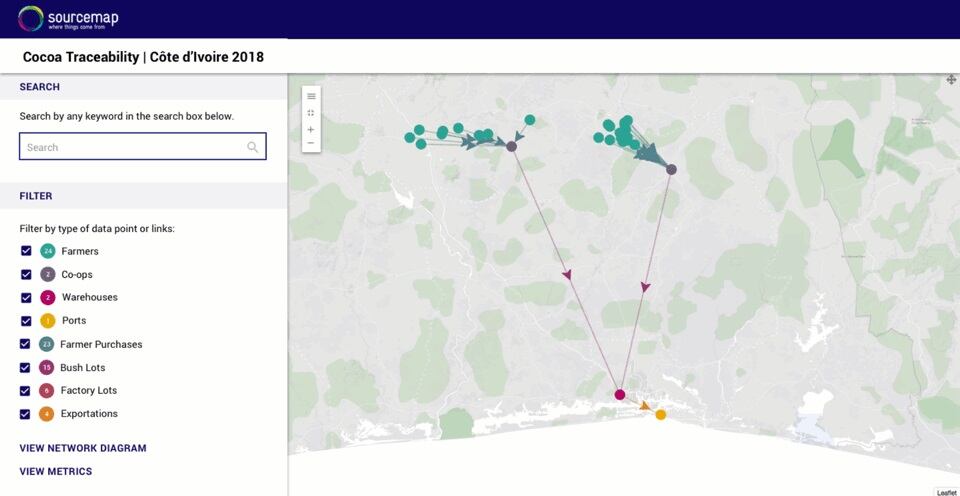

"Almost none of the world's cocoa is traceable to the farm,” Dr. Leonardo Bonanni, founder and CEO of SourceMap, a traceability software company, told ConfectioneryNews.

"Until three years ago only some of the certified cocoa was mapped to the farmer organization or co-operative where the farmer drops off the cocoa,” he said.

This meant a company had no way of knowing which farmers contributed to a truckload of cocoa shipped to their factory.

"Now cocoa can be mapped down to the GPS coordinates of the farm,” said Bonanni.

How does it work?

Mars, Hershey, Cargill, Barry Callebaut and others are now building a better picture of where their cocoa comes from using free Android applications available on cheap phones.

The companies’ own traders, local traders or partner farmer organizations have begun to collect GPS coordinates for each farm as well as social and environmental information about a farmer’s household.

Bonanni said this was done once a year and takes an hour per farm. "A single person can visit a thousand farmers a year.

"With this technology they spend much less time doing this than with the prior solution which was to use dedicated GPS devices, clipboards and spreadsheets to transcribe everything,” he said.

Now everything is on a centralized database in the cloud.

"What that means is as the real-time data rolls in [farmer organizations and companies] are immediately able to identify problems,” said the Sourcemap founder.

Cocoa buyers can for example see if there are not enough paid laborers on a given farm, which may indicate a risk of forced or child labor.

They can also identify if a farm is within a protected forest area or is contributing to loss of forest cover by comparing a farm’s GPS coordinates with satellite data showing changes in leaf coverage.

"It's a whole new paradigm that you can virtually audit your supply chain from your computer,” said Bonanni.

"It will create a sustainable cocoa farmer registry where they [manufacturers] can confidently buy any bag of cocoa that's been verified to come from these farmers,” he said.

Every deal in the cloud

The cloud-based systems also keeps a record of every cocoa transaction.

Farmers with smartphones have access to their transaction records and to tailored farm development plans from a co-operative field agent.

Speaking to ConfectioneryNews at the recent World Cocoa Conference in Berlin, Taco Terheijden, manager of sustainable cocoa at Cargill, said: "The benefit for the farmer is they get a better insight on what they have delivered and what they received and this will hopefully help them to get a better business mind."

Most transactions are still initially logged via paper receipts and then uploaded to the cloud weekly.

However, software companies are now piloting bar codes that can be stapled or stitched onto jute bags unique to each individual farmer.

