FNA Deep Dive: Yoghurt

Culturing innovation: Creativity in flavours and formats key driver for APAC yoghurt market

In this edition of the FNA Deep Dive, we take a closer look at these, and find out just what sorts of innovations regional yoghurt firms are concentrating on to respond to consumer trends and maintain relevance.

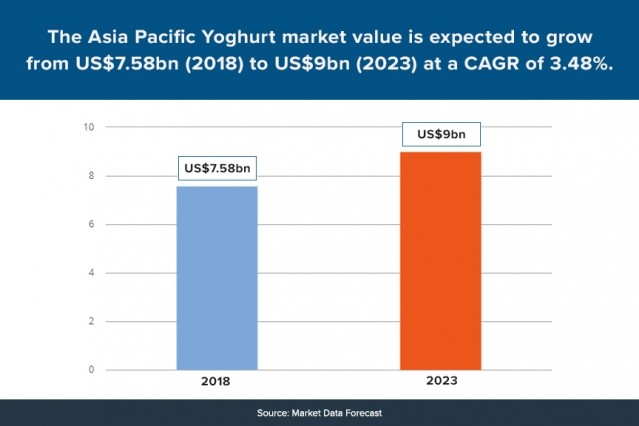

In APAC, the value of the yoghurt market value is expected to hit US$9bn by 2023 with a CAGR of 3.48%, particularly driven by consumer demands for healthier food products.

Yoghurt dates back many millennia, with some research estimating its origins as far back as the Neolithic period, so the this sector’s resilience can be seen in its continued growth – but firms in the industry believe that continuous innovation is more important than ever today in order to remain relevant and continue this growth trend.

One of these is Brownes Dairy, Australia’s oldest dairy company which was established in 1886.

“[We are aware we need to] constantly innovate to stay relevant [despite] being the oldest dairy company in Australia,” Brownes Foods Operations Senior Marketing Manager Nicole Ohm told FoodNavigator-Asia.

“One of the ways we’ve taken to make yoghurt more interesting is to borrow trends from confectionery – so besides popular flavours like vanilla and strawberry, Brownes also has exciting ones like tutti fruity, bubble gum, and marshmallow.

“[Keeping things exciting] is especially important when it comes to catering to kids [to get them interested] in a healthy product like yoghurt, so we’ve tailored our range so that exciting flavours are found in the yoghurt pouches targeting children.”

In addition to this, Brownes Dairy also has other interesting like its kombucha yoghurt range launched last year, which uses the culture in kombucha and the fermented tea base and consists of flavours like ginger, lemon, hibiscus and mango.

Watch the video below to find out more about how Brownes Dairy is innovating in its yoghurt line.

Formats and consumption occasions

One of APAC’s most popular yoghurt brands Chobani believes that traditional fruit flavours are important, but also consumers are looking for more as the consumption occasion of yoghurt evolves.

“Traditional fruit flavours have always been adored by yoghurt lovers. Many of the fruit flavours we ranged when Chobani Australia first launched are still some of our most loved – such as Mango, Passionfruit and Strawberry.” Chobani Australia Managing Director Lyn Radford told us.

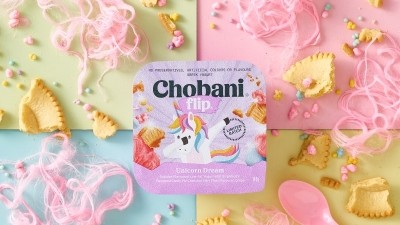

"With the launch of our Chobani Flip range, we also started targeting completely different occasions for yogurt [and more flavours come in to play here. For instance, many consumers still eat yoghurt] for breakfast, but plenty also like to enjoy an afternoon or late-night treat with flavours such as Cookies and Cream.

“Whether it be breakfast, a snack or a sweet treat, [yoghurt is versatile, and we bring this to consumers] not only through our range of flavours but also the various formats in which it is available - Our pouches offer a convenient on-the-go choice, while our large tubs provide a multi-serve option.”

COVID-19 has also had a notable impact on the popularity of yoghurt formats – according to Radford, in Australia convenient, on-the-go pouches were ‘definitely winning’ prior to the onset of the pandemic, but after it hit and most consumers started staying home, there was a move towards multi-serve yoghurt tubs.

“[Beyond the conventional flavours, formats and experiences], at Chobani we push the boundaries of innovation [and] go the extra mile, such as with our limited batch products,” Radford added.

We launched our first limited batch for three weeks in October 2016 with a Halloween-themed Pumpkin Pie flavour and since then, we have also featured a Mandarin Chinese New Year pot, Spooky Vanilla pouch, Christmas Pavlova Flip, [Unicorn Flip], Easter Hot Cross Bun Flip and Santa’s Milk and Cookies Flip.”

India’s Epigamia believes that the main difference for different yoghurt formats such as those sold in pots and drinkable yoghurt is very much the consumption occasion.

“Yoghurt sold in pots and drinkable yoghurt have a very different value proposition – the former is usually consumed as a snack, whereas the consumption point for drinkable yogurt is mostly on-the-go,” Epigamia CEO Rohan Mirchandani told us.

“So both have their own unique consumption occasion, but from what we’ve observed, growth has been roughly the same for both sectors.”

Yoghurt as a healthier food

One of the main drivers of APAC yoghurt demand is its health benefits, which generally include high-calcium, high-protein, gut health and a range of others – and according to Ohm, it’s an important vehicle for this as it manages to taste good while providing these benefits.

