This week Down Under

Kiwi grocers come out in praise of TPP ahead of its Auckland signing

“It will mean our food producers will have a fairer chance of competing in international markets. The TPP covers a huge marketplace of consumers where New Zealand is growing its exports,” said Katherine Rich, chief executive of the country’s Food and Grocery Council, referring to the 11 national co-signatories.

The signing of the TPP, at SkyCity convention centre on Thursday, is expected to draw thousands of opponents in protest on Auckland’s streets. The free-trade agreement has polarised opinion across all its signatories from Malaysia to Mexico, and in New Zealand, some are calling for a referendum on its implementation.

Anti-TPP protests took place last weekend across Kiwi cities as a petition was handed to the governor-general’s secretary to a backdrop of placards stating "Support local, not global" and "Protect our freedoms”.

An opposition Green party co-leader predicted during one gathering that the trade agreement would bring down the government.

Once signed, the TPP will go through the New Zealand ratification process of select committee hearings, public submissions, and debate and vote in parliament.

“Our economy flourishes or falters based on trade, and a huge amount of that trade is in food. The food industry employs one in five Kiwis, and food exports earn a massive 50% of all our export earnings. Some 90%o of the dairy and meat produced in New Zealand is exported,” said Rich.

“Our country is a market smaller than Sydney so we have to trade with the world. This is why access to markets matters so much. If the world shut its doors to New Zealand products and solely followed a ‘buy local’ policy then our standard of living would go backwards fast.”

She said the pact would give New Zealand’s food producers a fairer chance of competing in international markets where the country’s exports have been growing.

“It will be our biggest ever free trade agreement—bigger even than the FTA with China.”

New Zealand became the first developed country to sign such an agreement with China in 2008 and saw total goods traded between the two countries double to NZ$20bn (US$13bn) by 2014, according to the NZ Foreign Affairs and Trade ministry.

The terms of the TPP will eliminate tariffs on exports to countries that have signed the agreement with the exception of beef exports to Japan, which will reduce significantly, and some dairy exports.

“Although we didn’t get the dairying benefits the government fought hard for, there are many benefits all around,” said Rich. “Dairying will still be better off, and there will be huge gains for kiwifruit, beef, seafood, wine, and manufactured goods.”

Under TPP, the kiwifruit sector is expected to become New Zealand’s fifth-biggest export earner.

Rich said that under the country’s current export volumes, tariff savings should amount to NZ$259m (US$169m) a year, exports would be boosted by 10% by 2030, and the overall economy would gain by NZ$2.7bn (US$1.76bn) year—an increase of around 3%—once the TPP is fully implemented.

Though she added that supermarket prices would be unlikely to drop once 5% tariffs on imported processed foods were removed.

“The issue isn’t really local food prices, it’s international food markets and the huge benefits New Zealand will gain from being a member of the TPP,” she said.

More stories from Down Under...

Australian retail growth continues in spite of difficult economic headwinds

Australian retail trade growth is expected to increase by 4.3% in the first quarter of 2016, following a solid Christmas trading period.

The AFGC CHEP Retail Index, the lead indicator for retail sales growth based on pallet movements, was 4% higher in December compared to a year ago, and showed retail trade turnover of A$24.72bn. By the end of February, this is expected to increase to A$25bn.

Australian Food and Grocery Council chief executive Gary Dawson said: “It’s encouraging that retail performance has improved steadily over the December quarter, particularly in light of the difficult economic headwinds that are dampening household expenditure.

“Low interest rates, low unemployment and strong job growth are providing signals of a positive outlook for retailers.”

Phillip Austin, president of CHEP Asia-Pacific, added: “The index indicates that expected stronger growth in the retail sector for early 2016 is most likely coming from lower interest rates, employment growth and lower petrol prices, with retailers likely to see some benefits.”

Company case study: Closed supply chain key to clean, green food exports

A closed-loop supply chain and a strong contact network in Asia are behind the success of an emerging premium food company from South Australia.

Beston Global Food Company listed on the Australian Stock Exchange last September and has already seen its share price rise from A$0.35 to A$0.67 (US$0.25-0.47).

It exports premium seafood, dairy, meat and health nutrition products to China, the Middle East, Thailand, Japan and Vietnam.

In January, the Adelaide-based company announced it had entered into a joint venture agreement with Sunwah, the largest importer of seafood products into Hong Kong and Macau.

