Promotional Features

Riding the mylk wave: Tapping into the minds of plant-based milk consumers in Indonesia

90% - that’s the percentage of consumers in Indonesia searching for information related to plant-based diets.1

Animal-free alternatives are fast gaining traction in the food industry, with plant-based beverages leading the pack. In fact, 71% of Indonesian consumers choose functional drinks over regular ones, and consume plant-based beverages at least once every two weeks.1 Why? One of the top reasons is because they are perceived as being healthier.

An ongoing study by Tetra Pak Indonesia indicates that modern consumers want low fat and low sugar, and plant-based beverages can align perfectly with these demands, with many associating ‘healthy’ and ‘low fat’ as two key attributes when talking about plant-based milk. Most of the participants in the study also agree that plant-based milk is perfect to replace dairy milk, since it can have all the nutrition with less fat and sugar.

'Mylk' vs Milk: Why plant-based milk is gaining popularity

Understanding Indonesia’s plant-based beverage boom: Who is drinking plant-based milk and why?

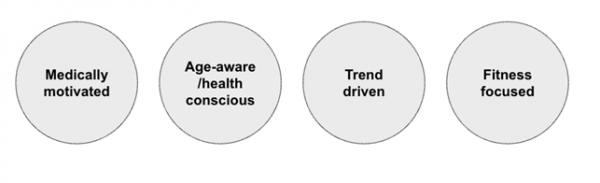

The demand for plant-based beverages is driven by health concerns, environmental considerations and even to feel part of a growing trend. Today’s plant-based beverage consumers fit into four different categories:

1. Medically-motivated consumers

Who are they?

- Varying ages, from young to old

- Usually lactose-intolerant or have an allergy to dairy

- Learn about plant-based milk from medical experts, and online research

- Look for milk without side effects such as gas and bloating

- Consider plant-based beverages to be a ‘life-saver’ and are willing to pay premium prices

- Consume plant-based beverages up to four times a week, if not daily

While still a small segment, these consumers experience negative reactions in their gut when consuming dairy, with some even suffering from acne breakouts. Switching to plant-based milk means avoiding these unpleasant side effects while still enjoying a beverage similar to milk, especially in commonly consumed drinks such as coffee or tea.

2. Age-aware/health-conscious consumers

Who are they?

- Mainly older age group, from 36 years and upwards

- Driven by the pandemic to seek out healthier food alternatives

- Learn about plant-based milk by actively seeking out information on social media and online

- Seek high-fibre, reduced fat and lower cholesterol in their drinks

- Might be deterred from buying when faced with high prices of plant-based milk

- Drink plant-based milk up to four times a week

With a deeper understanding of wellness and healthy living, these consumers tend to be mature individuals who prioritise their health due to their age. They actively seek ways to maintain a healthy and balanced lifestyle.

3. Trend-driven consumers

Who are they?

- Younger consumers, aged 18-35 years

- Seek out plant-based beverages based on current trends

- Learn about plant-based milk from influencer-endorsement campaigns

- Want their plant-based beverage to taste good

- May find the drinks expensive, and if the taste does not meet their expectations, are likely to revert back to dairy.

- Consume plant-based beverages once a week, typically at a cafe

With plant-based milk gaining popularity in cafes across Indonesia, these consumers have become a part of the growing movement towards plant-based milk consumption. As a result, they feel compelled to incorporate it into their lifestyle to keep up with the latest trends.

4. Fitness-focused consumers

Who are they?

- Mixed age group, with a higher portion of younger consumers

- Concerned about gaining weight

- Learn about plant-based milk from private fitness trainers, like-minded friends and health influencers

- Seek out low-fat content, with high calcium and protein in their drinks

- May not consume it regularly due to its significantly higher price

- While some drink it daily, many consume plant-based milk up to four times a week

While health benefits are important, these consumers are also motivated by the desire to look their best. To achieve their goals, they often try to reduce their fat intake to prevent weight gain.

When are they drinking plant-based milk?