“There's nothing like yoghurt, because yoghurt combines two things that are quite rare to find in food, that is health and pleasure. Most foods you trade off one for the other, especially when it comes to snack foods,” she said.

“But yoghurt is healthier than ice cream, tastier than milk, and more affordable than a protein bar. [That’s why] it is often called the ‘good face of dairy’, for its perceived functional benefits, such as live cultures and probiotics.

“Yoghurt is also less linked to negative associations in dairy – we did some consumer research on milk recently [and] there were a lot of emotions about farmers not getting paid enough for the animals being looked after, not sustainable for the planet, giving an upset tummy, etc. - But when we did the same research with yoghurt, none of those things were mentioned.”

Epigamia believes that the health benefits yoghurt can confer are particularly valuable for those on a vegetarian diet.

“[I’d say] yoghurt is a substantially good source of protein and probiotics [for consumers] in India as an addition to the regular diet, especially for vegetarians [which make up a lot of the population],” said Mirchandani.

Chobani is focused on the high-protein aspect, having two ranges dedicated to this: FiT and Fit X. The FiT line boasts 15g of protein per serve and more common flavours like vanilla and blueberry, whereas FitX has 13g of protein and comes in more ‘decadent’ flavours like mint chocolate and rocky road. Both have no added sugar.

“We launched FiT in 2018 and then FiT X the following year - the latter was very much targeted at those 3pm sweet cravings and also provides great opportunity for delicious flavour innovations - recent additions including FiT X Rocky Road Rumble and FiT X Salted Caramel Craze” said Radford.

The Fit X range contains ingredients with more texture, such as soy crisps, chocolate bits, or cookies depending on the flavour.

Local insights

Within APAC, the evolution of yoghurt has been different for different countries – in India for example, until recently yoghurt was mostly considered a side dish alongside main meals to aid in digestion, and home-made yoghurt was much more prominent in the market than packaged products.

Today, packaged branded yoghurt is becoming more mainstream, although the traditional consumption occasion as a side dish still persists.

“In India, homemade curd continues to be a popular side consumption dish and packaged yogurt is mostly consumed as a ‘mid-meal snack’,” said Mirchandani.

“[That said], now that one-third of the population is working from home, we’ve noticed that most of our consumers consume [our yoghurts] either as a snack or as a dessert.”

In Malaysia, one clear divide that has emerged is in the field of drinkable yoghurt – according to local firm YourGutBB Co-Founder Wilson Ang, there is a difference between ‘drinking yoghurt’ and ‘yoghurt drinks’, where the former is 100% yoghurt in a drinkable format, but the latter only contains 30% yoghurt.

“Almost two-thirds of Malaysians have IBS or similar gut issues, with or without their awareness, [and] I myself first created YourGutBB drinking yoghurts to deal with my own Irritable Bowel Syndrome (IBS),” he told us.

“People who consume yoghurt regularly in Malaysia are usually health conscious. Some people take it as a source of calcium, [but] for most people, yoghurt is still a luxury food, taken for leisure, and when they do drink, its usually the fruity flavours.”

“[This is] unlike developed markets like Japan where people consume yoghurt regularly as a functional food, [but we hope to] be the first to initiate this eating pattern in Malaysia.”

YourgutBB operates ‘production studios’ as opposed to commercial mass production, and has five of these studios across Malaysia to cater to national demand, selling over 1,000 bottles per month.

Plant-based on the rise

The rise of the plant-based trend has so far been most prominent in the meat and milk areas – but a steady rise is being seen in yoghurt too, which is actually being taken much more positively by traditional yoghurt firms.

“Plant-based is growing but still remains a small part of the market. As far as we are concerned though, any innovation within yoghurt is good for all of us,” said Ohm.

“In the last 10 years, we went from diet and low-fat yoghurt, pot set yoghurt, Greek yoghurt to high protein. Then, we had a trend around Skyr (Icelandic) yogurt, kefir, and now plant-based yoghurts.

“[That said], I think one of the key challenges with plant based is still around the taste, as nothing tastes as creamy in mouthfeel as dairy.”

As for Epigamia, the firm has long positioned itself as both a dairy and plant-based firm, with Mirchandani previously describing to us how this has led to challenges by being viewed as ‘the enemy’ by both sides.

“We’ve had traditional dairy speak out against us as we’re ‘the plant-based guys’, then we’ve also had the plant-based activists speak out against us because they think we’re still the dairy guys,” he said.

“We are not an activist brand – we believe it’s our job to deliver nutritious, healthy options and let consumers decide what they feel is the right way to go about it, but not forced any sorts of products down their throats either way. “

Either way, apart from its portfolio of regular dairy products, Epigamia also has a range of plant-based coconut yoghurt and recently launched its first almond milk products too, so it’s clear the firm is not backing away from the challenge.

Even yoghurt giant Chobani has its eye on entering the plant-based space, having already launched its first plant-based oat milk in Australian foodservice with plans to develop a plant-based range of products further down the line.

“Oat-based products are increasingly popular with consumers because they address common barriers to purchasing non-dairy alternatives, including sustainability, taste and texture,” said Radford.

“There is plenty of opportunity for future innovations [in] the non-dairy category, though we’ll never abandon our dairy roots – yogurt is and always will be an important part of the Chobani story, but it’s only the first chapter.”