Whether on a work break or unwinding at home watching TV, snacking on biscuits and cookies is a simple pleasure, offering comfort and enjoyment to many.

In Southeast Asia, it is a daily indulgence, where almost half of consumers (45%) eat sweet biscuits and cookies once a day or more, reaching for them to satisfy cravings, reward themselves and to savour the ‘delightful taste and textures’.

According to Cargill’s recent Indulgence study in Southeast Asia, taste is the key purchase driver for sweet biscuits and cookies, particularly for consumers in Indonesia. Price and multi-sensorial experiences are also a high priority for consumers, with convenience and price drops also playing a role.

An emerging driver of growth and increased market share for biscuit and cookie manufacturers? Innovation. The introduction of new flavours was cited as the top reason for buying more cookies in 2024 than 2023. Furthermore, of those surveyed, 70% said they were likely to pay more for innovative flavours and tastes.

“It is no secret that continuous innovation is vitally important in keeping today’s consumers interested and engaged with products,” says Rob Lilly, Senior Director, Marketing & Insights, Cargill’s Food Southeast Asia & ANZ.

“Here in Asia, we continue to see a wide variety of flavor innovations, yet also see huge potential for further product innovation around wider sensorial attributes, including textures. Enticing consumers with ‘unique’ consumption experiences is the primary opportunity to help differentiate in this market,” says Lilly.

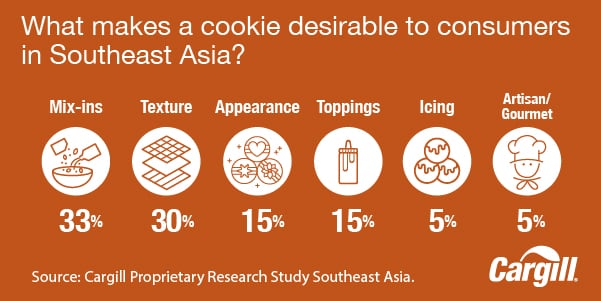

Consumers, particularly those in Indonesia and Malaysia, seek indulgent biscuit and cookie products with multi-sensorial qualities, such as mix-ins, added texture, appearance and toppings. A ‘super-sensorial’ experience was important to 82% of respondents with 79% saying they were likely to pay a premium for a unique sensorial or textural experience.

In the SEA biscuits and cookies market, it is clear that texture drives value, and this creates opportunities for manufacturers to establish a premium position.

Country of origin claims are also important for biscuit and cookie snackers in SEA who place high value on locally sourced ingredients. Of those surveyed, 65% said that the country of origin is important to them, with almost half (48%) preferring ingredients from Asia; furthermore, 65% said they were likely to pay a premium for ingredients of local Asian origin.

These findings open additional opportunities for manufacturers to leverage on-pack claims to strengthen product positioning.

Dark chocolate emerges as desirable ingredient

With a growing consumer preference for premium ingredients, textures and rich flavours, dark chocolate has emerged as the top choice for coatings for Southeast Asian consumers (33%), surpassing milk chocolate. Dark chocolate is also the ingredient of preference for inclusions (32%), ahead of milk chocolate chips/chunks, white chocolate chips/chunks and nougat.

Those surveyed perceived dark chocolate as richer and more intense in flavour, as well as associating it with better-for-you qualities. It is known that certain dark chocolates with higher cocoa content than other chocolate types contain antioxidants and essential minerals such as iron, magnesium and zinc, as well as more flavonoids, aligning with positive health connotations.

Dark chocolate also has an elevated premium status; data also shows that SEA consumers with high incomes are more likely to seek dark chocolate over other variants, particularly in the Philippines.

With consumers seeking more intense, indulgent dark chocolate flavours, some brands are already capitalising on this by emphasising the ‘dark’ colour of dark chocolate and its intense chocolatey flavour profile and higher cocoa content.

However, analysis reveals that dark sweet biscuit launches represented only 8% of all sweet biscuit launches across Southeast Asia during 2020-2023, underscoring a clear market gap and untapped opportunities for more premium products featuring dark chocolate.¹

“Here in Asia, we see a clear opportunity for food manufacturers to co-create with ingredient suppliers to innovate more premium positioned products aimed at meeting the preference demands of consumers across the region. The inclusion of dark cocoa and chocolate for coatings, fillings and inclusions delivers the experiences consumers desire, with the added potential for increased value capture,” says Lilly.

Leveraging dark cocoa and chocolate for indulgence

Cargill offers customisable solutions and advanced product development for manufacturers wanting to unlock opportunities that leverage quality cocoa as an ingredient in coatings and inclusions. The company’s insights-driven innovation support is designed to help its partners enhance customer engagement and deepen their understanding of the market.

Cargill’s portfolio of cocoa powders, ranging from light to dark brown, now includes Gerkens® MAX 80, Cargill’s darkest cocoa powder in Asia. Offering a more rounded flavour profile, it is designed for deep, dimensional colours and flavours and indulgent creations, as well as potential cost savings for manufacturers.

In formulations, Gerkens® MAX 80 has been shown to elevate chocolate cookies, delivering a significantly dark hue and luxurious, intense cocoa notes, aligning with consumer preferences for more rounded flavour profiles.

It can also be used in dip formulations, to provide a significantly darker and more decadent taste experience, in combination with other solutions such as OcolnaTM 9020, a specialty fat designed to promote smooth texture and shelf-stability in cocoa-based dips.

As an innovation partner, Cargill is committed to co-create innovations with value-added specialty solutions. With a broad product portfolio strongly aligned to APAC origin sourcing – further aligning with SEA consumer preference – it is designed to help elevate manufacturers’ innovations with evolving consumer trends and preferences.

By incorporating dark cocoa and chocolate into innovations with rich, intense flavours that deliver the sensorial experience that consumers crave, manufacturers can unlock white space opportunities in the biscuits and cookies market and increase their chances of success.

References

- Innova market insights. “Dark”, “Rich Choco”, “Intense” Vs all sweet biscuits and cookies launches.