Faster, cheaper halal certification: WhatsHalal targets food firms in Malaysia and Indonesia

WhatsHalal previously made waves in the Asia Pacific halal industry with its halal-ingredient assurance consumer app powered using blockchain, which it launched last year.

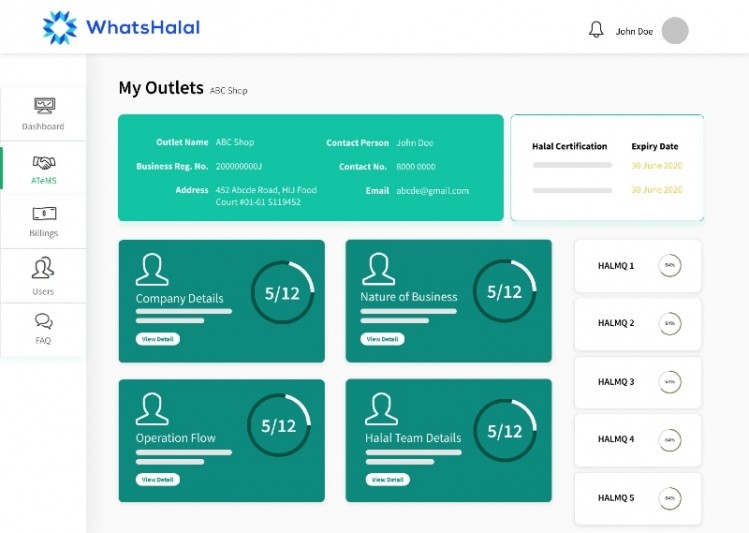

This new platform is dubbed the Assurance and Traceability Management System (ATeMS), and has been described as an ‘agnostic’ platform comprising global halal standards which will help companies to digitise, collate provenance documents and other stipulated key information needed before submitting to the halal certifying authority of choice via the platform.

ATeMS manages the halal requirements through operational bookkeeping and will monitor the post certification halal process as well to ensure client companies are audit and compliance ready.

“Phase One of our plans will be centred around Malaysia and Indonesia as these two countries have a high demand and affinity to halal certification,” WhatsHalal Founder and CEO Azman Ivan Tan told FoodNavigator-Asia.

“As two of the largest markets globally for the halal sector, they have very high interest in advancing the growth of the halal sector. The surge in demand and need for halal exports from these two countries are key for WhatsHalal as we can help to facilitate this demand and spur growth.”

Azman added that key benefits of utilising the ATeMS platform are time and cost savings, particularly when it comes to dealing with regulatory red tape.

“In halal-mature countries like Malaysia and Indonesia where the application cost and time is dictated by regulations which are already in place, WhatsHalal is able to reduce the time required to consolidate, verify and prepare documentation and the manpower cost allocated to prepare and maintain the halal certification,” he said.

WhatsHalal estimates that the platform can reduce the time taken to prepare certification documentation by up to 66%, and decrease overall halal certification costs by up to 50%.

“The objective [is to reduce] the overall time taken to achieve certification by 50% in the next couple of years,” Azman added.

Food companies are WhatsHalal’s primary target currently, but the plan is to go all-out to cover the entire halal industry.

“As the food sector is the second largest (behind Islamic finance) in the halal world, we are targeting mainly food companies right now,” said Azman.

“But what we are building can easily be mirrored to other halal sectors like pharmaceuticals and cosmetics which may have the same or stricter halal requirements and processes in place to ensure safety and assurance.”

For overall end-to-end halal certification application, covering the pre, ongoing and post application processes, WhatsHalal charges users an annual fee starting from SG$788 (US$555.10) depending on the specific services.

Tackling Indonesia

Indonesia is one of the platform’s primary targets, especially given recent halal regulatory changes in the country which have led food firms to scrutinise their halal certification applications even more closely.

“In Indonesia, the government is pushing for stronger halal certification regulations in order to grow their domestic halal industry,” said WhatsHalal.

“Under new regulations (UU 33/2014) which took effect in October 2019, businesses [are] required to undergo a certification process and secure a halal label with a grace period of five years. The implementation of this regulation means that there are at least 1.6 million businesses in the F&B industry scrambling for a trusted and verified halal seal on their products.”

According to Azman, they intend to tackle this challenging market by directly collaborating with the relevant authorities and are already in talks with the various parties.

“The ATeMS platform actually helps regulators by digitising the entire certification process, and[we] are not looking to change or implement anything new that requires regulatory approval,” said Azman.

“The challenge, if any, actually involves working with current legacy systems which tend to be quite manual and traditional, and we believe requires a multi-faceted approach to implement this.”

Moving forward

WhatsHalal recently secured investment [the specific amount of which was undisclosed but with company valuation standing at SG$4.8mn (US$3.38mn)] in a seed round and plans to use these funds to expand further.

“This investment will primarily be used to fund WhatsHalal’s continued regional expansion and further development of its proprietary technology platform, and a secondary focus on talent acquisition and continued product development,” said the firm in a formal statement.

Azman added that WhatsHalal had plans far beyond South East Asia for ATeMS, and was looking to work with more countries to push this forward.

“Phase Two of our ATeMS expansion includes entering the North-East Asian market which is rapidly opening up to the halal industry,” he said.

“Concurrently, we continue to reach out and aim to secure the buy in of more governmental bodies / certifying authorities, which will be win-win in helping all parties advance the growth of their halal food industry.”