“The market value for dairy bioactives reflects their high value-added nature, and is estimated to reach approximately $830m in 2015,” said the report's lead author, Tage Affertsholt of 3A Business Consulting.

Product ranges are expanding, and there are more consumer products being launched with bioactives, and the market is growing by almost 10% per annum, he added.

“Dairy bioactives is a high tech business growing strongly given main applications segments, such as sports nutrition, infant formula and other nutritional sectors."

All bioactives, from whey protein hydrolysate to alpha-lactalbumin, are high value-added ingredients, because they have beneficial physiological effects beyond the supply of nutrients, Affertsholt wrote in the report 'The World Market for Dairy Bioactives 2015-2019.'

Dairy bioactives

According to recent research conducted by the Centre for Nutrition, Dietetics and Food Science in the UK, bioactive peptides offer the additional benefits of protecting the human body from various diseases and dysfunctions of certain organs.

Small, yet emerging market

However, cost continues to be a factor for the market.

“Due to the beneficial properties of dairy bioactives, they are often quite expensive, which makes the market for dairy bioactives a low-volume one,” Affertsholt said.

Currently, the combined dairy bioactives market is only a fraction of the market size of other high-end dairy ingredients with an estimated market volume of approximately 55,000 MT in 2015, according to the report.

Of the dairy bioactives markets, protein hydrolysates is by far the largest both in volume and value terms, comprising 80% and 60% of total market size.

“Many of the [bioactives] ingredients are still at an emerging market stage. Some of the more recent proteins include osteopontin and milk fat global membranes, so-called MFGM,” Affertsholt said.

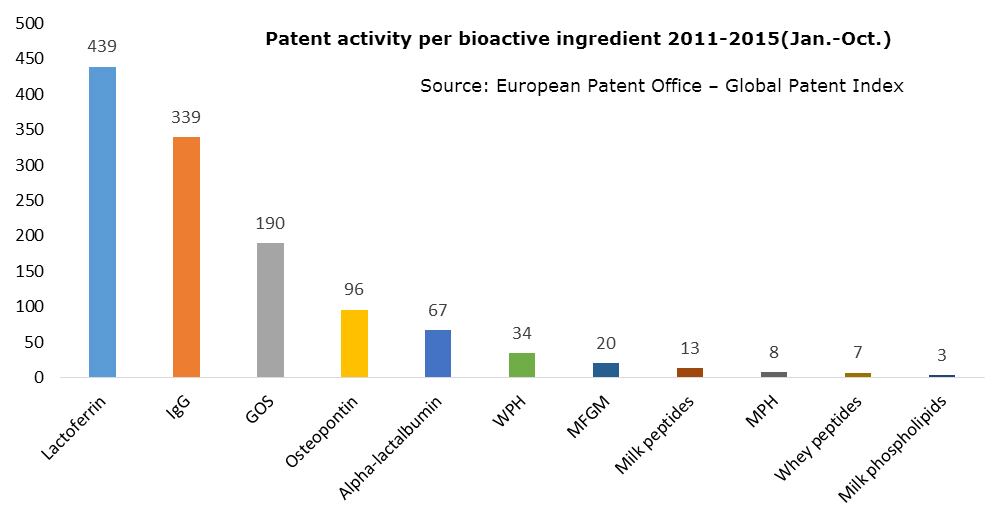

Even though the bioactives market is still small worldwide, certain major players in the global dairy market have been active in patenting processes and applications within more than one of the bioactives, according to European Patent Office.

From 2011 to 2015, infant formula companies and a few dairy companies stand out as being heavily patent active, European Patent Office’s global patent index suggests. These companies include Mead Johnson, Inner Mongolia Yili, and Megmilk Snow Brand.

In addition, the report says that, since 2012, the New Product Development (NPD) level more than doubled for many of the bioactives and significant amounts of products containing dairy bioactives are now launched every year.

However, the launch of the new bioactives-containing products are still limited to three regions – Asia, Europe and North America – which together comprise 85% to 90% of all the newly-launched products.

“In general, Asia has been faster to take up new bioactives than the US and Europe,” said Affertsholt.

Challenges and opportunities

Affertsholt said the difficulties dairy bioactives industry faces include health claims and clinical trials.

Processing requires a very large raw material volume to generate a small output of dairy bioactives. In addition, processing bioactives alongside commodities in large industrial plants is often complicated, given the skills required and logistics at factory sites.

Despite the challenges in producing dairy bioactives, the study shows the market keeps growing.

“A group of four types of dairy bioactives, GOS, alpha-lactabumin, lactoferrin and dairy peptides are all in a growing state and increased usage of these dairy bioactives is expected for the coming years,” the report says. “[The usage of bioactives in] sports nutrition, clinical nutrition, and infant formula sectors are all expected to grow by 5% to 7% annually towards 2019.”

In the future, Affertsholt said the native whey proteins and derivatives based on native whey may represent an opportunity for dairy companies.