Asian sweetener market on the rise again, report

The financial crisis that struck from late 2008 to 2009 dragged down the Asian sweetener market as demand from downstream industries – food, beverages and pharmaceuticals – dipped. This led to oversupply in the market, according to China Chemicals Market (CCM), which has just published its Survey of High Intensity Sweeteners in Asia.

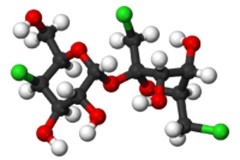

However volume output grew by 10.11 per cent between 2009 and 2010, from around 109,114 tonnes to 99,088 tonnes, indicating a rebound. This includes production of saccharin, cyclamate, acesulfame-K, stevia sweetener, aspartame, sucralose, glycyrrhizin, alitame and neotame.

While the market value is expected to increase in the coming years, there look likely to be some shifts in usage of different sweeteners is expected.

“CCM estimates that the market of natural high intensity sweeteners (stevia sweetener as an example) will become more important in the future, while saccharin and cyclamate will encounter falling demand and shrunken market,” a spokesperson told FoodNavigator.com.

Cyclamate is currently the most produced high intensity sweetener in Asia Pacific, with volumes reaching 57,800 tonnes in 2010. Sodium cyclamate, the most common cyclamate salt, is about 40 times sweetener than sucrose and the sweetness effect lasts longer. It is used in beverages, desserts, confectionery, fruit derivatives, bakery products, foods for special dietary needs such as meal replacements, and supplements.

The market researcher said that between 10 and 20 per cent of high intensity sweeteners produced in Asia Pacific are consumed in the region, with over 50 exported to the EU and the US.

China leading

Use of high intensity sweeteners in Asia Pacific is driven by people’s increasing health care awareness. Moreover high sugar prices are leading manufacturers to consider ways to use less – while the production technology for high intensity sweeteners is maturing.

China is the biggest player in sweeteners in the Asia Pacific market, with consumption reaching around 24,641 tonnes and a market value of US$135 million in 2010, according to CCM. It is also the most important sweetener producer in the region, with output of 80,639 tonnes, of which 47,981 tonnes were exported in 2009.

However other countries have made their marks in specific sweeteners. For instance Japan, home of Ajinomoto, is an important aspartame producer, while Malaysia is renowned for its stevia sweetener production.

Singapore, meanwhile, is now a “weighty sucralose producer in the world” since Tate & Lyle, the world’s largest sucralose producer, established a new production facility there in 2007. It has since transferred all its sucralose production to that site, which uses the most modern production technology.

More information on CCM’s Survey of High Intensity Sweeteners in Asia is available at http://www.cnchemicals.com