The latest quarterly Supermarket Currency report by Roy Morgan Research shows Australia’s grocery buyers spent A$89.8bn (US$68.5bn) at supermarkets in the last year.

This represents 87% of the overall A$103bn spent on groceries annually in Australia. Every percentage point change in market share is equal to nearly a billion dollars lost or gained.

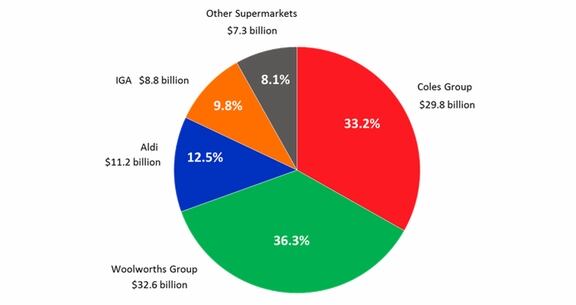

The study estimates that Australians spent A$32.6bn at Woolworths over the period—36.3% of all supermarket expenditure nationally. This, however, is down A$825m compared to the previous year, representing a decline in market share of 1.4 percentage points.

This is the second consecutive year that Woolworths’ sales and market share have has declined since they reached a peak of A$34.4bn in 2014, 40% of that year’s market share.

It’s a very different story for Coles, where grocery shoppers spent A$1.1bn more than they did in 2015, and which gained 0.9 percentage points in market share with A$29.8bn in revenues.

Woolworths’ loss was not solely Coles’ gain: Aldi claimed 0.5 percentage points in increased market share after a good year. The German discount supermarket hit a new high as its checkout staff took in 12.5% of Australia’s supermarket dollars.

IGA gained 0.3 percentage points of market share year-on-year to 9.8% (A$8.8bn), while the share for all other supermarkets combined fell by the same amount, down to 8.1% ($7.3billion).

“Price wars between Coles and Woolworths, and the rise of discount chain Aldi, appear to have stalled growth in the overall market,” said Michele Levine, chief executive of Roy Morgan Research.

Between 2008 and 2014, the total national spend at supermarkets grew an average 4% annually, adding around A$3bn a year to the tills.

“Then from 2014 to 2015, supermarket spend grew by only 1.8%, and by only 1.2% from 2015 to now—or only a billion dollars more than last year,” Levine said.

“As overall expenditure slows, market share is more important than ever for supermarkets: getting more grocery buyers into the stores, and claiming a larger share of their grocery budgets.”