The Shanghai Food and Drug Administration said it had received a “large number” of complaints about some of the 1,000-6,000 kitchens used by each of the apps.

Some customers complained after feeling sick after eating food delivered by Yami, Linshi, Home-Cook and Minshi, which are the most popular of their kind in Shanghai, according to local media reports.

“Most of the home kitchens are not capable of temperature-controlled supply chain food delivery, and that could be dangerous under high-temperature conditions in summer,” said Zhang Lei, deputy director of the bureau’s food supervision and management department.

Information provided to the authorities about about how and where the kitchens operated is often vague, Zhang added.

According to Shanghai FDA, anybody can register for permission to open a home kitchen for the apps by completing a form.

Linshi and Yami have stopped operating, though Home-Cook and Mishi have not yet ceased their service, Shanghai FDA officials said.

More stories from China…

Chinese fund eyes Australian investments to supply home health market

A Chinese investment management company will establish a specialist food and agriculture fund worth up to A$1bn (US$760m) in Australia.

The Australian has reported that Beijing-based Tsing Capital will invest in fermentation and extraction of grains, cane and vegetables in Australia to supply China’s supplements and health foods market. It also intends to buy Australian processing and branded food businesses that can leverage surging demand from Asian buyers.

As a means to support the entire supply chain, Tsing will establish processing factories in the Wimmera region of Victoria. To do so, it expects to raise A$500m-$1bn in capital, with the possibility of increasing that amount to A$2bn through loans.

Charles Hunting, managing partner of Tsing’s food fund, said that creating a fund backed by numerous investors may prove to a suitable way for Chinese interests to play the agriculture boom.

“We’re not creating the food products for the sake of hopefully getting that food into the Chinese market,” Hunting told Weekly Times.

“The plan is to bring strategic Chinese investors who have distribution networks in China so that we can create an end-to-end opportunity that is demand driven, not supply driven.”

Tsing—one of China’s first investment management companies—has put together eight similar funds with investments totalling A$1bn since it was set up in 2000.

Beans distributor sets out to tap into China’s coffee-shop culture

Gourmet coffee wholesaler DTS8 Coffee Company has plans to expand into the world’s fastest growing coffee-shop market by acquiring existing coffee chains.

The Canadian company, which was originally founded in Nevada in 2009 and moved its base to Shanghai as a “wholly owned foreign subsidiary entity”, has until now focused on roasting and distributing artisan coffees in China.

Douglas Thomas, DTS8’s chief executive, called the move its next expansionary step in a market that has added 1,462 retail coffee shops in the last year, according to research by Allegra Strategies.

“With an estimated 5,391 branded coffee shop outlets, China is the current market leader in American-style chains in Southeast Asia,” Thomas said.

“Four new coffee cafés open in China every day. In order to capitalise on the competitive edge of having our own roaster, DTS8 is moving into its second phase of expansion and plans to create a network of coffee cafés through acquisitions and mergers. These coffee shops will enhance the DTS8 brand in China, help build a direct link to retail consumers, and contribute to long -erm revenues.”

Until now, the company’s coffees have been sold through distribution channels reaching consumers at restaurants, multi-location coffee shops and offices.

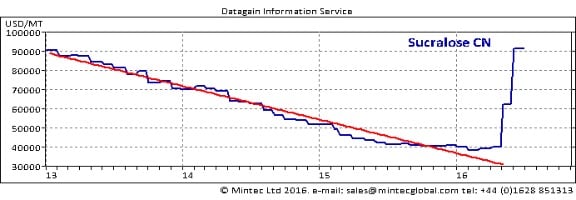

Supply restrictions cause sucralose prices to spike

Chinese sucralose prices have been rising sharply this year due to supply restrictions. According to Mintec, the commodities analyst, they increased 47% month on month in June, and 56% from April to May.

Recently, Chinese producers were unable to take new orders due to production constraints from stricter environmental laws affecting waste disposal and water purification. Further restricting supply, Tate and Lyle, one of the world’s leading sucralose producers, recently permanently shut its Singapore plant.

The high prices were also supported by lower sugar exports from Brazil, the largest producer and exporter, due to currency fluctuations.

Derived from common table sugar or sucrose, and extensively used as a sweetener in the food and beverage industry, sucralose is is 600 times sweeter than sugar and contains no calories.

Sucralose manufacturing has a high entry barrier due to the level of capital investment and technology required. Even with new capacity being added to the market, prices are expected to remain at high levels in the short-term.