Australian meat bodies clash over data criticism

In a blog post on its website, the ABA questioned the accuracy of the EYCI, claiming it was a “false measure for the true value of slaughter cattle”.

The EYCI is used by MLA as a benchmark of Australian cattle prices across a seven-day rolling average.

The blog went on to say: “While restocker and live export cattle prices have been remaining high – and therefore affecting the prices quoted by the EYCI – the real prices being paid by processors are at least $1.20 less. The amount of wrong information on pricing being put out by MLA and media is concerning.

“We must remember that when the EYCI was first launched, saleyards would have been the place where most cattle transactions took place. The simple fact is saleyards for prime cattle are becoming a thing of the past, and the biggest majority of prime cattle go direct to the processing works.”

Factually wrong

ABA also called for a return to a previous indicator which it felt was more accurate. “From 1998 to 2006, the MLA provided a quarterly Trade Steer V Heavy Steer Indicator which also shows the price for the Female kill. This is what ABC Landline, the rural media programs and cattlemen should be referring to. Where is that information MLA?”

When contacted by GlobalMeatNews about the comments, Richard Norton, MLA managing director, said: “Unfortunately, many of the comments from the ABA are again simply factually incorrect.

“The Eastern Young Cattle Indicator (EYCI) has been a key indicator for the Australian livestock industry since its introduction in 1996. It is considered by our industry as the general benchmark of Australian cattle prices and represents a seven-day rolling average produced daily by MLA.

“As an indicator, the EYCI includes vealer and yearling heifers and steers, grade score C2 or C3, 200kg+ liveweight from saleyards in NSW, QLD and VIC. These results include cattle purchased for slaughter, restocking or lot feeding and are expressed in cents per kilogram carcase (dressed) weight (c/kg cwt).

“Contrary to the comments from the ABA, MLA has published extensive analysis in recent months focusing on the high EYCI and the key drivers within the Australian cattle market. Simply put, the reason for the record highs of the EYCI are that restockers are driving the market as our national cattle herd rebuilds from the drought which saw record slaughter and production figures.”

Norton suggested that ABA look at the MLA website and its resources before commenting in this way again. “I would encourage all producers and interested stakeholders of the Australian red meat and livestock industry to visit our website to see the full breadth of the reports and analysis that MLA provides. It may be handy for the ABA to do the same before providing such misleading comments about MLA’s Market Reporting.

“Unfortunately, this type of irresponsible behaviour is par for course for the ABA. The ABA is not representative of the roughly 70,000 red meat producers and is considered by many to be destructive towards the industry for the sake of seeking attention.”

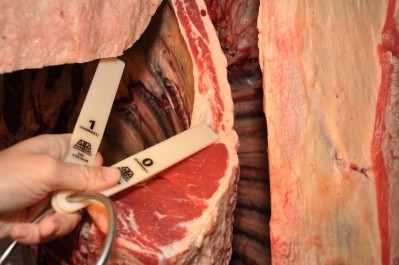

This is just the latest salvo in a continued battle between the two bodies. In June, the MLA hit back at criticism from the ABA over the meat quality program. ABA chief officer David Byard said that the MLA-established Meat Standards Australia’s practices were “watered down” and were in need of change. In response, the MLA highlighted the additional AU$185m in farmgate revenue that was generated thanks to the scheme.