‘Maximising corporate value’: Asahi hopes massive group restructure will enhance advantages across four key markets

Asahi recently announced its FY2023 full-year financial results, reporting 6.8% year-on-year growth in revenue to JPY2.77tn (US$18.4bn) and 3.9% year-on-year growth in core operating profits to JPY263.7bn (US$1.75bn).

The firm attributed the revenue growth to unit sales price increases and premiumisation.

Asahi conducted a wide-scale restructuring of its business governance in 2022, including the establishment of a six-person Executive Committee as well as separate regional headquarters with individual CEOs across its four key markets in Japan, Europe, Oceania and South East Asia.

“In 2024, we will begin a transition towards our new phase of growth, with a focus on further globalisation,” Asahi Group CEO and President Atsushi Katsuki told the floor at the results’ announcement.

“[This will be] driven by the strengthening of our group governance, including the initiation of Asahi Global Procurement and the transformation of our management structure.

“The aim is to maximise corporate value beyond just the sum of our regional businesses, to bolster global brands as the driving force of our premium strategy through global partnerships.”

“Going forward, we will continue to expand our competitive advantages in each region and boost the sustainability of our premium strategy by maintaining our active investment in key brands.”

Globally-recognised brands are expected to remain a mainstay in terms of investment for Asahi, particularly when it comes to exposure and marketing.

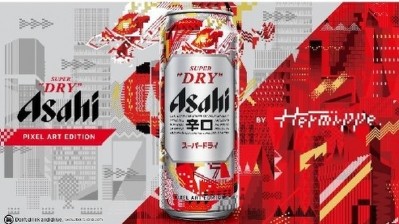

“Asahi Super Dry is a top priority in our global brand portfolio,” he added.

“This brand saw a sales volume growth of 35% year-on-year [in international markets excluding Japan], owing to sales expansions in our major markets of Asia, Europe, and Oceania.

“Partnerships with Rugby World Cup and City Football Group increased brand awareness, with sales volumes during the September/October Rugby World Cup tournament period growing 60% in Q3 and 26% in Q4.”

One other recognised Global Brand in Asahi’s portfolio is Peroni Nastro Azzurro beer, which saw a surge in recognition via another sports collaboration, this time with the Aston Martin Martin Aramco Cognizant Formula One team; and an upcoming new partnership in 2024 with the Scuderia Ferrary Formula One team.

Local focus

Within its home market of Japan, Asahi has plans to strengthen less mainstream categories such as its higher-value Asahi SHOKUSAI premium beer and Mirai no Lemon Sour RTD cocktail; and its Asahi ZERO alcohol-free beer under its Smart Drinking category.

This is in addition to non-alcoholic drinks which will include focus on the revamp of classic brands such as Mitsuya and Wilkinson in 2024, as well as the expansion of labelless beverages.

“In 2024, the sales volume forecasted growth for labelless products is expected to increase by 19%,” stated the company.

“In addition, we also saw a rise in sales for our food products such as Mintia mints in 2023 which rose by 23% - we hope to further augment this in 2024 with a forecast of sales increasing by another 6%.”