"You can imagine people at the co-operatives scanning every bag that comes in just like a checkout person at a supermarket. That's the dream, but it'll take a couple of years before that becomes the norm,” said Bonanni.

Cargill and cocoa traceability

Cargill has set a target for 100% farm to factory cocoa traceability by 2030.

“I think it's going to happen earlier,” said Terheijden. "We see it as a 'must-have' for sustainability but also for consumer confidence."

The cocoa ingredients supplier is working with software companies SourceTrace Systems, which is also used by Olam and UTZ, as well as Farm Force.

Data is gathered across a range of areas such as farm sizes, farming practices, yields, access to finance, farmer income, access to healthcare and measures on child protection

Cargill’s Ghanaian cocoa supply is already fully traceable as well as around a quarter of its volumes in Côte d’Ivoire.

Farm area: ‘The next evolution’

"Now we're seeing the next evolution which is not just GPS coordinates but also the area of the farm,” said Bonanni.

NGOs on cocoa traceability

The latest Cocoa Barometer from a consortium of NGOs including the Voice Network and Solidaridad urges companies to source traceable cocoa and forge long-term trade relationships with farmer groups.

“With no supply chain traceability, companies have been willingly (and often knowingly) purchasing vast amounts of cocoa from areas that should have been protected natural parks for years,” it said.

He said tracking farm size allows companies to detect adulteration or smuggling.

“If you know the size of the farm, you know how much cocoa it's capable of producing and you can make sure that's not too much or too little being sold under that farmer's certification,” said Bonanni.

Sourcemap currently maps around 50,000 metric tons of certifed cocoa down to this detail, but it plans to scale up.

Mobile money

The next step for cocoa traceability is likely to be cashless transactions.

Cargill is already paying farmers in mobile money in Ghana in partnerships with E-Zwich.

"The benefit for farmers is they receive their money way quicker. They get a receipt and they know exactly how many tons they have delivered,” said Terheijden.

Cargill set up its own licensed buying company in Ghana in 2016, allowing it to directly source from farmers in the country.

Sourcemap is also piloting e-money payments.

"We're looking to a future where mobile money is used to buy cocoa directly from farmers and the payments can be issued through a system that's secure through blockchain,” said Bonanni.

ISO: A traceability standard

The International Standards Organization (ISO) is currently developing a standard for ‘sustainable and traceable cocoa’, in which it will define requirements for traceability. The standard is due for publication in July 2018.

Who pays?

According to the Sourcemap founder, digital cocoa traceability can be paid for via existing certification premiums.

"This is far cheaper than the way certification used to be done. People are spending far less time to certify far more cocoa and more accurately,” he said.

Bonanni added digital traceability can also exist where no farmer organization is present as information can be collected by a buyer travelling to the field or by the farmer themselves.

The end of mass balance?

Many expect the future of cocoa traceability is likely to run from farmer to first buyer, under the mass balance system, at least for the large chocolate companies.

Under mass balance, companies agree to buy a set volume of certified cocoa, typically the amount needed for a particular chocolate brand. These volumes can be mixed with ‘non-sustainable’ cocoa along the supply chain.

Some smaller companies such as Tony’s Chocolonely and Divine Chocolate purchase identify preserved, segregated certified cocoa from their suppliers which is linked to partner cooperatives.

However, such a model is rare for larger players.

"We have not invested in physical traceability,” said Cathy Pieters, director of Mondelēz International’s Cocoa Life program.

”We're following the bean from the farm to the first buying point...then it's mass balance.

"When it's processed - we don’t follow it anymore. We're too big. We'd need to invest all the money to get traceability and that would not benefit farmers at all,” she said.

Sourcemap’s CEO said bundling and mixing cocoa at processing level is likely to remain the industry norm.

"But certainly the days of mass balance are shrinking,” he said.

“Because you have dedicated sourcing up to the point where you absolutely need to blend the cocoa, whereas before you had mass balance right away - even at the cooperative you didn’t know what a truck of cocoa leaving contained and which farmers contributed."