The research organization’s newly published data for 2014 said that while Western Europe would remain the premier confectionery market globally by some distance; Asia Pacific would outpace North America for the first time.

“With per capita consumption beginning to fall and plateau in Western Europe, it is unsurprising that the majority of both global value and volume is expected to come from Asia Pacific,” said Euromonitor analyst Lauren Bandy.

The research organization said that it expected Asia Pacific confectionery value sales to hit $37.4bn this calendar year, ahead of North America’s $35.2bn.

No chocolate affair in China

China - Asia-Pacific’s largest and the world’s second largest confectionery market – is forecast to reach retail value sales of around $15bn in 2014.

Top three in 2014

- Western Europe - $62.9bn

- Asia Pacific - $37.4bn

- North America - $35.2bn

Source: Euromonitor International 2014 retail value sales forecasts

“Retail value growth of confectionery in China is driven by sugar confectionery, which dominates the market – only a quarter of absolute growth is expected to come from chocolate confectionery over the next five years,” said Bandy.

The analyst said that at half the unit price of chocolate, sugar confectionery was more affordable for Chinese consumers.

Mars leads the Chinese confectionery market with a 19% market share, mainly due to the strength of its Wrigley brand.

India: The world’s fastest

Asia Pacific sales were also propelled by India, the world’s fastest growing confectionery market. Euromonitor predicted a 9% compound annual growth rate (CAGR) over 2014-19 in India.

“Launching small and very low-priced versions of well-known chocolate confectionery brands has been a leading strategy in India by a lot of companies, including multinationals Nestlé and Mondelez, and has helped drive this strong growth rate,” said Bandy.

Premium products for established markets

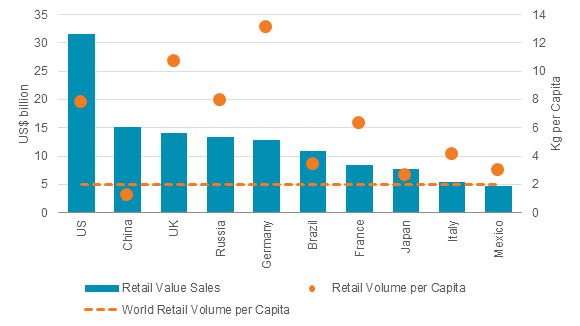

The US is still the world’s largest confectionery market by some distance with double the sales of second-placed China.

Euromonitor 2014 predictions

- Russia expected to overtake Germany as the fourth largest confectionery market with $13.4bn in retail value sales.

- Brazil to move up two places to sixth ahead of France and struggling Japan, where gum sales have fallen dramatically.

- Global retail value confectionery sales to reached record highs to $198bn, up $4bn on the previous year.

Bandy said that Western markets were expected to account for just 18% of global confectionery growth in the next five years.

She noted that despite a $1.5bn vale growth decline in Western Europe over the past five years, some niche categories had performed strongly.

“Bagged selflines/softlines is one notable success story, as consumers look to re-sealable share and snack bags to help with portion control.” Euromonitor said that the category in Western Europe and North America combined had grown by $1.8bn since 2009.

Bandy also flagged growth in chocolate tablets and dark chocolate as consumers looked to fine flavors, specific origins and ethically-sourced ingredients.

However, milk chocolate is expected to remain the most popular variety, accounting for 40% of global value sales in 2014.