At home, plant-based beverages are used as a substitute for breakfast or a light dinner in the late afternoon or evening. When consumed on the go, plant-based milk is approached as a mid-morning or afternoon snack.

Fitness-focused consumers in particular turn to plant-based milk as an energy booster before or after exercising. They see it as a way to stimulate muscle development and achieve their fitness goals.

Meanwhile, trend-driven consumers drink plant-based beverages while out with friends, rather than at home. They are likely to choose plant-based milk as a way to fit in rather than for specific health benefits.

What is their journey-to-purchase like?

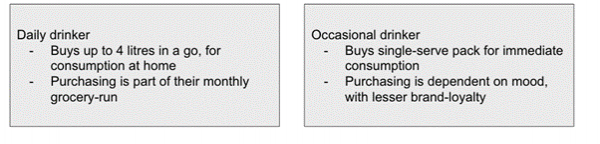

The plant-based dairy category has two distinct types of buyers across all consumer groups: the daily enthusiasts who fully embrace the category and the occasional treat-seekers who love to indulge.

Does branding play a part?

Consumers choose a plant-based milk brand based primarily on familiarity. Endorsements from friends, family, or social media influencers can affect consumers’ choices. In cases where consumers don't have a specific brand in mind, availability and store exposure become important factors.

“Previously, I didn't know which brands were any good - I went to Ranch Market and saw V-Soy in the chiller area, so I tried it” - a plant-based drink consumer

Consumers tend to gravitate towards brands that are prominently displayed in stores. From that point on, they compare the brand against the price and size or volume, packaging, and other information or image they have gathered about the brand.

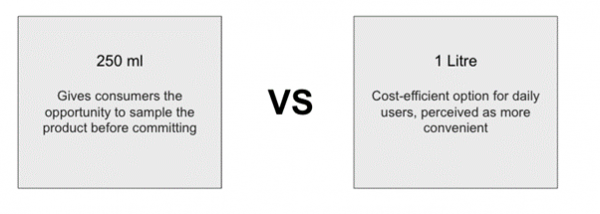

What makes a ‘good packaging size’?

As plant-based dairy is a relatively new category with many potential first-time consumers, introducing the 250ml pack as an entry point can be crucial for brands. With market maturity, the 1-litre pack may become more popular, while the 250ml pack can remain for on-the-go consumption.

Consumer groups | Functional | Emotional |

Medically motivated | Get the benefits of milk despite lactose intolerance, without any health risks. | Enjoy milk consumption without the discomfort and risk of diarrhoea. |

Age-aware/health-conscious | Promotes healthy metabolism and reduces the risk of heart disease, diabetes, and high blood pressure. | A sense of calm and security, knowing that the body is being well taken care of and protected. |

Trend-driven | Allows them to fit in with their peers and social groups. | Sense of belonging to a community of like-minded individuals. |

Fitness-focused | Facilitates healthy metabolism, leading to improved muscle development and body maintenance. | Feeling empowered and optimistic about body transformation goals, with regular bodily functions. |

Above: Plant-based power - functional and emotional benefits

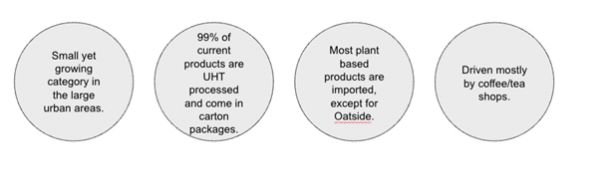

What do we know about the plant-based market in Indonesia?

What does this mean for manufacturers?

Indonesians want functional, low-fat and low-calorie alternatives to dairy milk, making now the perfect time to enter this market. Tetra Pak can help you uncover the ‘it’ ingredients in plant-based beverage production and their benefits, so you can make informed decisions.

Tetra Pak’s end-to-end solutions to develop, produce, package, and distribute your product will have you riding this ‘mylk wave’ before you know it.

Want to reach a new consumer segment and take advantage of this growing trend? Let’s unlock plant-based opportunities.

References

1. Milk Substitutes - Indonesia Statista (March 2023).