This week Down Under

Income squeeze slams Australian food retail

Overall retail sales have slowed this year to 2.5% from 3.3% in 2014-15, when adjusted for inflation, Deloitte Access Economics has found. The economic advisory now predicts that sales growth will only resume, albeit slowly, from 2017-18 after further slowing is seen in the coming year.

While supermarkets have survived a competitive environment by pushing down supplier prices in recent years, costs may not have much further to fall and profits are being squeezed. Deloitte found that supermarket and catered food operators are now relying on population growth to increase their sales, as real retail turnover per capita decreases.

“Interest rates are expected to be ‘lower for longer’, as inflation is barely registering and, while growth is okay, it is below trend globally and at risk of returning below trend here,” the report said.

“For now, weak underlying income growth has slammed food retail, but low interest rates and asset inflation are saving non-food sales. In total, the value of non-food turnover increased by 3.4% over the year to June 2016 in real terms, while food turnover growth was just 0.7% for the same period.”

Australia’s non-food retail spending has moved on from household goods, it found. Last year, the strong growth in housing activity spurred turnover in this segment. This year, though, is characterised by growth in apparel and department stores.

Retail turnover by state is characterised by a two-speed split. Slowdown in resource-rich states, such as Western Australia, Queensland and the Northern Territory, is contrasted by stronger conditions in New South Wales and Victoria.

“That is a direct reflection of the shift from a mining construction boom to a housing construction boom, with the big states of the south and east getting the upside from that baton pass,” the report concluded.

More stories from Down Under…

Craft-beer delivery start-up has eyes on expansion from Adelaide to Asia

A home-delivery craft-beer service is helping put independent brews in the hands of ale lovers around Australia.

Small Beer launched last month with a handful of independent Australian craft breweries on its books, including Mismatch Brewing, Pirate Life, Smiling Samoyed, Hawkers and West City Brewing.

Based in Adelaide, Small Beer is starting with South Australian and Victorian beers, though it hopes to ramp up quickly to include craft beers from around Australia.

It is in talks with La Sirene and Big Shed Brewing, which it hopes to have in stock by the end of the month.

“Really there’s no limit, as long as it’s a good, consistent product, we’re happy to stock it,” founder Evan Hayes said.

“It’s trying to just take away that barrier to getting good beer from an independent producer that maybe doesn’t have much reach with their distribution channels and being able to get that to someone who’s interested in beer.

“We’re shipping all around Australia straight to people’s door.”

Customers can buy specific beers or sign up to a monthly subscription service where mixed six-packs or cases of Australian craft beer are delivered to give them a chance to try a variety of brews.

“It’s focusing on Australian breweries that are a little bit quirky, crafty and niche to get their name out there and build distribution through a previously unavailable channel,” Hayes said.

“We’re trying to build up that level of trust to where people can say ‘if it’s on the Small Beer website’ then it must be good.”

He said the ability to deliver beer while it was still fresh was a key feature of the model.

“We’re not selling anything that we don’t have in stock, so it’ll be shipped within two days,” Hayes added.

The founder came up with the idea while living in America, where he was impressed by the highly developed craft beer industry.

“In America, the independent craft scene is quite established and it’s about to blow up here.

“We’ll be focusing on Australia to start with but possibly down the track we’ll look at going to Southeast Asia and maybe China.

“We’re thinking about possibly including cider as well.”

Tea companies should target teens as market grows slowly

Despite its well-publicised coffee craze in recent years, Australia firmly remains a nation that loves its tea—only tap water, milk and hot coffee are more widely consumed.

That’s according to market research that found that exactly half the population drinks at least one cup of tea each week—a trend that has increased slightly over the last year, from 9.6m Australians to 9.8m.

Women are more likely to be tea-drinkers than men: 55% drink at least one cup a week, compared with 45% of men.

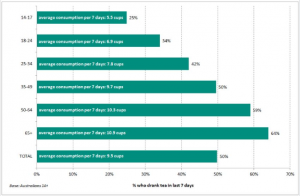

There is also a strong correlation between tea-drinking and age. Whereas 25% of Australians aged 14-17 drink tea, the proportion of tea-drinkers grows with each subsequent age group, peaking at 64% among the 65-plus age demographic.

The average number of cups consumed also increases in direct proportion with age. Tea-drinking teenagers between 14 and 17 years each drink an average of 5.5 cups per week, compared to the over-65s, who consume an average of 11 cups. Moreover, almost a third of this group drink 15 or more cups per week.

Similarly, the proportion of hot-coffee drinkers in each age group, and the average number of cups they consume, also rises in direct proportion to age. But it is worth noting that only the 14-17-year group is more likely to drink hot tea (25%) than hot coffee (19%) in an average week. From 18 years and up, coffee is the more popular beverage.

Norman Morris of Roy Morgan Research, which carried out the study, suggested that tea marketeers should set their sights on the tea-loving youngest age-group.

He said: “Could this be an opportunity for a savvy tea brand to get in on the ground floor, so to speak, and win over this young demographic so as to build a life-long relationship?

The research also found that sales of regular tea had actually declined slightly over the last five years. At the same time, herbal and fruit tea sales had crept up, and green tea sales had plateaued.

“It is crucial for brands wishing to remain competitive in this uncertain market to identify exactly those consumers most likely to keep, or start, buying their product, so they can tailor their marketing in a way that resonates with these people,” Morris added.

Market update: Australian lamb

Strengthening domestic demand for Australian lamb has forced prices to grow to be 32% higher in August than they were in the corresponding month in 2015. This represents a two-year high, according to Mintec, the commodities analyst.

Demand has risen as consumers have switched from beef to lamb in their diets, due to corresponding increase in cattle prices.

This August, Australian cattle prices rose to the highest level seen in six years on the back of tight supplies.

In addition, Australian lamb exports from the January to July period rose 4% year on year to 140,922 tonnes, driven by an increase in demand from America and China. As a result, lamb supplies are lower than normal for this time of year, which has caused prices to increase further.