Sunwah also owns and operates restaurants in Hong Kong and China, including the Nishimura Japanese Restaurant chain.

Beston chairman Roger Sexton, a former investment banker in London, Singapore and Hong Kong, said the company’s unique supply chain, which allowed it to grow, process and distribute almost all of its products, was key to its success.

“We have what we call a closed-loop supply chain so we own farms and other sources of supply, we own the processing and we own the marketing and distribution; so all three legs are owned by the company and that’s quite a unique model,” he said.

“We have very good products and we have excellent marketing distribution operations in Asia with our own people so we are taking those products directly to the market. We’re certainly in an expansion mode.”

Beston employs 190 people and has staff across Asia, including a 26-strong workforce in China.

Its full range of dairy and seafood products include southern rock lobster, tuna, kingfish, oysters, cheeses and milk. Beston’s brands have a focus on “clean, green and healthy” and include Ferguson Australia, Mori Seafood, B-d Farm Paris Creek, Australian Provincial Cheeses and Scorpio Foods.

Dr Sexton said rising incomes in China meant people were demanding higher quality foods such as fish, meat, eggs and dairy products.

“Increasingly, discerning consumers are looking for healthy products from Australia, and they recognise that South Australia is a source of very pure, very healthy food products,” he said.

“New Zealand got into China earlier than Australia so we’re playing catch-up, but South Australia is recognised as having similar qualities to New Zealand in terms of the purity of our farms and oceans.”

Sunwah group chairman Jonathan Choi said the joint-venture with Beston recognised and capitalised on the relative strengths of the two companies.

“Beston has a wide variety of premium quality food and beverage products which are in high demand in Asia. Sunwah has a strong distribution business in Hong Kong and Macau, which has earned a reputation over a period of more than 50 years for the provenance of its products and the quality of service provided to its customers. We share a lot in common. It is a perfect marriage,” Dr Choi said.

Sweet-toothed Aussie youngsters build platform for chocolate spreads

While nowhere near as popular as salty spreads like Vegemite and peanut butter, or as widely consumed as honey or jam, chocolate and hazelnut spreads have gained a definite cult following among certain sections of the Australian population.

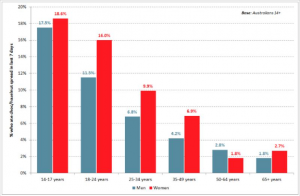

In an average week, 6.4% of Australians—or just over 1.2m people—eat Nutella or a similar brand of spread. While this figure pales in comparison to Vegemite, Marmite and Promite (which are consumed by 40.2% of the population), jams (31.5%), peanut butter (30.0%) and honey (29.4%), it still has a more youthful demographic unlike most of the old favourites, which tend to be most popular among those over the age of 50.

Teenage girls aged 14-17 are the most avid consumers of chocolate spreads, being almost three times more likely than average to eat Nutella and its counterparts each week (18.6%). Boys are close behind (17.5%), as are young women aged 18-24 (16%)—after which the consumption rate drops off quite steeply, bottoming out among older Australians.

Age is not the only factor influencing a person’s taste for chocolate and hazelnut spreads, with ethnic background also appearing to have some relevance. While a modest 6.0% of Australian-born consumers eat it in an average seven days, the rate jumps among those born in Asian countries such as the Philippines (24.4%), China (10.5%) and Malaysia (9.5%). Moreover, 17.2% of Australians born in the Middle East and 14.0% of those hailing from America enjoy these spreads.

Conversely, consumption is almost negligible among Australians born in New Zealand (3.5%) and India (3.4%).

According to Andrew Price of Roy Morgan Research, which carried out the research, chocolate spread manufacturers need to develop to extend the “cachet” these have already gained.

“The challenge for brands is to broaden their customer base across age groups, while ensuring their young consumers continue to enjoy eating them as they get older,” he said.

“Data shows that targeting consumers from different ethnic backgrounds could be one effective way of growing their market share. It also reveals that Aussies who eat choc/hazelnut spreads in an average seven days are markedly more likely than the average Australian to satisfy their sweet tooth with chocolate, lollies and sweet biscuits during that same period.

“Could this be a cross-promotional campaign waiting to happen? Or even the basis for a whole new product – a Nutella-filled chocolate bar, perhaps?”